(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Come eat some of these ‘member berries with me.

‘Member when folks used to travel hours per day to plop their tush into a seat in a steel cage called an “office”?

‘Member when traders used to congregate on a trading floor 5 days a week and shout at each other?

‘Member when degens on the trading floor used to haze interns and fresh graduates?

‘Member??

I have regaled readers with many stories from my early years as an analyst in Deutsche Bank’s Hong Kong office. It truly was a special place, filled with some of the most interesting and aggressive individuals I have ever met. Today we shall talk about a teammate of mine and fellow graduate classmate who, in my crew, went by the nickname Killah. Don’t worry how or why she acquired said name– just know she is a gangsta.

Killah and my team worked very closely together. She traded a variety of equity index swaps. Her team worked quite late into the evening due to poor middle-office tech, and the fact that they covered the India close from Hong Kong. Anyone who trades or traded Indian equities knows how much of a pain in the ass booking trades is. While I thankfully exited stage left circa 5:30pm each day (when Singapore closed), Killah and her team routinely left the office later than 8:00pm.

In pre-COVID Hong Kong, post-work jaunts into Lan Kwai Fong were the norm. One particular evening after work, Killah informed her team that she could eat 10 Big Macs in under 2 hours.

There is nothing that excites the animal spirits of a trading floor like a good old-fashioned eating contest. Depending on the difficulty of the challenge, the whole Street might drop what they are doing to gamble on the outcome. Sadly, as I am told by current bankster compadres, these sorts of activities are now forbidden by the woke-inatti.

But things were looser back then, and we couldn’t let such a bold claim go unchallenged. The next day at work, we decided to put Killah’s appetite to the test. In the morning, chatter began as to whether the alcohol had given her unwarranted confidence in her ability to consume Big Macs. She doubled down, and said she would show us.

A palpable feeling of giddy excitement quickly spread across the trading floor and throughout the Hong Kong trading community at large. Bloomies lit up as clients and friends across the city started placing wages on whether or not she could complete the challenge.

An intern was tasked with procuring the victuals, and at twelve noon, the contest began.

All activity on the floor ceased, and people crowded around her desk. Her strategy was sound – she separated the meat and bun, chowed down the patties first, and then finished off the bun and toppings separately.

About 20 minutes into the event, one of the senior MD’s walked over to the battlefield. I can imagine he probably had heart palpitations as he watched a junior female trader scarfing down burgers surrounded by a bunch of cheering dudes. It just wasn’t a good look for the bank. And as the most senior person on the floor that day, he quickly and sternly shouted “SHUT IT DOWN!” – and that was the end of the spectacle. To this day, Killah maintains that she could have done it.

The Fed believes it can eat Big Macs made of 50bps rate hikes without the US and global economy violently vomiting. We are just a few minutes into the competition, and already risk asset markets are begging some senior politician to SHUT IT DOWN!

Everyone who owns risk assets globally is watching the Fed and its tolerance for pain. This pain is purely political. There are no easy outs when you combine the most levered domestic US and global economy in history, interest rates that are already at their lowest in recorded human history, the disruption of the world’s largest energy and food exporters (Russia + Ukraine), and inflation that was already at its highest in 40 years even before the Russia / Ukraine war.

The Real Question

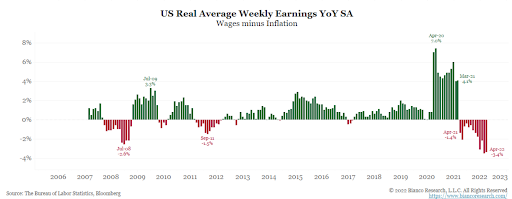

The bull market can only begin once the Fed and its sycophantic cadre of other central bankers reverse course, which at the very least requires pausing rate hikes and keeping the size of their balance sheets constant. The problem is that the average American worker bee is making increasingly less money month after month when adjusted for the government measured rate of inflation (CPI). Given it is a midterm election year in the US, this will become a bigger and bigger issue as we approach November. The ruling Democratic party will need to do something to course correct, or many formerly elected folks will have to revisit what it’s like to work a real job.

Inflation becomes extremely important to voters when they work harder and harder for less and less money. Those red bars in the chart above mean trouble for whoever is in charge. For those of you who delight in consuming 24/7 poli-tainment and can’t hold a civil conversion with a member of the opposite party, if the Republican party were the majority party they would face the same can of inflation adjusted whoop-ass currently spanking the Democrats.

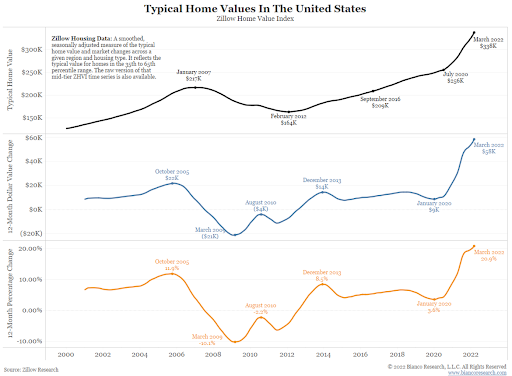

The median yearly income for Americans is approximately $50,000. You know you’ve printed too much money when the median house appreciated more than the median income. That means you made more money sitting in your Lulu jammies than going to work, assuming you own a home. Woe is the plebe that rents – NGMI.

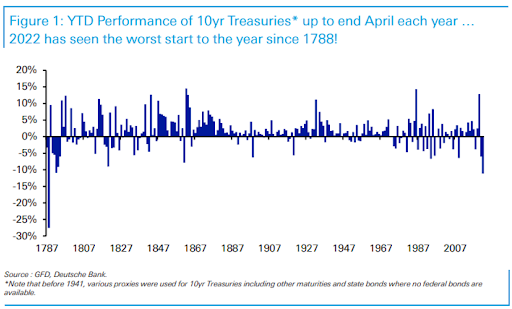

Inflation is enough of a problem that President Biden has explicitly tasked Jay Powell, the pro tempore head of the Fed, to deal with it. He is dealing with it, and it has made 2022 one of the worst years on record for financial asset investors.

The Fed did such a good job crushing asset prices that the 2022 year-to-date return on the US 10-year treasury is the worst since 1788. Booyakasha!

The Fed did such a good job crushing asset prices that the 2022 year-to-date return on the US 10-year treasury is the worst since 1788. Booyakasha!

I repeat, the reason inflation pisses off the electorate is that everyone moves from place to place, and consumes calories. The average person cares deeply about the prices of fuel and food. Even though every central bank tries to hoodwink the populace into believing that fuel and food prices are not important yardsticks of inflation, we all take notice when these prices rise. Failure to tame this type of inflation has historically led to revolutions.

The Fed believes that by destroying demand through the negative wealth effect, it can materially slow the rise of fuel and food prices. The theory is that rich people – and by that, I mean those who own financial assets – consume far more of these resources than their plebeian brothas and sistas. Therefore, if you raise rates, it will crater the stonk and bond markets, which will in turn force the rich to consume less – destroying fuel and food price inflation in the process.

In a recent speech Gov. Waller said this, “I support tightening policy by another 50 basis points for several meetings. In particular, I am not taking 50 basis-point hikes off the table until I see inflation coming down closer to our 2 percent target. And, by the end of this year, I support having the policy rate at a level above neutral so that it is reducing demand for products and labor, bringing it more in line with supply and thus helping rein in inflation.”

That might work if the world weren’t in the middle of a pseudo-World War. I say pseudo because the US and NATO are openly supplying sophisticated weapons to Ukraine in order for their armed forces to engage directly with Russia. While there is no direct kinetic confrontation between the West and Russia, the West is economically at war with Russia via various sanctions.

Together, Russia and Ukraine produce a large amount of fuel and food. The longer this conflict drags on, the less access the rest of the world will have to these key resources. And the truly frightening aspect is that, when shut down, complex systems do not resume prior output in a linear fashion. We may lose a significant amount of global agricultural and energy output for decades due to the current disruptions. Making matters worse is the fact that Russia and Ukraine supply a significant chunk of the world’s fertiliser – and without those exports, the agricultural yields of other countries will likely also plummet. And if Russia has to shut-in oil and natural gas wells because it lacks a buyer who can logistically receive them, it will take decades to recover the current daily output. Listen to this very informative interview with Peter Zeihan to fully understand the current precarious situation in the world vis-a-vis Russian + Ukrainian fuel and food output.

The Fed may continue to seek to destroy demand for fuel and food, but both will continue to rise in price unless full trade with Russia and Ukraine is resumed. While this is a dire situation, the US, the wealthiest country in the world, has an easy solution to this problem of inflation in the things we need.

The US Government can offer fuel and food subsidies, which would allow consumption of these essential items to remain constant at affordable prices. Subsidies come in various forms. Windfall profits taxes on “price-gouging” private companies, price controls for various items, and checks sent directly from the government (aka food stamps) are all forms of potential subsidies. How many politicians were against the COVID stimmie checks? How many politicians of any party could face their constituents and say “I want you to pay more money for gas and ground beef because I am concerned about the fiscal health of the country?” Ain’t gonna happen!

To pay the subsidies, the government will need to generate more cash, which would necessitate the issuing of more Treasury bonds, due to a widening fiscal deficit. But who will buy these bonds?

In a war-time economy, the central bank loses its independence and merges with the Treasury. It happened in the aftermath of WW2, and it will happen again now. The Fed will press The Button, and instantly start buying all of the debt the Treasury issues at a politically expedient rate of interest. Hello, Yield Curve Control (YCC).

YCC = $1 million Bitcoin

YCC = $10,000 to $20,000 Gold

The externality of this policy is the acceleration of global inflation and famine. The hardest hit will be the countries of the Global South that do not have the ability to print money to solve their macroeconomic problems. The US issues the global reserve currency and has the strongest military, so it will be fine – it will get all the things it needs at the expense of everyone else. The EU bloc will be in a similar boat, because the Euro is the second largest currency used in trade. The Europeans are experts at subsidies that distort demand and ensure domestic entities receive preferential treatment vs. the rest of the world. But if the richest global citizens do not curb their consumption in the face of lower global output, it will be everyone else who starves.

Before we get to this eventuality, which I bet will occur in the third quarter, the Fed must act tough. Even if the S&P 500 and Nasdaq 100 are below 3,000 and 10,000 respectively, the Fed cannot relent. Asset holders must feel like the ugliest duckling to ever be created. As the global financial markets meltdown because of rising nominal interest rates, the Fed will look nervously at the backward-looking inflation statistics. If fuel and food inflation do not correct meaningfully, then it will be over to the politicians to offer subsidies to placate agitated voters.

The subsidies will be paid for with printed money, which the Fed will happily provide. At that point, we will enter the mother of all risky-asset bull markets. And if the omniscient hedge fund extraordinaire Felix Zulauf is to be believed (based on his most recent newsletter), what follows will be a once-in-a-generation financial market collapse a few short years later as fiat money self-implodes under the weight of the largest amount of money printing in human history.

With this political backdrop, the resumption of the “everything bubble” is but a few quarters away. However, we are here now and must ask ourselves: is this the bottom of this current crypto bear market?

Bottom Fishing

Given that crypto is the last free market globally and will incorporate the resumption of risk-on more quickly, how confident are we that the recent TerraUSD / LUNA inspired puke fest is the local low?

Has crypto bottomed and brought forward the price of multiple additional Fed hikes to the present? Should diamond-handed traders be stooping down to collect treasure?

Please, faithful acolytes – follow me through the valley of darkness and let the chart porn presented set you free.

The VC – TerraUSD Connection

I want to connect two theories.

- Most tech VC shops are vehicles of expensive beta to the overall market when viewed against fee-adjusted performance. As a result, as inflation crushed bellwethers like Netflix because subscribers chose to eat rather than pay for the privilege of watching more mediocre Netflix originals, and some of the world’s most successful tech companies – such as Facebook – saw flat to negative user growth, and the general funding and IPO environment deteriorated rapidly in 1Q 2022. Add rising nominal rates to the equation – which mathematically destroys value in long-duration assets like unprofitable tech companies – and you can imagine the pain felt by the Patagonia, khaki-wearing brosefs in Silicon Valley, Zhongguancun (中关村) Beijing, and Mayfair.

- The following theory is from one of the smartest crypto traders – and frankly, humans – I know. I haven’t done the work to verify his thesis, but logically, it makes sense. He postulates that the event that pricked the TerraUSD bubble originated from VC shops that needed to cash out of their LUNA positions with minimal market impact.

Due to the public nature of the blockchain, early investors liquidating massive LUNA positions would be easily spotted. The protocol allowed holders of LUNA to tender $1 of LUNA for 1 UST at the current LUNA/UST market price. That LUNA would be burned and an equal amount of UST would be created, with zero market impact on the broader LUNA value. Using Over-The-Counter (OTC) trading desks, VC’s swapped large amounts of UST for other stables like USDT, USDC, or even physical USDs. Voila – now LUNA profits are monetised with no market impact. The end result was a significant rise in the supply of UST, which eventually weighed on its price vs. the USD.

