(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Art is an expression of human civilisation’s energy abundance. When viewed in net energy terms, it is completely worthless. But when viewed as the purest expression of humanity beyond our basic functions of consuming calories, reproducing, and perishing, it is priceless. We “work” to enjoy leisure, and leisure is a personal pursuit that usually involves some art form. That encompasses music, film, paintings, sculptures, sports etc. All of these activities are energy sinks, but bring endless pleasure to the participant and the spectator.

Art is an expression of human civilisation’s energy abundance. When viewed in net energy terms, it is completely worthless. But when viewed as the purest expression of humanity beyond our basic functions of consuming calories, reproducing, and perishing, it is priceless. We “work” to enjoy leisure, and leisure is a personal pursuit that usually involves some art form. That encompasses music, film, paintings, sculptures, sports etc. All of these activities are energy sinks, but bring endless pleasure to the participant and the spectator.

The advent of super-intelligent networked thinking machines will herald an era where the vast majority of humans’ labour is economically worthless. Freed from the physical constraints of work, humans will turn to their new digital worlds and the complete expression of civilisation’s creativity and vitality. The metaverse is the future.

What, then, of the concept of “art” in a purely digital construct? How will money, which is just an energy abstraction, be “wasted” on the pursuit of digital art? Are NFT-based art forms both worthless and priceless at the same time, similar to all other “traditional” forms of art?

NFT-permissioned art is completely worthless from an energy standpoint, but it will represent the ultimate way to Flex social standing in a purely digital world. While it seems silly to those who think Art Basel and The Venice Biennale are the epitome of gatherings of like-minded cultured individuals, infinitely replicable JPEGs traded on the blockchain are no sillier than squiggles on a piece of canvas.

You Are Worthless

Compared with a self-learning intelligent machine, the vast majority of human labour is not worth the energy inputs it takes to sustain it. Regardless of how “smart” or “creative” you think you are, a machine will be better than you over the next few decades.

What to do now? Old people will play physical sports, hang out on the beach, go to physical nightclubs, etc. once we tire of COVID lockdowns. (By old I mean millennials and older.) Young people will play video games and create entire new worlds inside various digital metaverses.

The COVID shock just accelerated these trends. Now a large percentage of the world is locked in their dwelling; their only means of interaction is through internet-connected machines. Whether you like it or not, your online avatar will only grow in importance. The metaverse is now, and you are participating in its creation.

The metaverse will be anything the human mind can dream up and it won’t be held back by the traditional physical laws we take for granted in meatspace. Entire new economies and occupations we cannot imagine will come to be in these worlds. Hopefully these jobs create the same sort of self-satisfaction as traditional employment such that the population feels content with their lot in life. The alternative is billions of restless souls that will lash out at perceived and real inequalities especially as capital is further concentrated amongst our tech overlords.

The most powerful man in the world – as defined by the number of users he influences – is Mark Zuckerberg. He is betting all the marbles that the true Facebook-enabled community of the future is the metaverse. AR and VR devices that allow humanity to create communities in digital space is what Facebook believes the next iteration of digital community represents.

China is fashioning a mobile-first online society. All data and interactions are networked, monitored, and policed by the state. The Chinese metaverse is complete with social credit scores that encompass the entirety of your on and offline lives. Given the amount of R&D spending on AI and 5G, Beijing believes the future is a digital first connected population.

Regardless of your politics, Western and Eastern capital believe in the metaverse.

Gamers Unite

According to Statista, in 2020 2.55 billion people played some sort of video game. On average, gamers spend 54 minutes per day, or 6.33 hours per week, doing their thang.

At 2.55 billion people, gamers represent the largest affiliated population cohort. They span traditional nationalities and religions. An interesting data point – which I don’t possess – would be whether gamers feel a stronger affiliation to the in-game community or their country of birth / practiced religion. I am willing to bet that as gamers spend more time in their virtual worlds, affinity to a nation state or religion wanes in favour of in-game communities.

Gaming is not just shoot ‘em ups. I view it essentially as some social activity inside a virtual world. The construct will morph into any activity inside a virtual world. If we consider how many hours humans now spend on Zoom and Microsoft Teams, which are just virtual workspaces, the amount of time spent socialising / working would be much higher.

People like these new worlds. Preferences for working from home (WFH) vs. inside an office building has drawn lines between generations and income levels. The boomer boss wants to see their younger and poorer chattel sitting physically in an office where they can be policed. Labour, if it can be done online, would rather sit in their athleisure in the comfort of their own home, and benefit from the additional leisure time that comes from no longer having to commute. As we socially evolve to form strong bonds in a completely virtual setting, the concept of an in-person meeting to seal a deal will become an anachronism.

How To Flex

As social beings, the sole purpose of many activities and purchases is to publicly display how much energy you can waste. The nightclub economy is extremely a propos to this concept. Individuals walk into a dark room, listen to loud music (art), dance (a waste of energy akin to a mating call), and pay exorbitant amounts of money to drink liquid. Everyone gets dressed up real nice in articles of clothing that serve no useful purpose other than to demonstrate that the wearer spent a lot of money to display their social status to the rest of the clubbers present.

If you think nightclubs are too gauche, then how about a global art exhibit? The rich and famous art lovers, creators, and curators waste energy travelling to one place. They congregate to “collect” useless paintings, sculptures, and other installations. There is a definite social pecking order based on the gallery you represent and/or how many pieces of useless stuff you hoard. Food and drink are provided to socialise with other like-minded enlightened art aficionados, and when finished, everyone packs up and wastes more energy returning to their homes.

Socialisation and communication are why humans are special. That’s how we build monuments to our gods and rulers. That’s how we put a man on the moon. That’s how we created the internet and integrated circuits. Flexing is both a 100% waste of energy, and essential to creating the social bonds that allow civilisation to progress.

As we imagine what the metaverse could become, how will its inhabitants flex their social standing? Turning back to gaming, an already burgeoning economy around skins worn by your online avatar points to a digital future of worthless artistic digital objects representing large amounts of value.

DMarket estimates a skin market of ~$40B.

Newzoo also conducted a report on US gamers attitudes towards skin trading which is insightful.

Highlights from the report

-

- “Of core U.S. gamers who are aware of skins, 81% would like to get real-world money for their skins and are therefore interested in skin trading. Over two-thirds of the group are unaware of any major skin-trading platforms in the U.S. (including Steam’s Community market, DMarket, OpenSea, and Bitskins).”

- “Crucially, 75% of the players that are interested in skin trading say they’d spend more on skins if they had a monetary value outside of the game.”

- Demographically, young males are most likely to engage with game cosmetics, but big spending whales are older.

Our online avatars need to flex. Digital items paired with our unique online identities will explode in value. Ask yourself this, would a die-hard gamer rather spend $1,000 on a rare skin, or $1,000 on a Louis Vuitton bag (and you’re probably asking, “what LV bag costs only $1,000”)? Both items serve the same purpose. They display the extent to which you can afford to waste energy due to your affluence. They are also scarce goods.

A Flex Good

Goods that you flex should feature some of these characteristics:

-

- The good must be intrinsically worthless, or if it has some use like a piece of clothing, there is a much cheaper substitute that achieves the same function.

-

- When in doubt, check whether said item is lyrically mentioned by a pop star. If true, then it’s probably a Flex Good and intrinsically bankrupt.

-

- The good must be intrinsically worthless, or if it has some use like a piece of clothing, there is a much cheaper substitute that achieves the same function.

-

- Possession of the good should confer membership in an exclusive community.

- The goods should be of limited quantity, in other words, scarce.

Have you ever wondered what it felt like to wear a sock sneaker? Well for the privilege, Balenciaga will sell you a pair for close to $1,000.

Is this a Flex Good? Let’s go through the checklist.

Attribute 1:

You can buy a pair of sneakers for much less money for the purpose of protecting your feet while engaging in the biomechanical activity humans call walking. And yes, a rapper named Cardi B had this to say about said sneakers:

“I like those Balenciagas, the ones that look like socks”.

Attribute 2:

If you buy these shoes, it projects that you are part of a small community that appreciates high fashion and can afford to wear the brand Balenciaga.

Attribute 3:

These shoes are semi-scarce. Balenciaga produces enough pairs such that anyone with $1,000 can probably purchase a pair. They are scarce in monetary terms, though, because the majority of humans cannot afford to waste $1,000 on sock sneakers.

Crypto Flexing – NFTs Enabled Art

NFTs, or non-fungible tokens, currently are just a record of ownership. The NFT tells us which cryptographic public key is the one true owner of a particular piece of data. As the market currently stands, the referenced art itself is easily copied, but original ownership is cryptographically unique.

Due to the fact that NFT art today mostly takes the form of digital images and videos, naysayers are dumbfounded as to why someone would pay money (energy) for a piece of data that can be copied for free. The connected art can be enjoyed without purchasing anything. It can also be transferred for free. However, what these folks do not grasp is that the art itself is tangential to the Flex. It is about owning the cryptographically unique certificate … the NFT.

Physical artwork has value because the artwork itself cannot be in two places at once. There is only one Mona Lisa that resides inside The Louvre. A jpeg of a pixelated rock can be in every place at once. So why do both have values greater than zero?

In the metaverse, it is not enough to “wear” or “display” your digital item. You must also be able to prove its scarcity. That can cryptographically be done by owning the NFT.

Your crypto Flex is two-fold. Firstly, you have a bad-ass looking pair of virtual sneakers, cute penguin, pixelated visage, or a jpeg rock you can display on or as your avatar on various social platforms. Take a look at how many crypto folks signal their worth and membership in an elite community by having their avatar be an image connected with an NFT. Lastly, and most importantly, after flexing you own a +1,000 ETH value crypto punk because it is your Twitter avatar, you can actually prove you cryptographically own it on the Ethereum blockchain. Now everyone knows how much you paid for it – without you having to shout, “Hey world, I’m rich as fuck.” We humans like to abstract our displays of wealth in goods rather than be too nouveaux about it by directly showing our bank balance or wealth held on-chain.

Ether Rocks is an interesting NFT project to evaluate vs. the checklist.

Attribute 1:

An EtherRock is literally a collection of rock PNG pictures. I wouldn’t say they took much in the way of human creativity to bring into existence. They are definitely intrinsically worthless.

Attribute 2:

If you own EtherRock you are part of an exclusive community no larger than 100 individuals. You can buy more than one EtherRock if you so choose, but there will only ever be 100.

Attribute 3:

EtherRocks are extremely scarce because there were only 100 minted.

This is a funny project because the PNG files are so obviously worthless and devoid of creativity that it triggers many to question why anyone would waste serious amounts of Ether to purchase them. In fact, almost 2,000 ETH worth of rocks have been traded in August alone. But the more obviously worthless and expensive the NFT, the greater the Flex. Also as with all things, the value can fluctuate. Imagine owning a Rock that was once worth a lot of ETH, and is now worthless. The value volatility also adds to the Flex because it connotes that the owner is perfectly happy that their Rock could be worth 0 at the propagation of the next Ethereum block.

Trading NFTs

Much like traditional art, a healthy ecosystem of speculators will and have gravitated towards NFTs. In the art world they call them dealers or collectors, but they are gambling as to which pieces of worthless matter will be “valued” by humanity in the future. It is a very tough thing to do well and profitably over time. How does one pick which contemporary artists to support such that a collection of their works continues to appreciate in value over time?

It is equally as difficult in the NFT space. How do you know which project’s artwork will pop? Should it be very scarce in the number of items minted? Should it be an old project, where “age” is the proximity to the Bitcoin genesis block? Should it be aesthetically pleasing to a particular moneyed cohort? Should it be directly tied to a popular video game? There are many questions, and no right or wrong answers. But there will exist a coterie of traders who are masters at narrative construction and meme propagation. They will be able to amass a collection of the most sought after NFTs and in the process earn a respectable return.

Trading Data

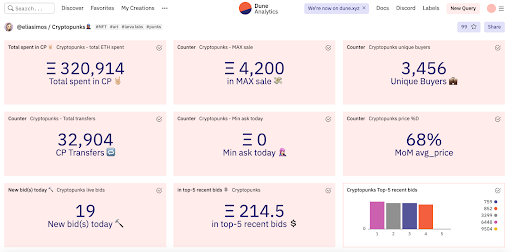

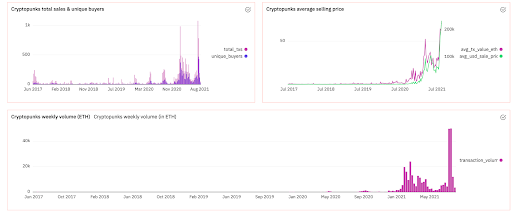

I do not have a complete picture of the daily trading volumes of NFT art, but I will use the CryptoPunks and OpenSea projects as useful illustrations.

The following data is from Dune Analytics.

It is immediately evident that 2021 is the breakout year for this project. I argue Punks are representative of the energy and activity present across the entire space. People are Flexing hard with the purchase of intrinsically worthless pixelated faces.

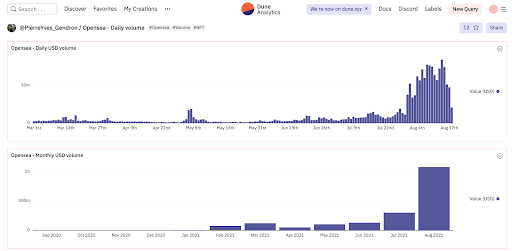

OpenSea is one of the most popular marketplaces for NFTs. It’s basically the crypto version of Christie’s and Sotheby’s.

The following data is from Dune Analytics.

This market is exploding. Imagine if there were transparent marketplaces that traded all art in meatspace. The amount of volume would be massive. That is the opportunity set right now with NFTs. If you still think they are piles of cow dung, it doesn’t matter, because the most sought after projects are attracting actual liquidity.

The art world employs thousands of people whose purpose is validation and verification of the provenance and authenticity of the works for sale. And given that it’s done by fallible and sometimes conflicted humans, fakes abound in the art world. That is not possible with NFTs traded on public blockchains. When you purchase something on OpenSea you know with 100% certainty that you are purchasing Number Whatever of a particular project.

Usage of blockchains to authenticate Flex goods is superior because it cannot be faked. Imagine a project that created a symbol which meant that if you displayed a digital item on your avatar you actually owned the original file. It would be something similar to the “blue check” on Twitter.

One of my boys, who by day slings EM FX and bonds for a large hedge fund, secretly is a wannabe K-pop star / NBA athlete, has gone deep into NFTs. In the crew, he is always wearing some funky expensive shit from brands none of us have ever heard of. He remarked in one of our chats on the topic of NFTs:

“It’s like wearable art online but online”

“U can flex on even more people”

Dismiss Them At Your Peril

Flexing is integral to the human experience. We don’t question the value of physical meatspace items used to project social standing. We understand and value fashion, paintings, jewelry etc. We all don costumes at work that illustrate which professional community we belong to. What is an investment banker without his Hermes tie or her pair of red-soled Louboutins? The costume is part of the self-worth.

Just because robots take all of our meatspace jobs doesn’t mean that humans stop being humans in the metaverse. Social signaling will take new forms powered by blockchain enabled NFT “worthless” objects. Those who recognise the similarities and are early to the creation of a new market for digital Flex goods will reap astronomical returns. Those content to pooh pooh this new worthless form of social signal can continue to walk down a street, into a shop, and purchase a $500 white t-shirt from some well-marketed fashion house. Choose your Flex Good appropriately.

Scalable Flexing is a tech person’s dream. The ability to appear wealthy and cool is not limited to physical proximity, but the entire addressable market of your avatar.

Related

The post appeared first on Blog BitMex