- The rollover for XRP continues today with a further 2.15% price drop, bringing the price for the coin down to $0.27.

- XRP is showing some signs of stabilizing at the 2750 SAT level against Bitcoin.

- Despite the recent price fall, the cryptocurrency is still up by a total of 26% over the last 30 days.

Key Support & Resistance Levels

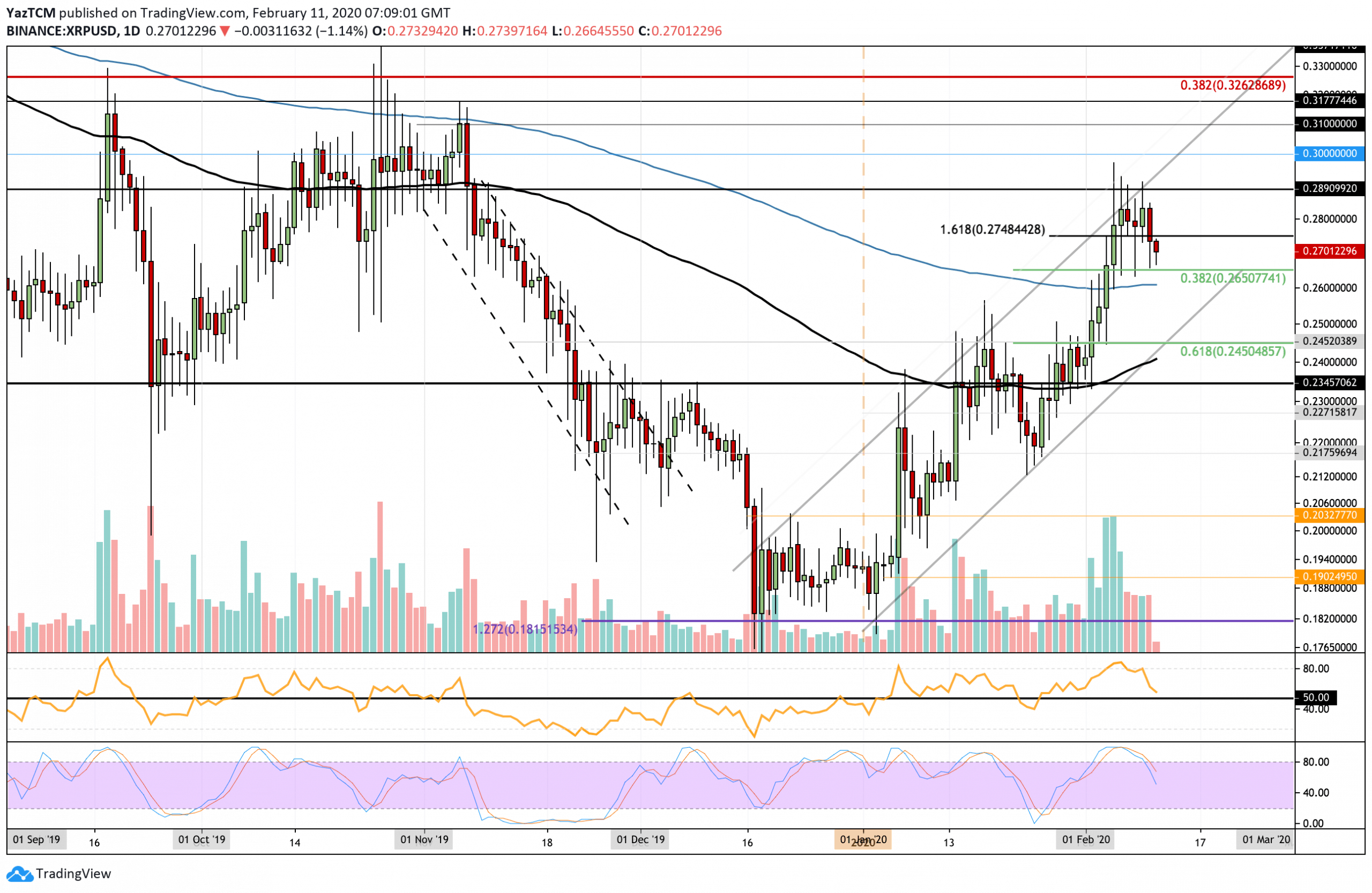

XRP/USD

Support: $0.265, $0.26, $0.245.

Resistance: $0.28, $0.289, $0.30.

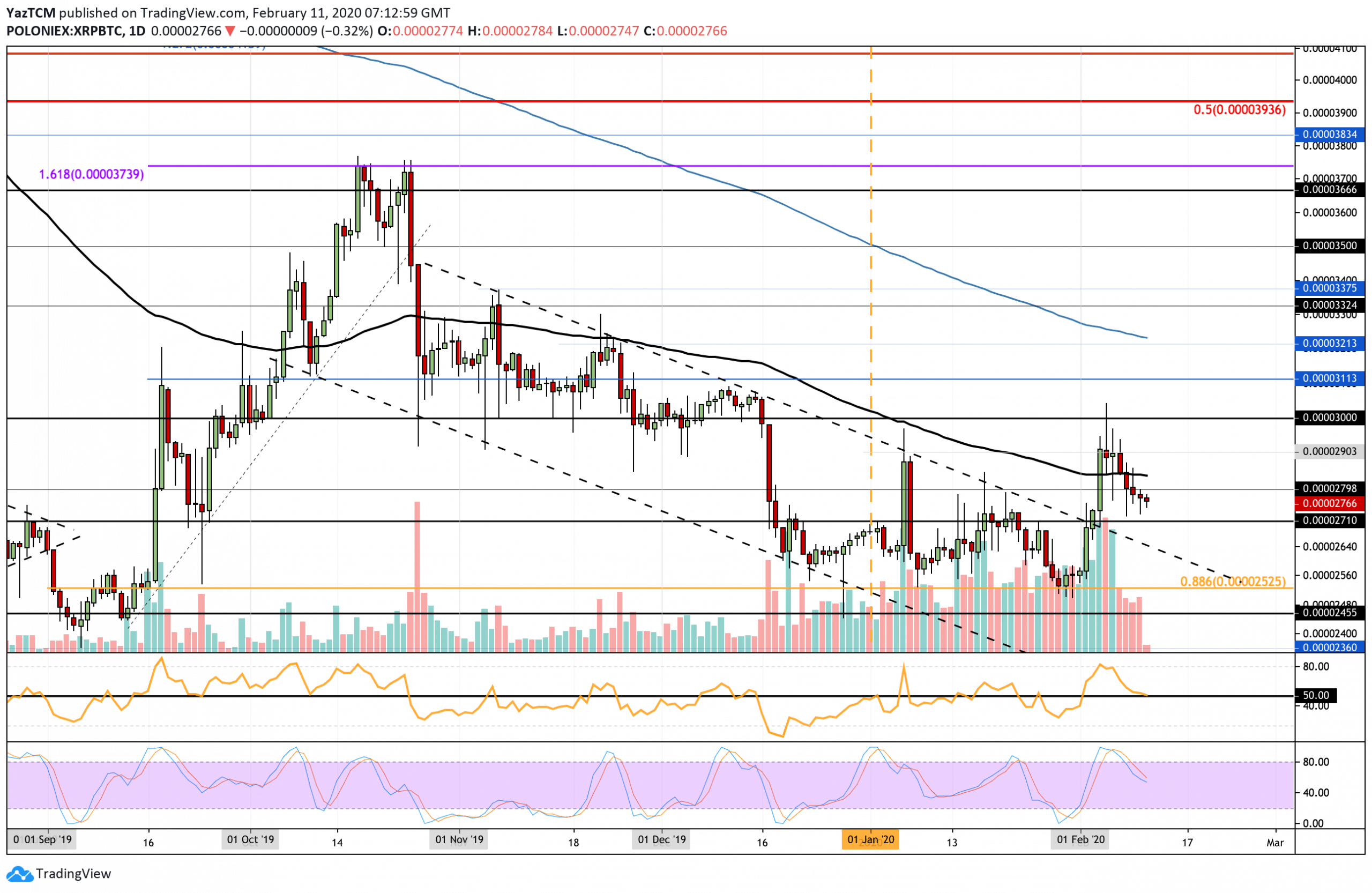

XRP/BTC:

Support: 2710 SAT, 2600 SAT, 2525 SAT.

Resistance: 2850 SAT, 2900 SAT, 3000 SAT.

XRP/USD: XRP Rolls Over After Failing To Break $0.285

Since our last analysis, XRP failed to penetrate above the resistance at $0.285 and rolled over. The cryptocurrency headed lower as it fell beneath $0.28 to reach the current support at $0.27.

After reversing, the volume has started to drop quite significantly, but it remains high above the average level for November and December 2019.

XRP remains bullish in the short term, but a break beneath $0.26 (200-days EMA) will discontinue this bullish trend. It would still need to drop beneath the support at $0.218 to turn bearish.

XRP/USD. Source: TradingView

XRP Short Term Price Prediction

If the selling continues to drive XRP lower, the first levels of support lie at $0.265 (short term .382 Fib Retracement level) and $0.26 (200-days EMA). Beneath this, additional support lies at $0.245 (also lower boundary of ascending price channel) and $0.24 (100-days EMA).

On the other hand, if the buyers can defend $0.27 and bounce higher, resistance lies at $0.28 and $0.289. Above this, additional resistance is expected at $0.30 and the upper boundary of the ascending price channel.

The RSI has dropped from overbought conditions as it approaches the 50 level. A break beneath 50 would shift the momentum into the hands of the bears, and we could see XRP breaking $0.26.

XRP/BTC – Is XRP Stabilizing At 2750 SAT?

Against Bitcoin, XRP continued to fall lower beneath the 100-days EMA, but it is showing some signs that it is stabilizing at around 2750 SAT, according to the candlesticks patterns.

XRP remains neutral against Bitcoin and would need to break above the 3000 SAT level to turn bullish. If it continues to fall beneath 2600 SAT, the market could become bearish.

XRP/BTC. Source: TradingView

XRP Short Term Price Prediction

If XRP does not stabilize at 2750 SAT and travels lower, the first level of support lies at 2710 SAT. Beneath this, additional support lies at 2650 SAT, 2600 SAT, and 2525 SAT (January 2020 support).

On the other hand, if the bulls rebound from here and break above 2850 SAT (100-days EMA), higher resistance lies at 2900 SAT and 3000 SAT. Above this, additional resistance lies at 3110 SAT and 3220 SAT (200-days EMA).

The RSI has returned to the 50 level to indicate indecision within the market. Although the previous bullish momentum has faded, the bears still haven’t managed to take control over the momentum. If the RSI does break beneath 50, XRP could be expected to head further beneath 2700 SAT.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato