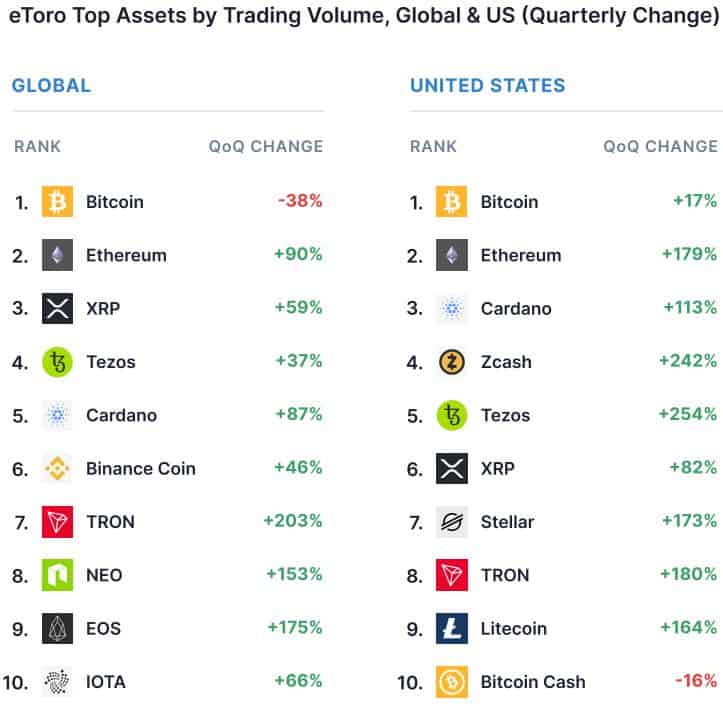

Cryptocurrency trades have steered clear from Bitcoin trading during Q3 2020, said eToro’s quarterly report. In contrast, the multi-asset brokerage platform revealed that some larger-cap altcoins, such as TRON, EOS, BNB, and Tezos, had experienced double- and even triple-digit trading volume surges.

Cryptocurrency Trading Changes On eToro In Q3

The popular platform published its latest quarterly report earlier this week, examining several crucial developments within the cryptocurrency industry. Being a trading platform, eToro broached data summarizing traders’ behavior. Interestingly, the most preferred assets for trading worldwide were alternative coins such as TRON, EOS, and NEO.

From all examined digital assets, eToro concluded that only one had a quarter-on-quarter decline in trading volume – Bitcoin. The report attributed this substantial 38% drop in the rapid popularity explosion of DeFi as users didn’t find the primary cryptocurrency compelling enough for trading.

The situation among US traders was different to some extent. The frequency of their Bitcoin trading endeavors increased by a modest 17%. By comparison, the Ethereum and TRON trading volume surged by about 180%.

However, it seemed as US traders were the fondest of Zcash and Tezos. The trading volume for ZEC and XTZ skyrocketed by 242% and 254%, respectively, compared to data from Q2 2020.

The Rise Of DeFi Is Bullish For Ethereum

As with most Q3 reports from other companies in the sector, eToro didn’t leave out the massive growth of the decentralized finance field.

The paper outlined that numerous DeFi-based protocols saw “an abundance of new money flowing in over the past quarter.” As most of those projects are built on top of the Ethereum blockchain, this raises a significantly bullish case for the native cryptocurrency – Ether (ETH).

Moreover, eToro believes that the current DeFi craze resembles the 2017 ICO boom, which again mainly utilized the Ethereum network.

“The amount of ETH locked in DeFi applications in January 2020 was 3 million and has nearly tripled ($8.4 million) since, with a peak of $8.9 million on September 15th. From mid-2016 to 2018, the ICO bubble locked up $16 million ETH. While DeFi hasn’t quite yet reached ICO hype levels, it has been the standout narrative for the cryptocurrency industry since 2018.”

Adding the substantial ETH amount that hasn’t moved in over a year and the growing interest for Ethereum use cases, it “tells us that investors are becoming more confident about using ETH as collateral. In theory, this would mean that there is less ETH to sell on the market.”

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato