Although Bitcoin has been trading mostly in the five-digit territory for the past two months, the retail interest towards the asset seems to be declining.

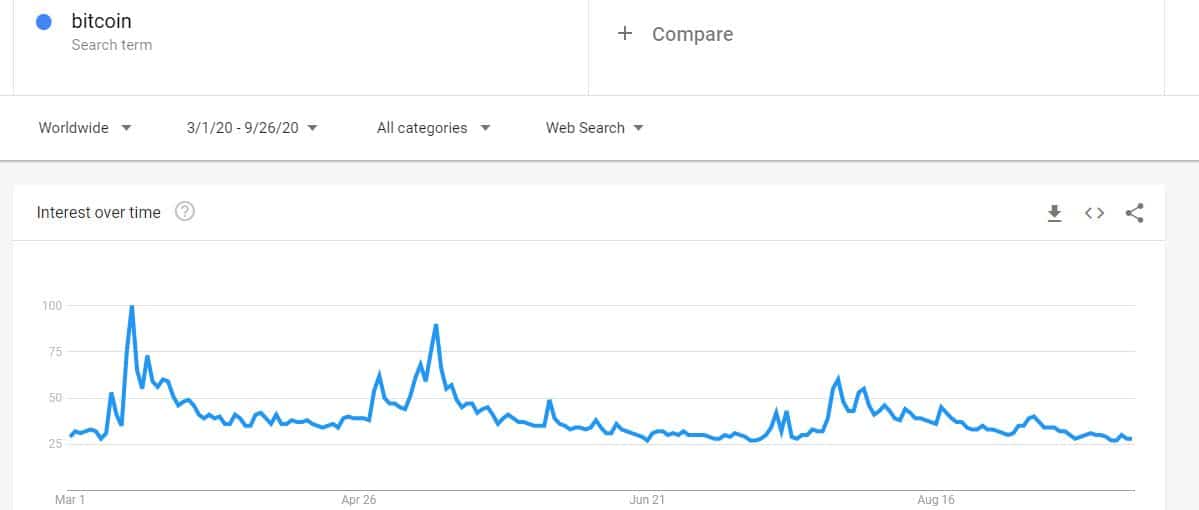

Data from Google Trends reveals that the “Bitcoin” searches are at their lowest levels since the COVID-19 crisis emerged during March 2020.

Bitcoin and Google Trends 2020 Edition

The Google searches typically represent the retail interest for a particular asset, and they surge once there’s a significant event in regards to its development. In the cryptocurrency industry, more likely it will shift due to highly volatile price movements in either direction.

As such, it didn’t come as a surprise when the interest in Bitcoin surged at the start of 2020 when BTC was increasing in value. During the most intense days of the COVID-19 pandemic, when Bitcoin plummeted by 50% in a day, the searches on Google soared.

The situation calmed in the next few months, while BTC was rapidly made a “V” recovery. However, Google trends indicated another increase in late April and especially in early May. This was somewhat expected as in mid-May, Bitcoin went through its third-ever halving. The event has historically served as a price catalyst and attracts lots of attention.

Following the halving, the interest sharply dropped once again until BTC exploded in value in late July. As Bitcoin was breaking above $10,000 and to its new 2020 high at over $12,000, the Google searches jumped as well.

The Downturn Of Retail Interest

Since those days of volatile price movements, Bitcoin has performed relatively calm on a macro scale, and the interest in the asset has decreased as a result. It seems that retail traders are not fond of searching for BTC during smaller price developments.

Consequently, Google trends’ data display that the worldwide interest in Bitcoin has been declining overall. In fact, it’s on its lowest point since early March – before the pandemic infiltrated the Western world. One of the few spikes came in early September. Unsurprisingly, it coincided with BTC’s drop from above $12,000 to beneath $10,000.

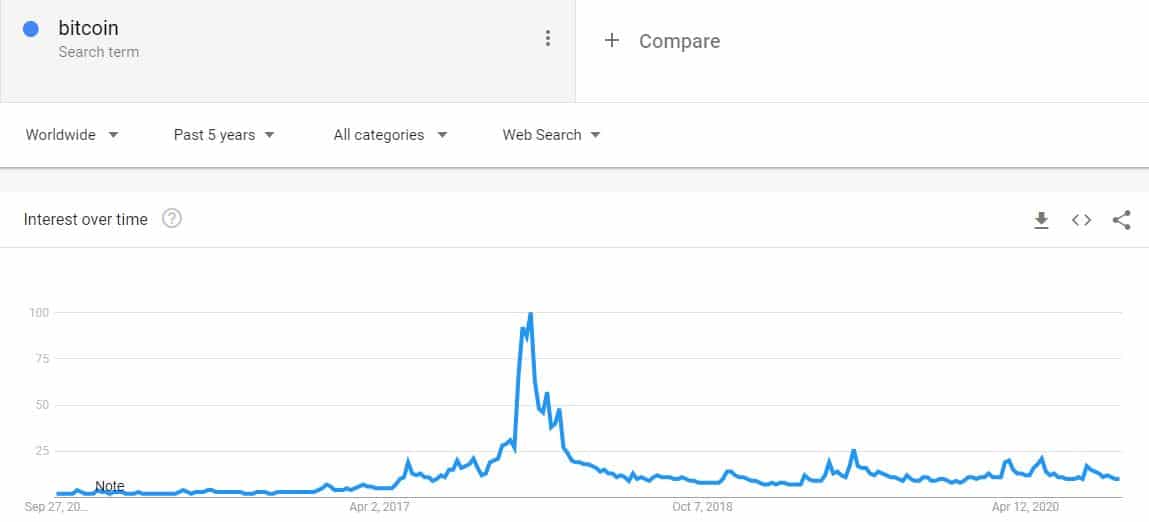

It’s worth noting that on a macro scale, the Google searches for Bitcoin are still far away from the highs of 2017. The low interest could suggest a lot of room for interest-growth as BTC remains stable above $10,000 even without a serious interest from the masses.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato