- XRP increased by 2.5% over the past 24 hours of trading, bringing the price up to $0.238.

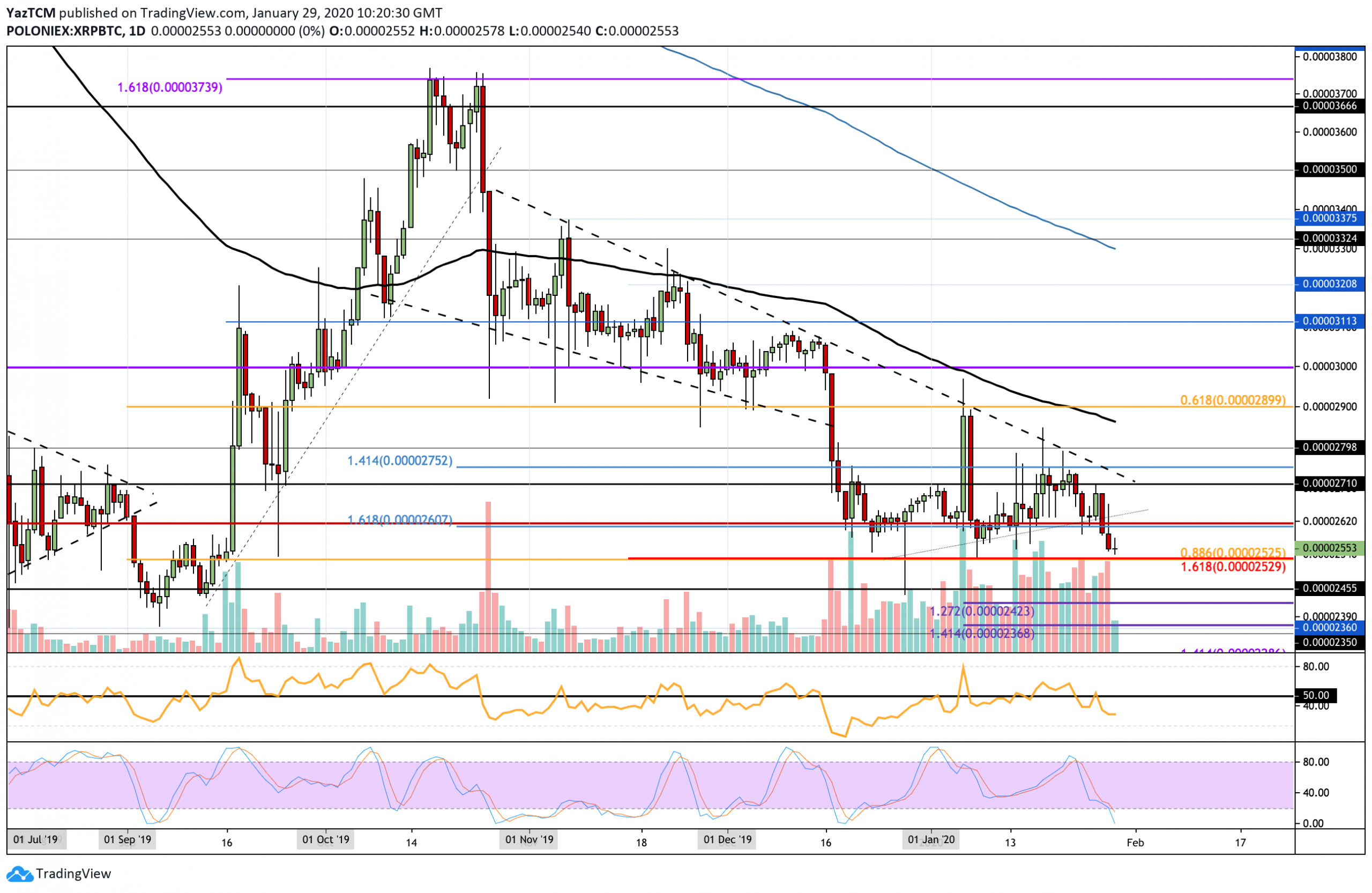

- Against BTC, XRP has suffered heavily after dropping beneath 2600 SAT to approach the January lows at 2525 SAT.

- The latest price increase is mostly a result of BTC surging back above $9,000.

Key Support & Resistance Levels

Support: $0.234, $0.218, $0.20.

Resistance: $0.245, $0.25, $0.26.

Support: 2525 SAT, 2455 SAT, 2423 SAT.

Resistance: 2600 SAT, 2710 SAT, 2800 SAT.

XRP/USD: XRP Rebounds From .5 Fib Retracement To Reach $0.24

Since our last analysis, XRP rebounded from the support at $0.218 as expected, and continued to climb higher above the 100-days EMA at $0.234. The cryptocurrency went as high as $0.25 before it rolled over and fell to the current price of $0.238.

Despite the recent price increases, XRP remains in a neutral trading condition. To turn bullish, it must rise and break above the resistance at $0.26, which is provided by the 200-days EMA. If XRP were to drop and fall beneath the support at $0.21, it would be considered as bearish.

XRP Short Term Price Prediction

If the buyers continue to bring XRP above $0.24, resistance lies at $0.245 (bearish .5 Fib Retracement) and $0.25. Above this, resistance lies at $0.257, $0.26 (200-days EMA), and $0.262. Alternatively, if the sellers regroup and push XRP lower, strong support lies at $0.234 (100-days EMA). Beneath this, support lies at $0.23, $0.218, $0.212, and $0.21.

The RSI climbed back above the 50 level, which shows that the bulls still have control over the market momentum. Furthermore, the Stochastic RSI recently produced a bullish crossover signal that helped XRP climb from $0.218. If the Stochastic RSI moving averages can continue to expand, XRP could break above $0.245.

XRP/BTC: XRP Approaching Jan 2020 Lows – Can It Hold Here?

Against BTC, XRP dropped beneath the strong support at 2600 SAT as it makes its way toward 2525 SAT, which is the January 2020 low. Worryingly, if XRP does drop and close beneath here, it would be creating a fresh 5-month low, and it might send XRP below 2400 SAT.

XRP remains neutral. However, it is very close to turning bearish. A close beneath the support at 2525 SAT would confirm a short term bearish trend. For XRP to become bullish, it must rise above the January 2020 highs and break 3000 SAT.

XRP Short Term Price Prediction

If the sellers push XRP beneath 2525 SAT, the first level of support is expected at 2455 SAT. Beneath this, additional support lies at 2423 SAT (downside 1.272 Fib Extension) and 2368 SAT (downside 1.414 Fib Extension). On the other hand, if the bulls defend the support at 2525 SAT and rebound, resistance lies at 2600 SAT, 2700 SAT, 2800 SAT (100-days EMA), and 2900 SAT.

The RSI remains beneath the 50 level, which indicates a strong bearish momentum within the market. The slope of the RSI is starting to shift, which could be the first sign that the selling momentum may be stabilizing. However, we must wait for a bullish crossover signal on the Stochastic RSI to confirm this.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato