Bitcoin has further declined to $11,750, while most of the larger-cap altcoins continue to bleed out with Ethereum close to testing $400. Lower-cap alts chart some notable performances in both directions.

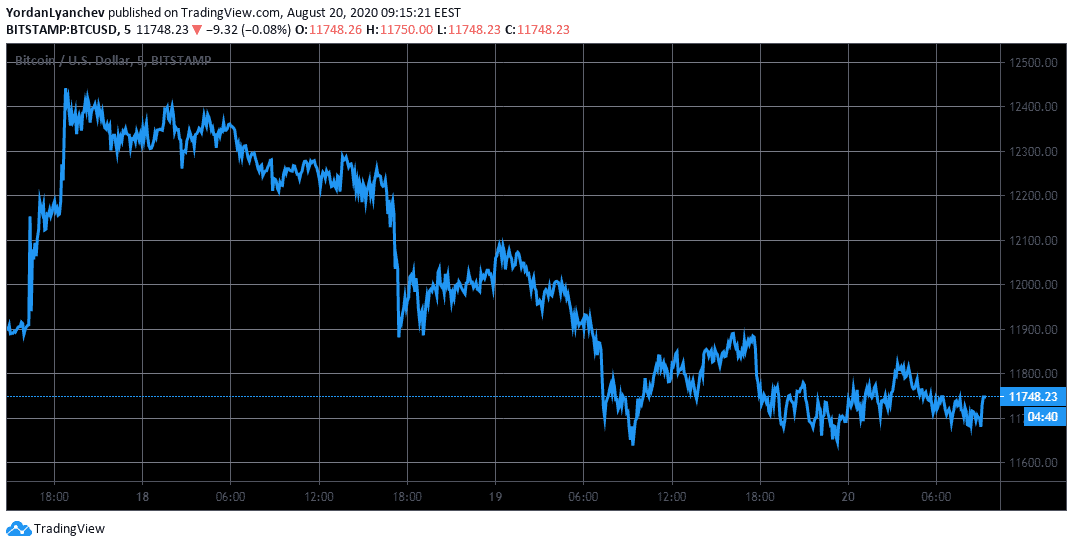

Bitcoin Dips To $11,750

The primary cryptocurrency attracted the community’s attention a few days ago when it reached a new yearly high of over $12,450. Despite a slight retrace, the move seemed solid as Bitcoin stood above $12,000 for a longer period for the first time this year.

However, it was not to be as the bears came out swinging and took the asset down to $11,560 on Binance. BTC recovered some of its value and is currently trading at about $11,750.

It may not come as a surprise anymore as gold couldn’t maintain its recent price pump similarly to Bitcoin. The precious metal exceeded $2,000 per ounce a few days ago but headed south to $1,920 before recovering to $1,940. As such, the two asset classes double-down on their identical performances as of late.

The most prominent Wall Street stock market indexes also closed yesterday’s trading session slightly in the red. The Dow Jones dropped by 0.3%, Nasdaq by 0.15%, and the S&P 500, which painted a new all-time high earlier this week, declined by 0.44%.

Altcoins Fluctuate

Most of the altcoins, and especially the larger-cap ones, continue to lose value today. Ethereum is down by another 1% and is close to the psychological level of $400. Just a few days ago, ETH reached its yearly high of $445, meaning a 9% drop since then.

Ripple is down by 1.5% to $0.287, Bitcoin Cash (-2%) to $290, Litecoin (-1%) to $62, BitcoinSV (-1.7%) to $205, Cardano (-3%) to $0.128, and Binance Coin (-1%) to $22 are all in the red from the top 10. The only exception comes from Chainlink, which gains over 5% and trades above $16.

More substantial losses are evident from Balancer (-20%), Terra (-11%), Flexacoin (-10%), Compound (-5.5%), and Aragon (-5%).

