Just a few hours back, bitcoin (BTC) price surged back higher to $13,500 and established a new high for this year. But along with BTC’s near exponential rise in valuation, retail buyers of the cryptocurrency have also soared and are now at an all-time high. Is this a direct result of a rally-induced FOMO?

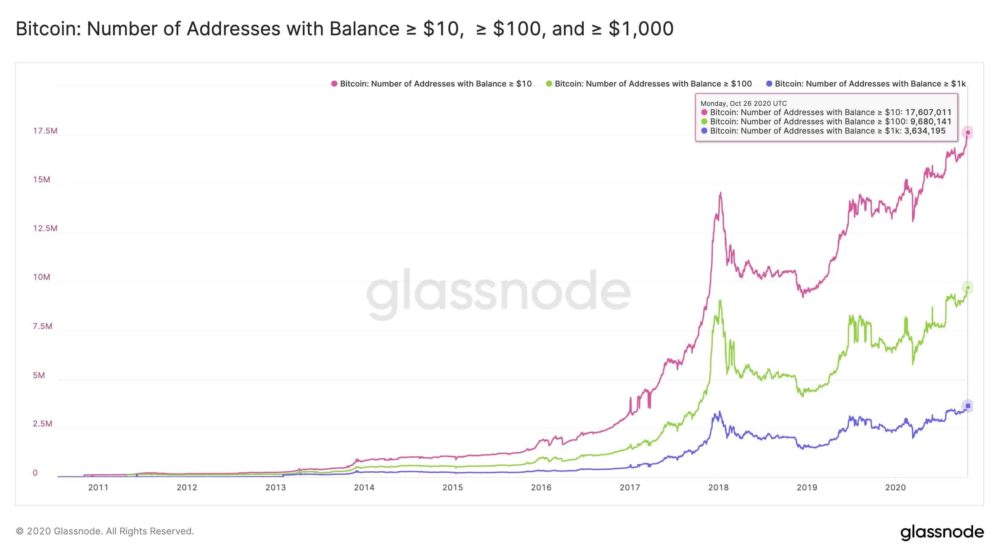

Bitcoin Addresses Holding BTC Worth $10, $100, and $1000 At ATH

Number of #Bitcoin addresses holding at least……$10 worth of BTC: 17.6M ––– ATH…$100 worth of BTC: 9.7M ––– ATH…$1000 worth of BTC: 3.6M ––– ATH

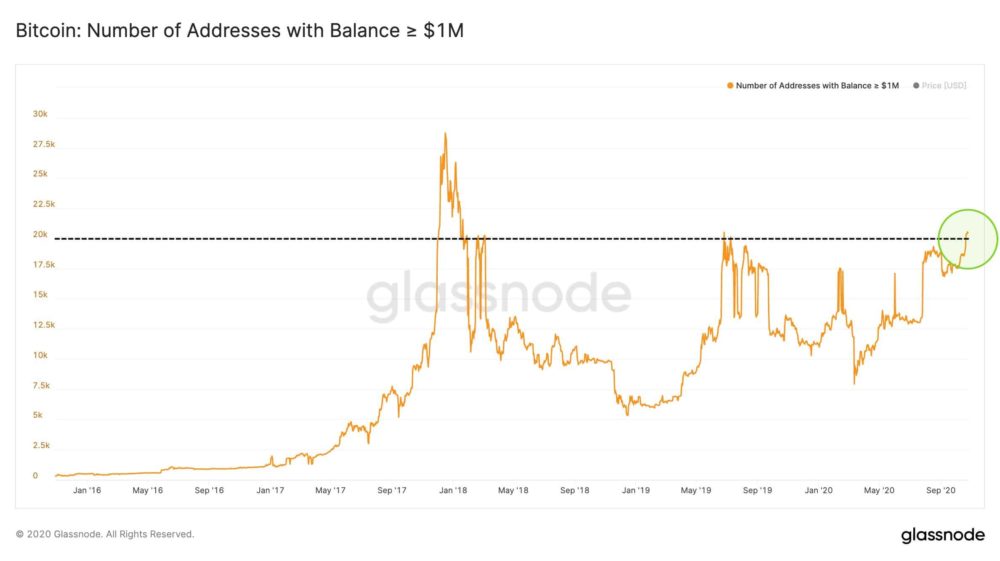

BTC Millionaires Are Also Steadily Increasing

While small bitcoin wallets (with less denomination) have clocked at an all-time high of 31 million, BTC millionaires haven’t stayed back either.

According to another bitcoin address update that Glassnode shared yesterday, now there are 20,000 wallets owning more than a million dollars worth of BTC. The on-chain analysis firm noted that this is the highest number seen since January 2018.

While the number of addresses holding bitcoin holding $1 million is comparatively less, the BTC holding valuations are far higher. Does this mean that the market will be left in shambles due to another dump? Not really.

Whales Might Not Dump Anytime Soon

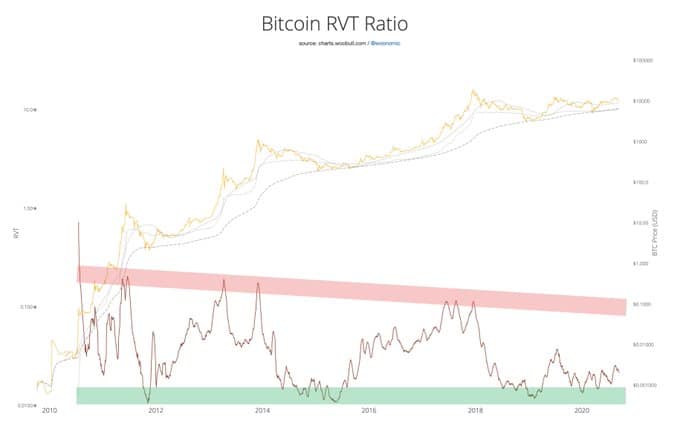

In September, after the notorious crash, Willy Woo, a noted on-chain analyst, had shared a macro market outlook where he said that it is ‘very unlikely we’ll see any kind of a catastrophic dump in price.’ Adding further to his statement, Woo commented:

Zooming out to the mid macro (months ahead), we’re in a really nice zone of Difficulty Ribbon compression, post halvening (red verticals), this is quite a reliable indicator of bullishness.

And moving to the full macro picture here’s RVT Ratio (very generally you can think of it as a PE Ratio for Bitcoin, a better version of my older NVT Ratio). Obviously we have a lot of room for growth in this cycle.

Woo’s argument makes it pretty clear that bitcoin millionaires are not selling anytime soon. As a matter of fact, it appears that the next leg of the BTC rally may have well begun.

One question still remains. Is this increment in retail and whale bitcoin addresses a direct result of BTC’s expanding price tag? It seems so. After all, with the given geopolitical and global economic scenario, everyone wants to jump in on the bandwagon and make some free money while they can, right?

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato