Last week’s massive Bitcoin sell-off that drove its price to below $4,000 came from short-term holders, new data shows. Long-term holders, on the other hand, are not moving or selling their BTC assets, at least for now.

New Players Sold Their BTC

March 12th-13th this year later became known as one of the worst trading days in the cryptocurrency market. Bitcoin, and most alternative coins, decreased by as much as 50% in less than 24 hours after extensive sell-offs.

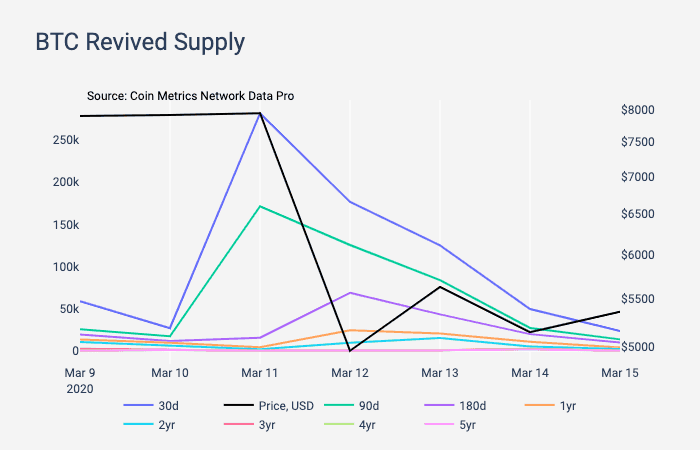

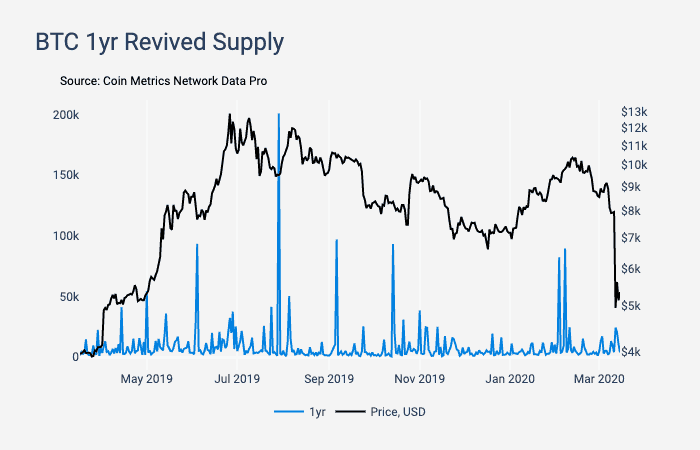

According to a report compiled by the popular monitoring resource, CoinMetrics, most BTC sales came from short-term holders. They came to this conclusion by monitoring on-chain transactions on substantial Bitcoin holdings on the days before the drop that were previously untouched for a specific period.

Thus, the document indicates that 281k BTC untouched for at least thirty days were revived, but only 4,131 of that amount was not moved for more than a year. In other words, almost 277k bitcoins were transferred on March 11th and March 12th from investors who have held the assets for less than a year.

At the same time, CoinMetrics informed that long-term holders (or HODLers) hadn’t moved an unusually large supply of their Bitcoin holdings.

Bitcoin SORP & MVRV Below One

The report also touched upon two compelling indicators regarding Bitcoin’s performance – SOPR and MVRV. The former provides the ratio of price sold (BTC’s price at the time new outputs are created) over the price paid (BTC’s price at the time a transaction’s inputs were created.)

Ultimately, it means that when the SOPR is below one, the investors are selling at a loss. In this case, the indicator dropped to 0.842 on March 12th – the lowest point it has recorded since February 2012.

The second one – MVRV – compares Bitcoin’s market capitalization to its realized capitalization. The latter is the estimated aggregate cost basis of the asset.

MVRV above one generally means that speculators have a higher average market valuation than holders and vice-versa if it’s below one. On March 12th, Bitcoin’s MVRV not only dropped below one, but it recorded its worst one-day drop of 0.5 points since December 2013. This, though, could be a good buying point, as the report concluded:

“In hindsight, the past periods where MVRV dropped below one have been the best times to accumulate BTC at a relatively discounted price.”

Other cryptocurrencies that went through a severe drop in their realized caps are Ethereum (-6%), Chainlink (-8.44%), and Tezos (-9.12%)

The Money Flow Goes To Stablecoins and Exchanges

The paper also brought up where most of the money flows went in this period of significant sell-offs. In the traditional financial markets, most investors are turning their assets into cash. In the cryptocurrency space, the situation is similar but instead of cash – its stablecoins.

In five days, from March 10th to 15th, Ethereum-issued Tether (USDT_ETH) market cap has risen by approximately $300M. USD Coin (USDC), another popular stablecoin, noted a market cap growth close to $150M during those dates.

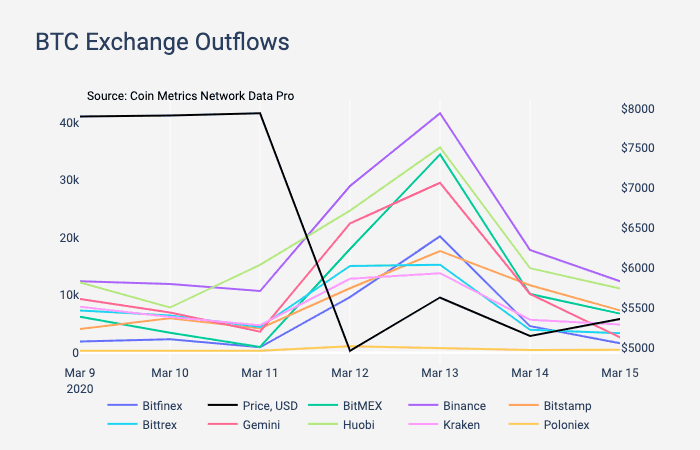

Additionally, the largest cryptocurrency exchanges, including Binance, Bitfinex, BitMEX, Bitstamp, Huobi, and others, had an in-flow of over 160k BTC on March 12th. Similarly, those exchanges saw a total outflow of about 171k BTC on the same date.

Both of these turned out to be the most substantial one-day inflows and outflows in over two years.

The leading Bitcoin margin trading exchange, BitMEX, noted the largest inflow. Contrary, Binance, and Huobi had more daily outflows.

The post Report: Most Of The Sellers During The Recent Bitcoin Plunge To $3,600 Were Short-Term Holders appeared first on CryptoPotato.

The post appeared first on CryptoPotato