(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The greatest nation states and civilisations efficiently use energy to create economic prosperity for their subjects. Up until recently, energy meant human labour. The state constructs a system where labour is provided and an economic energy surplus is created. There are various ways in which the great societies of past and present “paid” for labour.

The greatest nation states and civilisations efficiently use energy to create economic prosperity for their subjects. Up until recently, energy meant human labour. The state constructs a system where labour is provided and an economic energy surplus is created. There are various ways in which the great societies of past and present “paid” for labour.

Pre-Industrial Revolution

Rome – Captured slaves from conquest

America – Transatlantic African slavery

Pre-Industrial Western Europe – Feudal serfs

Post-industrial revolution, most societies moved away from implicit or explicit slavery towards a system where the wages of labour were not allowed to grow at the same rate as the overall economy. That is a long-winded way of saying savers are financially repressed. Workers save at a depressed rate, and the difference allows a country to direct national savings towards heavy industrialisation.

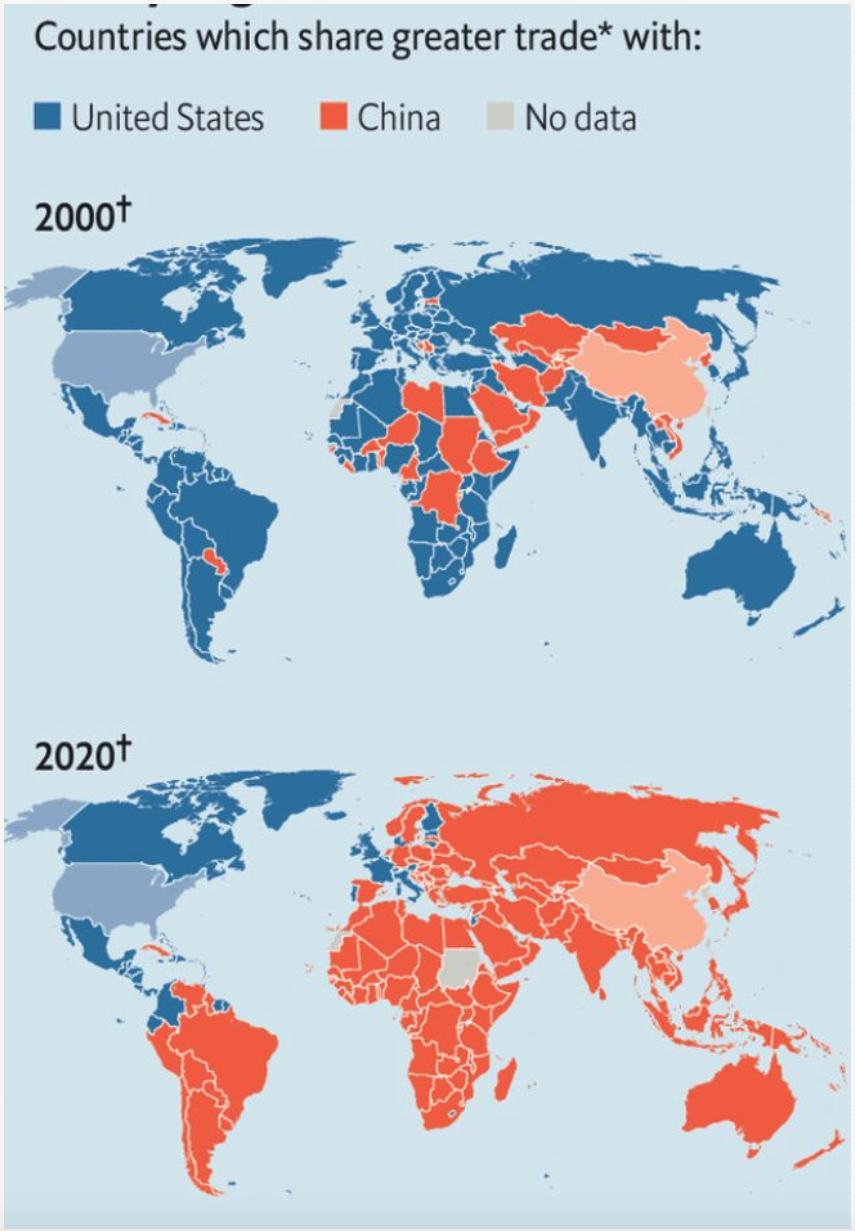

Modern China, Taiwan, South Korea, and Japan are excellent recent examples of post WWII nations that quickly industrialised using the savings of their labourers. I will repost this chart of the China 10-year government bond yield vs. real GDP growth. These negative rates have allowed China to internally finance the creation of the industrial behemoth that supplies most of the world’s stuff.

The image above is courtesy of The Economist. It is absolutely shocking and amazing what China accomplished over the last 20 years. In 2001, China joined the WTO, which meant by international law it became much harder to slap protective tariffs on goods it produced. American-seeking corporations proceeded to ship as much production to China, at a cheaper cost, as it could. In the process, corporate America reaped an increase in profit margins. As a result, manufacturing jobs moved from West to East. Beijing read the industrialisation textbook, and executed perfectly.

The computer and internet connected devices power the current industrial revolution. The exponential changes to human civilisation are about to get REAL. Artificial intelligence (AI), quantum computing, and networked robots will completely change the meaning of labour. What are the 7 billion of us good for compared to a robot?

A robot that “thinks” in ways our linear brains cannot comprehend.

A robot that does not get sick.

A robot that does not unionise.

A robot that follows instructions perfectly.

Every other economic revolution hoisted upon human civilisation empowered more people than it disenfranchised. That is why we can support 7 billion people on this planet. But faced with a completely different sort of change, is it prudent to believe that 7 billion people will have a role in this new society that will emerge in the coming decades?

The rich nations have, by definition, a surplus of capital. This capital may be taxed in such a way to provide for a “basic” income for those left behind. But there is a slice of the world (which some call the Global South) that provides essential cheap labour to rich nations doing agricultural, construction, and domestic services at very low relative wages.

In America, the Central and South American immigrants come to do back-breaking agricultural labour, staff meat packing plants in arduous conditions, and also clean toilets and change nappies. In Western Europe, you have the Magreb and Eastern Europe that fills this gap. Polish plumber meme anyone? In Asia, it’s poor ASEAN nations like the Philippines.

Immigration always creates tension. The locals perceive the immigrants as taking their jobs and benefits. But these locals would also rather wear a collar or pencil skirt and work in a climate controlled office than on a field or in a kitchen.

The unfortunate reality is that many nations in the Global South lack domestic inclusive institutions to channel the remittance income from their citizens working abroad towards accumulating the capital necessary to fully participate in this current industrial revolution. These nations often possess some range of natural resources, but all too often they extract and export primary inputs, and import finished products. Because of the cost difference between inputs and outputs, these nations are capital-starved and must get loans from western policy banks such as the World Bank and IMF.

The truly sad part for these nations is that aid is predicated on a continuation of an economic system in which domestic manufacturing capability is stunted because market access must be given on equal terms to all first world companies. No successful empire or nation state ever practiced “free trade” while they were themselves industrialising. Free trade is only beneficial when your companies can offer cheaper goods and services than others. Free trade is then the condition for foreign aid loans. Free trade in a position of weakness guarantees a nation will always remain weak.

The current spat between America and China illustrates this point very clearly. Each side wants unfettered access to the other’s domestic market. Each side wants the ability for its capital to purchase the other’s most innovative companies. And each side blocks outright control of strategic industries. Poor nations cannot negotiate on the same terms, and therefore rarely get into the position where they have national champions worthy of acquisition.

As an aside, consider the current China big tech “crackdown”. Beijing allowed these massive homegrown platforms to grow quickly because American firms were denied entry to the market. Then when these upstarts got a bit too big for their Mao suits, Beijing stepped in and clearly demonstrated who was 老板.

Give unto Caesar what is Caesar’s.

Western investors have been licking their wounds from the resulting stock market losses and crying foul. “What about property rights?” That’s a little rich coming from a coterie of investors who cheered the US Federal Reserve when it nationalised the investment grade corporate credit market on 23 March 2021. A little gubment intervention ain’t hurt nobody, as long as it helps the home team.

Turning back to the topic at hand, to understand the impact that lopsided trade has on developing nations, just look at El Salvador. My research assistant dug into the El Salvadoran economy and had this to say about the country’s current situation:

“In brief, El Salvador was hit very hard by the pandemic and has subsequently rolled out extensive government programs to offset the human and economic fallout. El Salvador is in a precarious financial position with sizable public debt, few options for financing projects, and a negative account deficit. It will need to successfully negotiate aid with the IMF to keep its recovery on track”.

