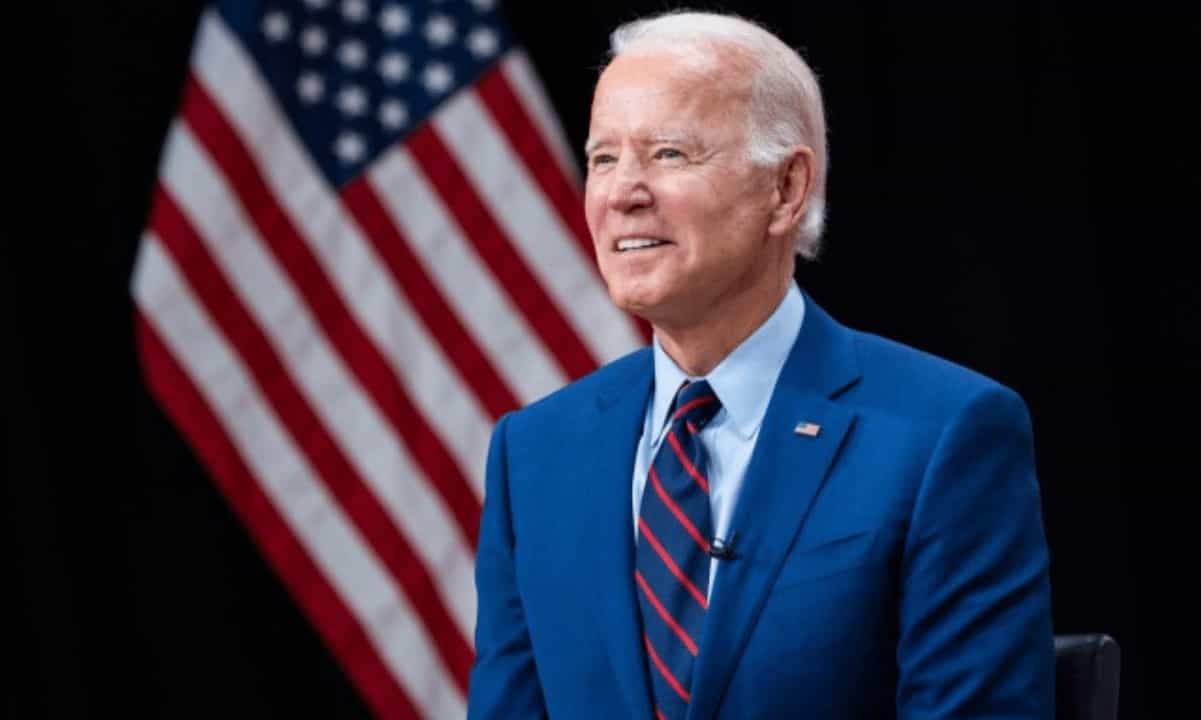

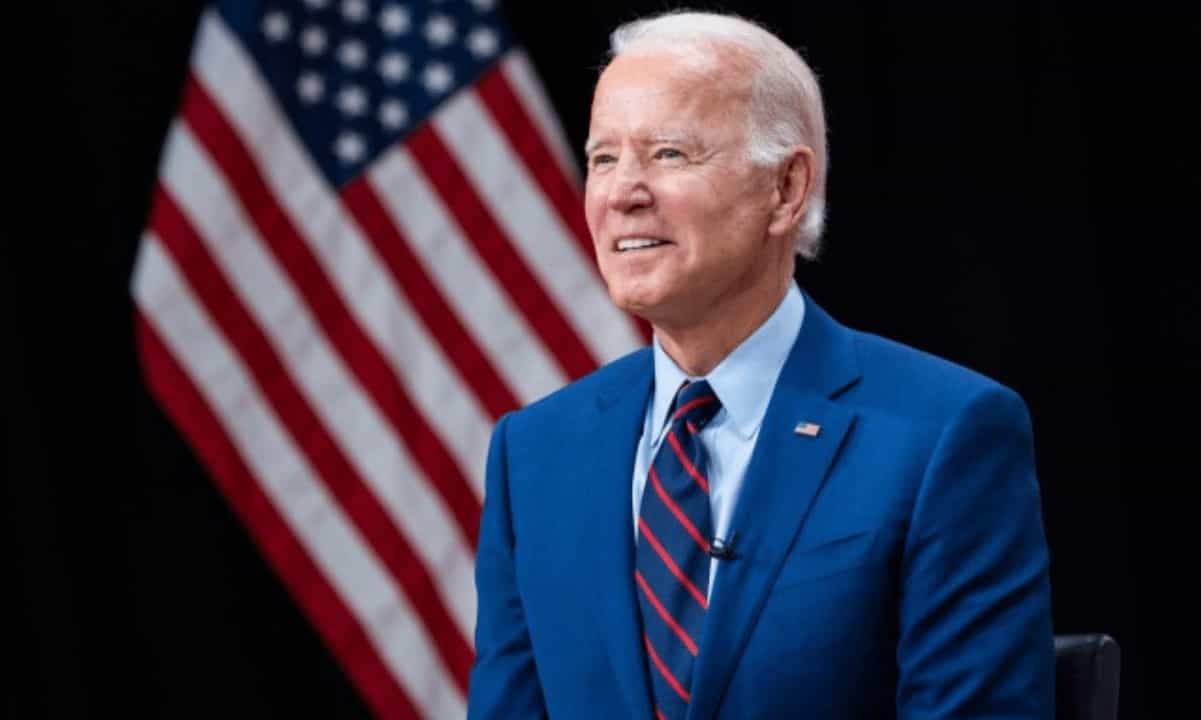

Speaking at the final day of the G7 summit in Japan, U.S. President Joe Biden addressed ongoing debt default talks saying he would not back a deal that supports tax cheats and crypto traders.

“I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistance at risk for nearly a million Americans,”

The comments come in opposition to a bipartisan debt ceiling agreement with Republican leaders that the President alleges would benefit crypto traders, among others.

BREAKING: President Joe Biden speaking on the final day of the G7 summit

“I’m not going to agree to a deal that protects wealthy tax cheats and crypto traders while putting food assistants at risk.”https://t.co/q2ATjj9RFh

📺 Sky 501, Virgin 602, Freeview 233 and YouTube pic.twitter.com/PIf0O5tKXq

— Sky News (@SkyNews) May 21, 2023

No Love for Crypto From Biden

The protections for crypto (and stock) investors revolve around tax loss harvesting. This is a process whereby an asset is sold at a loss and repurchased again instantly so that it doesn’t leave the investor’s portfolio, but there is diminished profit on the purchase. This will enable a reduction in taxes due as capital gains are offset.

The two sides of the political divide in America cannot come to an agreement on negotiations over the federal budget and the debt ceiling. Without a new budget deal, the U.S. could run out of cash as soon as next month as the national debt skyrockets toward $32 trillion.

ADVERTISEMENT

President Biden took a swipe at “wealthy crypto investors” earlier this month as he plans to close tax loopholes.

Americans and the crypto industry remains hopeful that a more industry-friendly administration and President are elected when the country votes in the November 2024 general election.

Until then, the war on crypto will likely continue, as will the exodus of talent and innovation to friendlier overseas jurisdictions.

Additionally, the Biden administration has also proposed a 30% energy tax on crypto miners which could further fuel the ongoing exodus.

There is a ray of hope, however. At the Miami Bitcoin conference last week, Presidential Candidate Robert F. Kennedy pledged his support for Bitcoin and the crypto industry in the United States.

Crypto Market Outlook

Crypto markets have fallen into the red during the Monday morning Asian trading session. As a result, total capitalization has lost 1.7% in a fall to $1.16 trillion at the time of writing.

Bitcoin was down almost 2% on the day to $26,633, meanwhile, Ethereum had dropped 1.1%, dipping below $1,800 again.

Overall, crypto markets are still choppy and range-bound on the monthly view, having retreated from their mid-April 2023 highs to current levels.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato