Gold has crossed the $1,700 mark for the first time since 2012 as traders and investors seek wealth security in these times of economic uncertainty — headlined by the COVID-19 outbreak. The recent gains in the gold market coincide with pressures on Bitcoin, which has dropped from nearly $7,500 to about $6,800 within seven days.

As of writing these lines, gold’s daily high lies at $1,722 following a 16% increase since the monthly low of March 16, 2020, at $1,450.

Relationship Between Gold and Bitcoin

An April 5, report published by fund manager VanEck found that there’s a growing asset correlation trend between gold and Bitcoin. Still, with the prices of the two assets moving in opposite directions recently, the said correlation could be fading away.

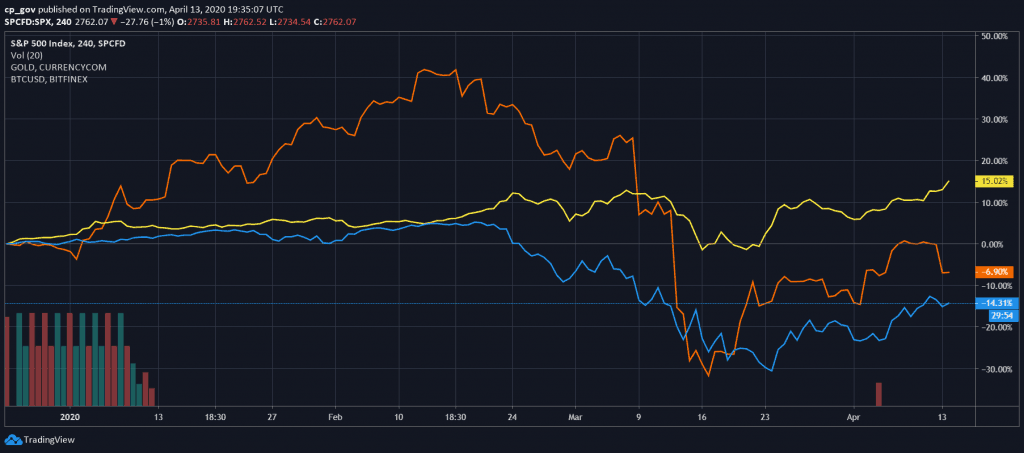

As the above chart shows, between the start of the year and March, the price movement of both assets was somewhat similar. That was the same period that the researchers at VanEck noticed that “Bitcoin correlation to gold has increased significantly.”

The VanEck report wasn’t limited to gold and Bitcoin, however. The researchers also so checked to see how Bitcoin correlated to other traditional assets and indices, including the S&P 500, Nasdaq 100, United States bonds, U.S. real estate, oil, and emerging market currencies. Of all the assets and indices examined, only gold showed a statistically significant correlation to Bitcoin over different timeframes since the start of 2020.

Why Bitcoin and Gold Correlation Matters

Despite Bitcoin existing only in digital form and gold available in physical form, the two assets possess similarities, including finite supply and scarcity. This has made many within the bitcoin community regarding Bitcoin as “the digital gold.”

By translation, expectations are that Bitcoin should be considered a safe-haven asset just like gold, an asset that historically holds better relative to equities during periods of economic uncertainties.

The growing correlation between gold and Bitcoin that researchers at VanEck noticed should, therefore, mean that Bitcoin is increasingly becoming a stronger alternative investment during economic downturns. That trend could change if Bitcoin continues to move in the opposite direction of gold.

Renowned economist Peter Schiff believes that there won’t be a correlation between gold and Bitcoin after a recent tweet in which he said gold would rise and Bitcoin will crash over the long-term.

The post Safe-Haven Uncorrelation: Gold Surpasses $1,700 Recording Highest Price Since 2012 As Bitcoin Struggles appeared first on CryptoPotato.

The post appeared first on CryptoPotato