So, the question becomes, how can developing nations like El Salvador change the game in their favor and break free of their financial woes? The time to act is now. Continuing to shackle one’s country to a global financial system that perpetuates a lack of domestic capital accumulation is a recipe for a dystopian nightmare for the Global South.

In El Salvador’s case, they looked at their options and made the game-changing decision to use Bitcoin as legal tender.

(Sadly, when they reached out to the World Bank for help in implementing Bitcoin as legal tender, the World Bank told them “No thanks.” Stepping outside the traditional financial system is simply not tolerated — and it is not unreasonable to predict that the IMF could make a precondition to new debt financing the abandonment of the usage of Bitcoin as legal tender. But I digress.)

This is great news, but El Salvador has committed only to adopting Bitcoin itself as a legal form of currency — which may potentially fall short of enacting the level of change they are looking for. The purpose of this essay is to reimagine the El Salvadoran economy if they were to create a new Bitcoin-backed currency which would likely be more helpful in turning their situation around. Can it credibly be done, and how can this help solve some of El Salvador’s problems? Nations like El Salvador must race against the progress of technology. Their cheap labour is only cheap relative to other humans, but compared to robots…

Selfishly, I want to explore how a real, vibrant, and large Bitcoin-pegged fixed income market can mature. I believe that a sovereign borrower like El Salvador could shine a guiding light for many other similarly situated nations.

The Bitcoin Standard

Current Conditions

El Salvador is currently a dollarised economy. The USD is the only major accepted form of currency. Bitcoin used as legal tender is a recent phenomenon.

The sole use of the USD subjugates El Salvador completely to the monetary policy decisions of the US Federal Reserve. Good or bad, El Salvador suffers the consequences of Fed policy. The Fed has domestic priorities that don’t include the wellbeing of any country that chooses to fully dollarise. This can and does cause issues where the macroeconomic situation of a foreign country does not require the same policies as that of the United States.

Creating the Peg

The El Salvadoran Colon, which was replaced by the USD as El Salvador’s national currency in 2001, should have new importance in this regime. The central bank should issue a new set of Salvadoran Colons — we’ll call them NSCs — and decide on an amount of Bitcoin each NSC represents.

Creating a peg is easy — defending it is another matter. The central bank must find a way to purchase enough Bitcoin to back its currency. The amount of currency in circulation should match the economic realities. The central bank can drive the NSC to appreciate and depreciate by increasing or reducing the Bitcoin exchange rate respectively.

Let’s walk through an example.

El Salvador decrees that each Salvadoran NSC will be exchangeable for 0.01 Bitcoin.

The amount of NSCs in circulation will depend on how many Bitcoin the central bank holds. Assume the central bank holds 10,000 Bitcoin — that translates into a money supply of 1,000,000 NSCs.

How to get Bitcoin?

This is the biggest problem. How does El Salvador obtain enough Bitcoin to credibly back its currency? If El Salvador goes down this path, the transition should be gradual.

Step 1:

The central bank should announce the future intended Bitcoin : NSC exchange rate. It is in the future because currently the central bank does not have enough Bitcoin to back the number of NSCs it will issue at the official peg. However, the NSC will replace Bitcoin and the USD as legal tender.

As a first course of business, the central bank should convert all of its financial assets and foreign currency into Bitcoin at the prevailing exchange rate.

It should then decree that all taxes and government levies must be paid in NSCs. Even if a shop wishes to price its goods in dollars, it must exchange some dollar income for NSC at the official Bitcoin : NSC peg in order to pay taxes.

The only way to “create” NSCs is to tender Bitcoin for NSC at the official peg. So as not to attract price gouging FX changers, the central bank should stand ready to exchange USD for Bitcoin at the global average with minimal transaction fees. Any large international crypto spot exchange would welcome the central bank as a client, and given the game-changing nature of this program, I would bet that the central bank could negotiate a very favourable fee schedule.

Scenario:

Local shop owner sells goods worth $100,000 and owes 100 NSC of taxes. But they received their income in USD not NSC.

1 NSC = 0.01 Bitcoin and 1 Bitcoin = $10,000; therefore the shop owner needs to obtain 1 Bitcoin in order to create 100 NSCs through the central bank.

