- XRP saw a very strong 9.5% price hike today, and it reached $0.24.

- The coin has now created a fresh 3-month high not seen since late April 2020.

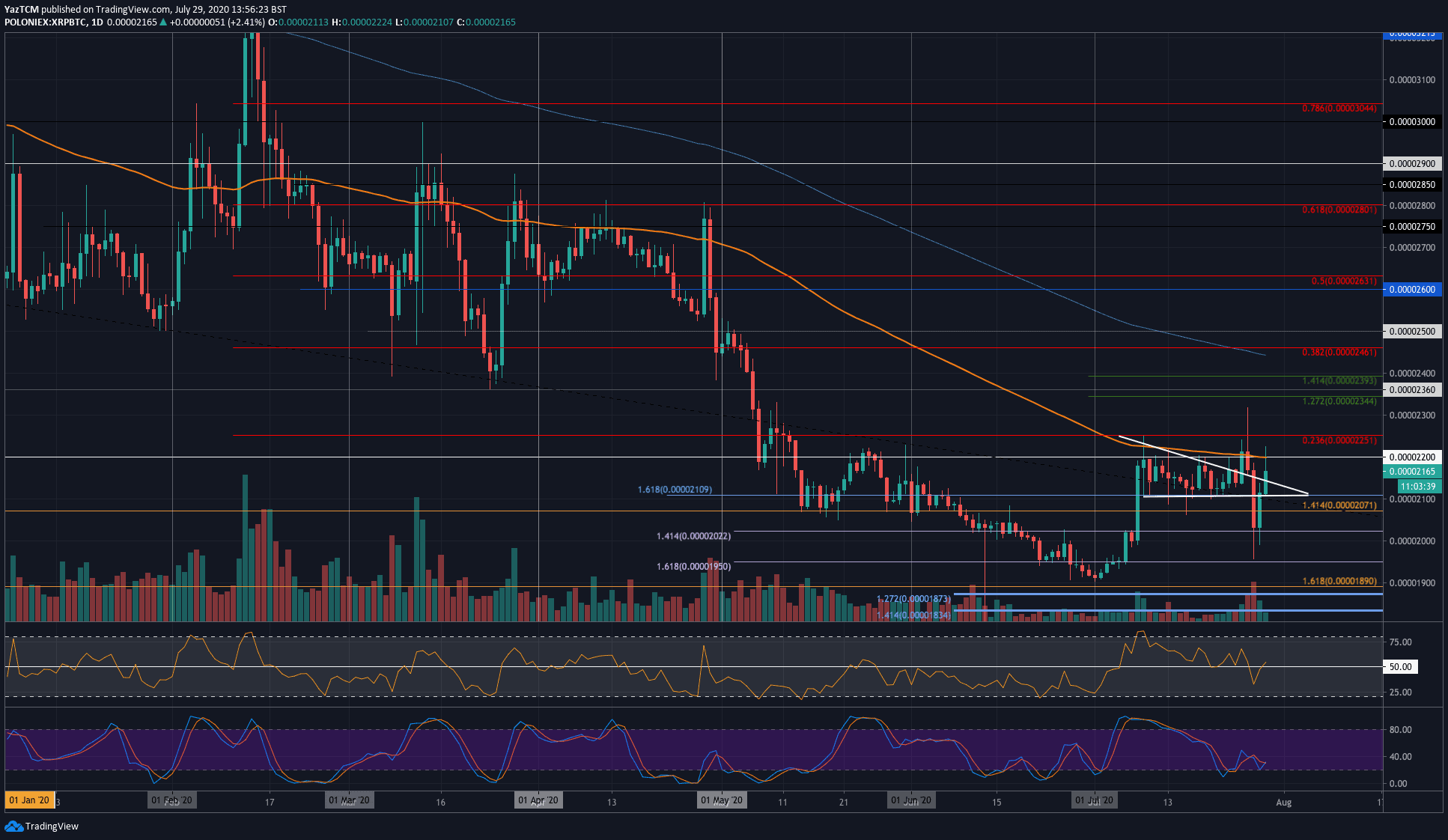

- Against Bitcoin, XRP continues to struggle as it fails to break 2200 SAT.

XRP/USD: XRP Bulls Attempting To Break Above April Highs

Key Support Levels: $0.234, $0.225, $0.22.

Key Resistance Levels: $0.245, $0.25, $0.255.

Since passing the 200-days EMA at $0.21 earlier in the week, XRP has continued to surge as it reached the $0.241 level today. It managed to push above resistance at $0.225 (bearish .5 Fib Retracement) and $0.23 to reach the $0.24 level.

If the bulls can continue to close above $0.25, they will be creating a fresh 5-month high and will be kick-starting a new bull run back toward the 2020 highs at around $0.34.

XRP-USD Short Term Price Prediction

Looking ahead, if the buyers continue to push, the first level of resistance is located at $0.245. This is followed by resistance at $0.25 and $0.255 (bearish .618 Fib Retracement level).

On the other side, the first level of support is located at $0.234. This is followed by support at $0.225, $0.22, and $0.21 (200-days EMA).

The RSI and Stochastic RSI have reached overbought conditions, which could suggest that the market may be a little overextended.

XRP/BTC – Bulls Struggle To Overcome 100-days EMA

Key Support Levels: 2100 SAT, 2071 SAT, 2050 SAT.

Key Resistance Levels: 2200 SAT, 2250 SAT, 2300 SAT.

Despite the promising look for XRP against the USD, the situation continues to be quite dire for XRP against Bitcoin. It was trading within a small triangle during July, which was broken earlier this week.

After that, XRP was unable to overcome the resistance at 2200 SAT (100-days EMA), which caused it to drop heavily into the 2022 SAT level. It has since rebounded as it attempts to break the 2200 SAT resistance again today.

XRP-BTC Short Term Price Prediction

Moving forward, the first level of resistance is at 2200 SAT (100-days EMA). Following this, added resistance lies at 2251 (bearish .236 Fib Retracement), 2300 SAT, and 2400 SAT.

On the other side, the first level of support lies at 2100 SAT. Beneath this, support is found at 2070 SAT, 2022 SAT, and 1950 SAT.

The RSI managed to break above the 50 line today, which is a promising sign as it shows the momentum is starting to shift in the bull’s favor. Additionally, the Stochastic RSI is primed for a bullish crossover signal that should also send the market higher.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato