Crypto traders in Poland have been unpleasantly surprised with a controversial tax they thought they wouldn’t have to pay. The Civil Law Transactions Tax (PCC) is applicable to digital asset trades conducted before the introduction of last year’s moratorium on its collection, the Polish tax administration recently clarified. The matter has been discussed on European level as well.

Also read: European AML Directive Pushes Crypto Startup Bottle Pay Out of Business

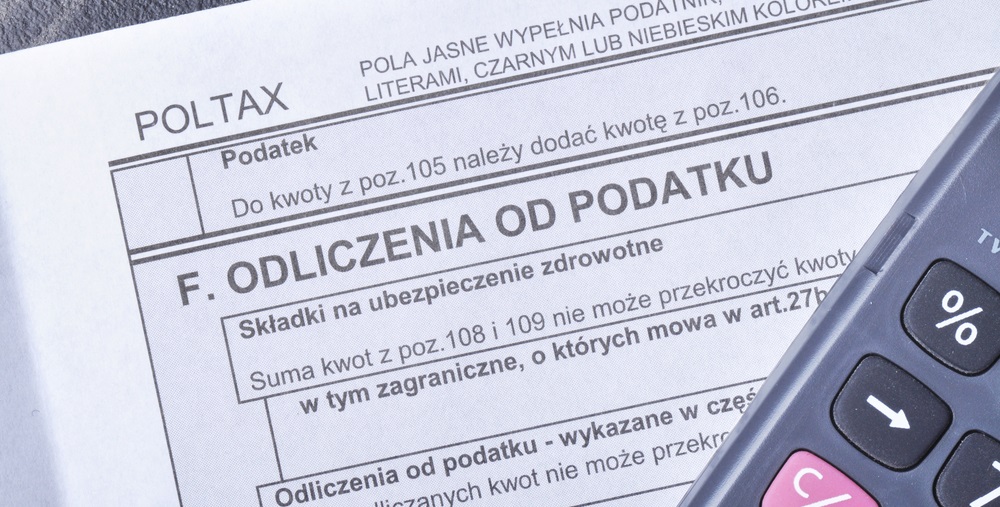

PCC Tax Applies to Crypto Transactions

In Poland, the PCC tax (Podatek od czynności cywilnoprawnych) is a 1 or 2% tax levied on sales of assets outside the scope of Europe’s widely implemented value added tax (VAT). The transfer tax on civil law transactions is usually due when the seller is not a business entity or the sale is of a movable property, real estate or various rights. The tax is payable by the buyer and is calculated on the value of the purchased asset.

According to an interpretation of the tax code issued in April last year, a 1% PCC tax should in principle apply to cryptocurrency transactions after digital coins were recognized as property rights. Following protests from the country’s crypto community and an online petition, however, the Ministry of Finance imposed a temporary hold on its collection in the summer of 2018, which was extended in July this year until June 30, 2020.

Since then, the issue has been hanging in the air, with the government in Warsaw taking time to consider its long-term policy regarding crypto taxation while also hoping for а pan-European solution. Polish media reported that the matter has been discussed during the Dec. 5 meeting of EU’s Economic and Financial Affairs Council (Ecofin). A decision on that level will certainly influence the taxation of cryptocurrencies in all member states, including Poland.

Controversial and Irrational Taxation

“In July, it seemed the case would be resolved once and for all and cryptocurrencies would be permanently exempted from this tax,” the Kryptowaluty news outlet noted in a recent post. However, the regulation adopted by Ministerstwo Finansów was only an interim measure. What’s more, a new clarification issued by the Polish National Tax Administration (KAS) states that persons who carried out cryptocurrency trading transactions before July 13, 2018 are liable for PCC.

The agency’s information service emphasized that last year’s regulation does not mean crypto trading from previous periods is not taxable. The clarification is bad news for Polish taxpayers who have carried out such transactions. First of all, reporting hundreds or thousands of transfers would be extremely complicated. Besides, the amount of the accumulated PCC can potentially exceed the profits from trading. The “irrational effect of the PCC tax on cryptocurrencies” was acknowledged by Poland’s deputy finance minister Pawel Gruza in an interview published last year.

Applied to crypto trades, the civil law transactions tax also creates a certain controversy. Transactions that are VAT-exempt, as is the case with buying and selling cryptocurrencies in the EU, are usually exempt from PCC as well. On the other hand, there are exceptions, as the professional services network KPMG explains on its website. In Poland, the tax is due on transfers of land and buildings, for example. In the case of crypto sales, the tax should be levied on each transaction over 1,000 Polish zloty, which is less than €235.

What do you think about the rationale behind the PCC tax? Share your thoughts on the subject in the comments section below.

Images courtesy of Shutterstock.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

Please enable JavaScript to view the comments powered by Disqus.

The post appeared first on Bitcoin News