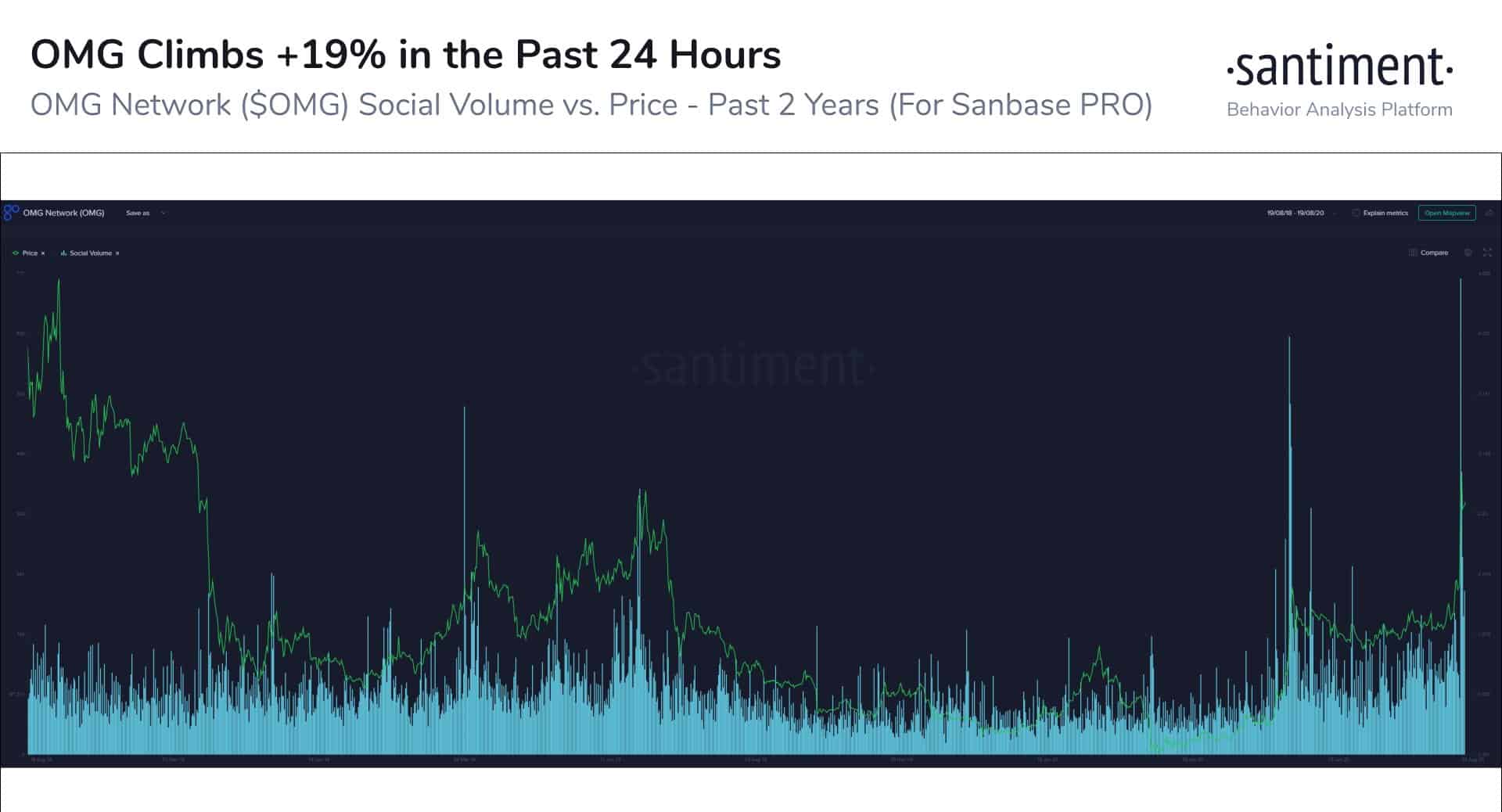

On the other hand, OMG is the most impressive gainer from the top 100, with a 36% price pump to $3.75. According to data from the analytics company Santiment, OMG Network is “enjoying the largest long-term social spike since April 2018.”

Utrust, with its 17% pump, has entered the top 100 coins. Algorand is also surging by 15% following its layer-1 network update announced yesterday.

Qtum (12%), Ocean Protocol (9%), Synthetix Network (8%), and Yearn.Finance (8%) are also increasing in value. Interestingly, despite created to have no financial value, YFI trades at $11,700 as of writing these lines.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato