- XRP decreased by 7% this week, which brought the coin back beneath the 100-days EMA.

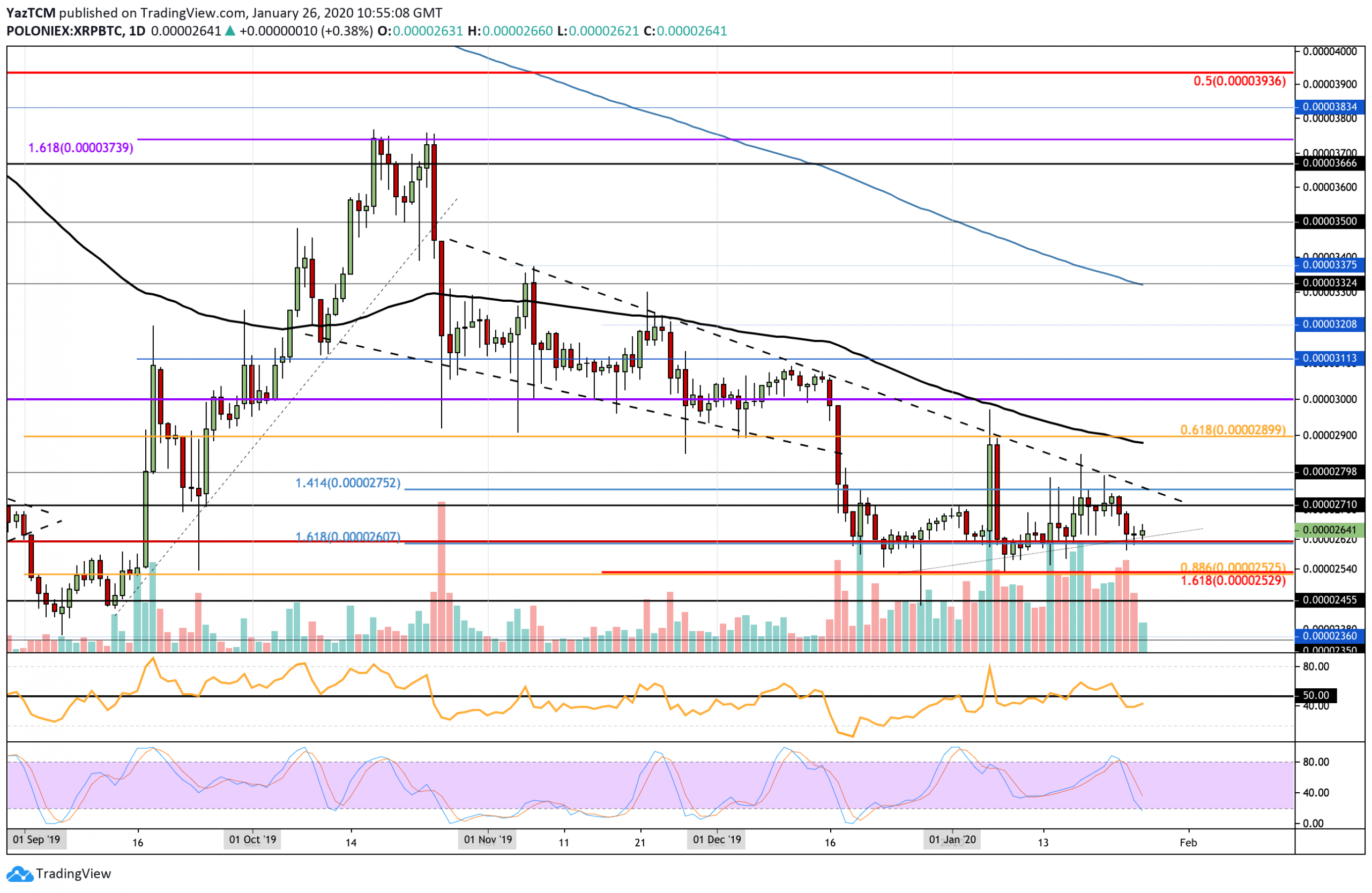

- Against BTC, XRP dropped into the support at the 2600 SAT level.

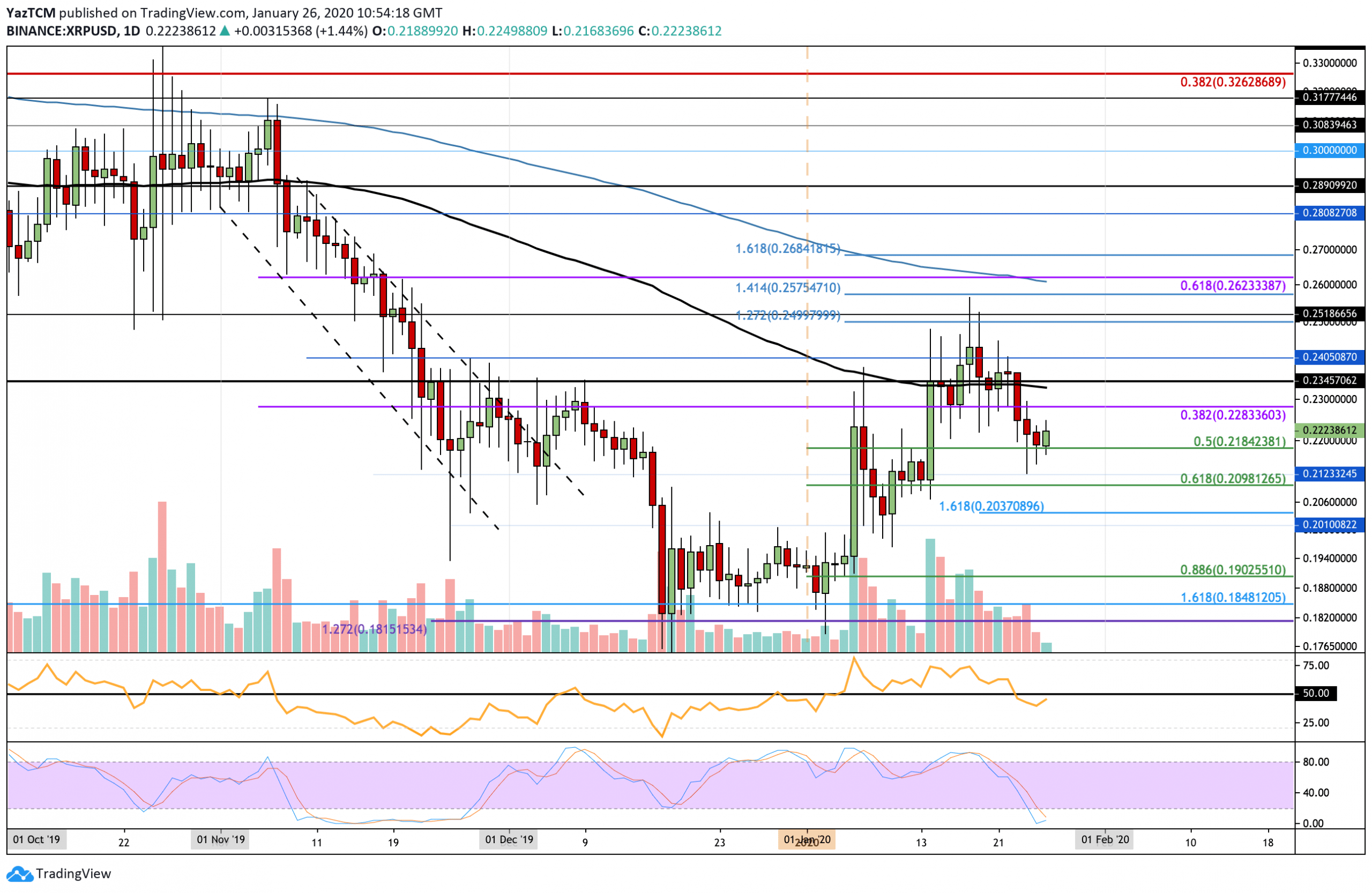

- XRP has found strong support at the .5 Fibonacci Retracement level.

Key Support & Resistance Levels

Support: $0.218, $0.209, $0.1850

Resistance: $0.2283, $0.234, $0.25.

Support: 2600 SAT, 2350 SAT, 2455 SAT.

Resistance: 2710 SAT, 2800 SAT, 2900 SAT.

XRP/USD: XRP Holding Support at .5 Fib Retracement

Since our last analysis, XRP went on to rise above the 100-days EMA. However, it found resistance at $0.25, which caused it to roll over and drop back beneath this level. It continued to fall until finding support at the short term .5 Fibonacci Retracement at around $0.218.

XRP has returned into a neutral trading condition after retracing below the $0.2345 level. It will need to make fresh ground above $0.26 to be able to be considered as bullish on the next push higher. If XRP were to continue to fall beneath the $0.20 level, the market could be considered as slightly bearish.

XRP Price Short-Term Prediction

If the bulls can defend the current support at $0.218 and rebound, initial resistance lies at $0.228 and $0.234 (100-days EMA). Beyond this, resistance is expected at $0.24 and $0.25 (1.272 Fib Extension). On the other hand, if the sellers push the market beneath $0.218, support lies at $0.209 (short term .618 Fib Retracement), $0.203 (downside 1.618 Fib Extension), and $0.19.

The RSI dipped beneath the 50 level but is battling to break back above. It currently indicates indecision within the market, meaning it could still head in any direction. Fortunately, the Stochastic RSI is in oversold conditions and is primed for a bullish crossover signal that should send the market higher.

XRP/BTC: XRP Remains Supported By Sideways Range At 2600 SAT

Against BTC, XRP continues to be supported at the 2600 SAT region, which has prevented the market from dipping lower during January (besides a brief drop to 2540 SAT). It remains trapped within the range from 2600 SAT to 2710 SAT and must break this range to dictate the next direction it would like to head toward.

As we are trading in a range, XRP remains neutral at this moment in time. However, if it drops beneath the support at 2530 SAT, the market would turn bearish and should head toward Septemeber 2019 lows. To turn bullish, XRP must rise and break above the 3100 SAT level to clear the 100-days EMA and the December highs.

XRP Price Short-Term Prediction

Toward the upside, the first level of strong resistance lies at 2710 SAT. Above this, resistance is expected at 2800 SAT, 2900 SAT(100-days EMA), and 3000 SAT. Alternatively, if the sellers push XRP beneath 2600 SAT, support lies at 2530 SAT (.886 Fib Retracement), 2455 SAT, and 2400 SAT.

Likewise, the RSI has dipped beneath the 50 level but is battling to break back above. The momentum is indeed flat, and XRP must rise well above the 50 level to begin any form of recovery.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

The post appeared first on CryptoPotato