The shop owner exchanges $10,000 with the central bank to acquire 1 Bitcoin, and then creates 100 NSCs through the central bank with 1 Bitcoin. The shop owner then remits 100 NSCs to the central government in order to pay their taxes.

The central bank’s balance sheet looks like this –

-

- 1 Bitcoin of assets from the shop owner

-

- 100 NSC liability by issuing 100 NSCs to the shop owner

Issue:

If the central bank issues 1,000,000 NSCs but does not have 10,000 Bitcoin of assets, should an NSC holder attempt to redeem NSC into Bitcoin, the central bank cannot stand by the peg.

In the initial transition period, the central bank should only allow creations and not redemptions. If they allowed redemptions, it would be as if the central bank issued an unbacked fiat currency at the start, because it would not have enough Bitcoin to meet the official peg. However, if everyone in El Salvador is forced to use the NSC to pay taxes, there would be a natural, price-insensitive demand.

The central bank should allow the free market to function, and until the balance sheet contains enough Bitcoin to match the official peg, 3rd parties must be allowed to price the “unofficial” exchange rate. That means if someone would like to convert NSC into USD or Bitcoin, these fx traders will buy NSC and remit whatever amount of USD or Bitcoin the secondary market prescribes. At some point the secondary market rate will appreciate to that of the official peg as more and more economic activity pays taxes in NSC.

The central bank cannot allow any individual or organisation to redeem NSCs at anything other than the official peg. Otherwise there is an arbitrage opportunity and that arbitrage opportunity essentially robs the central government of funds.

Scenario:

El Salvador receives billions of dollars each year of remittance income from its citizens working abroad. The central government should encourage and train its emigrants to demand payment in NSC or Bitcoin. No more USD.

Employers up north may not want to deal with obtaining NSCs or Bitcoin, but they should not be given a choice. Nothing motivates a change in behaviour like not cleaning toilets or shushing a crying child. Employers have much motivation to figure out how to meet the currency of payment demands of their domestic employees.

Scenario:

Taxes paid in NSCs must be levied on Exports and Imports. This creates another source of demand to bolster the balance sheet of the central bank. It also creates a more circular economy for the use of the NSC instead of the dollar.

Step 2:

The NSC is purely digital, and is issued using the Ethereum protocol. It becomes an ERC-20 asset. I believe that if a country were to issue on a public blockchain such as Ethereum, then it gets DeFi out of the box, which is very important when we evaluate how the NSC can sidestep the traditional financial system that aims to keep El Salvador subservient.

This is extremely important. There is no point going through this process if the traditional parasitic financial system must be used to move money domestically and internationally. By creating the NSC on a public blockchain like Ethereum, anyone with a mobile phone and internet would be able to move money. These are the same folks who are not banked because their level of net worth is too small to be worth the cost. Now everyone has a digital bank account for free.

The central bank should create a retail digital wallet to hold NSCs. The app should come with functionality to transfer, exchange, and invest NSCs. While this is easier said than done, any protocol’s foundation would jump at the opportunity to build a secure and user-friendly app for El Salvador. It is in the ecosystem’s interest to make this endeavor as successful as possible for the lowest amount of effort and cost to El Salvador.

This wallet can also be paid with a digital identity system that upgrades the fidelity of PII data. Paired with open and permissioned APIs, El Salvador will have better data which it can use to manage the economy.

Scenario:

The central government would like to offer micro loans to farmers in El Salvador. The central government can credibly ensure that person A receives 100 NSCs, at an affordable rate, and the cost of administering the loan is almost free due to the use of technology throughout the loan origination life cycle.

Issue:

Public blockchains must charge fees to upkeep the network. Due to the heavy usage of Ethereum during the recent DeFi craze, gas fees became prohibitively expensive for small transactions.

The central bank could structure the official NSC wallet in such a way that intra-app transactions are free because these transactions don’t need to be broadcast to the public blockchain. This is akin to how many of the layer 2 solutions work for Ethereum. A channel is opened, things happen in the channel, and the public blockchain only knows the state of the channel. When the state changes, only then is a fee-generating transaction broadcast to the network. Yes, there would be a bit of trust involved in the central bank’s app, but an individual could also choose to hold their NSC, which is ERC-20, in any Ethereum third party wallet like Metamask.

Step 3:

This is where I get the tinglies. El Salvador can issue sovereign bonds denominated in NSC to meet its capital account deficit. The country imports more goods than it exports, therefore it owes the global market money that it doesn’t have. The country still needs foreign funds to balance its books. The crypto community should stand behind the nation as it attempts to become sovereign once more.

A NSC bond, which would essentially be a Bitcoin bond, could be issued at a rate the market deems reasonable for El Salvador to finance its capital account deficit.

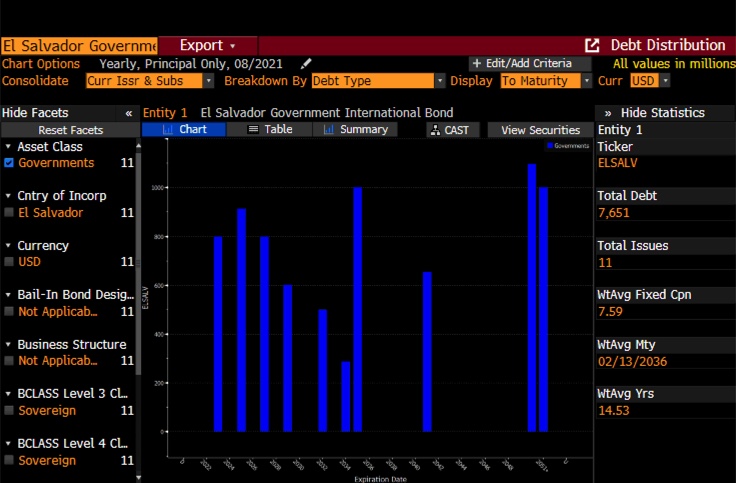

This is a table of the El Salvadorian debt outstanding (Bloomie: ELSALV Govt DDIS). In addition to these sovereign issues, the government borrowed approx. $3.5 billion from the World Bank and IMF combined.

Right now, El Salvador’s weighted average coupon is 7.59% and weighted average maturity is 14.53 years. In order to build confidence within the crypto community, El Salvador should issue short term debt with a maturity between 1 – 5 years.

If there wasn’t a crypto ego complex involved in pricing the debt, the government would not be able to issue a NSC bond at a lower interest rate than a USD bond. However, because I believe the crypto community would like to show the world it can be done, and we support our own, investors out of pride and ideology would accept a lower interest rate than on a USD bond.

Therefore, imagine this El Salvador issued NSC bond:

Type: Zero Coupon Bond

Maturity: 1 year

Face Value: 100 NSC

Issue Price: 95%

That means for every 100 NSC face / par value bond purchased, the investor would pay 95 NSCs. The effective interest rate would be 5%.

The bond would be issued as an ERC-20 asset, which means it rides on the Ethereum blockchain. To obtain NSCs, investors tender Bitcoin to the central bank in return for NSCs at the official exchange rate.

The proceeds would be used to refinance the upcoming maturing USD bonds, and to invest in the leveling up of the country.

The bonds would freely trade in the DeFi ecosystem. And as they would be the first sovereign Bitcoin backed credit, the price would appreciate after issuance.

Issue:

By purchasing these bonds at a below market interest rate, the community is placing a lot of trust in the competency of the El Salvadoran government. It is beyond the scope of this essay to opine on whether that is a sound investment or not.

However, even if they squander the money, the fact that they would have had attempted and successfully launched this type of fixed income instrument would show other similar nations they can too. The first step is always the hardest.

Just Give it a Try

El Salvador made the bold first step to formally recognise Bitcoin as legal tender. Now they must follow through. Half assing it will do the country no justice. And unfortunately the clock is ticking towards a future where their low-value manufacturing and domestic labour exports are replaced by more energy efficient robots.

A good chunk of the world is in a similar situation vis-a-vis their position on the side of capital vs. labour. Labour is going through a renaissance right now due to COVID disruptions, but robots ‘bout to get WOKE, and they are coming for everyone’s jobs.

El Salvador taking back control of its finances is only the first step. By removing the tentacles of TradFi, they are giving themselves a fighting chance. But the hard part comes when the political institutions must use the savings and efficiencies gained not to line their pockets, but to upskill their constituents and create greater prosperity for all.

Related

The post appeared first on Blog BitMex