My boy estimates that close to $5 billion of these flows took place. The start to the TerraUSD meltdown occurred when the peg broke slightly on Curve. This happened as too much UST was supplied relative to other stables like USDT and USDC. Once the peg begins to break slightly, and confidence in a quick reversion wanes, the negative convexity of the algo stable coin design takes over and creates an unstoppable downward force.

Putting the two events together – the inflation-driven contraction of VC balance sheets and the popping of the Luna bubble – my theory is that the broader risk-off environment crushed the animal spirits of VC punters and drove them to cash in on their successful LUNA investments all around the same time. The global risk-off movement is of the Fed’s making. Therefore, the TerraUSD collapse was an indirect result of global central bank liquidity tightening. As such, I believe this event brought forward pain that would have occurred anyway months down the line as the Fed and others continued to tighten liquidity conditions.

For the record, I’m not blaming the Fed for the collapse of TerraUSD. Its collapse was preordained because of how it was programmed. That information was fully available to anyone who read the whitepaper and/or researched the bleak history of algorithmic stablecoins. My point is that the Fed provided the catalyst for something that would have happened eventually anyway. And thankfully due to the fact that there are no government bailouts in crypto, we found the real clearing price quickly, can now heal, and then resume the upward march to the altar of our Lord.

TerraUSD, like all central banks, is guilty of violating the holy trinity.

TerraUSD tried to pay a very high interest rate (20% on Anchor), fix its price vs. the USD (the UST to 1 USD peg), and have an elastic supply (UST supply could rise infinitely). This is akin to a central bank fixing the rate of interest, fixing its fiat currency’s exchange vs. the rest of the world, but having an open capital account. It doesn’t work in TradFi, and it (clearly) doesn’t work in DeFi either.

Crypto Bottom Metrics

I firmly believe that crypto leads the broader markets. The data supports this, as correlations broke down between Bitcoin / Ether and the Nasdaq 100 during the recent crypto market meltdown. Below, let’s revisit the correlation charts and look at how they all turned sharply lower.

In successive order, the following are charts of the rolling 10-, 30-, and 90-day correlation between Bitcoin and the front-month Nasdaq 100 futures contract.

In successive order, the following are charts of the rolling 10-, 30-, and 90-day correlation between Ether and the front-month Nasdaq 100 futures contract.

As you can see, crypto decoupled from the broader risky asset universe during this recent selloff. That is good at a macro level, but there are other crypto market indicators that also point toward a local low.

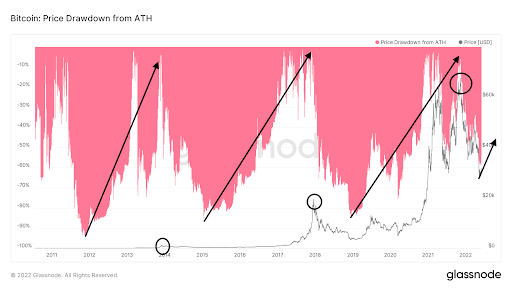

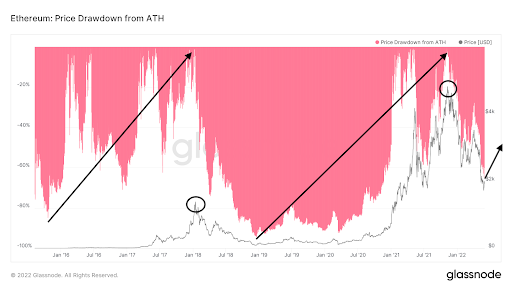

Let’s concentrate only on Bitcoin and Ether, as they are my crypto benchmark assets. Both of these cryptos are in a secular bull market. By this, I mean that Bitcoin and Ether vs. the USD make higher lows each bull / bear cycle. The largest drawdown of each cycle is still higher than the all-time high of its preceding cycle.

Bitcoin’s Major Cycles

This is a great chart from Glassnode that helps me conceptualise the three major Bitcoin price cycles. A local bottom is reached at the largest drawdown vs. the previous cycle’s all-time high (ATH). Below is a table representing the levels for the three major cycles.

|

Intra-Day High |

Date |

Intra-Day Low |

Date |

Low / Prev. ATH |

|

$68,742.31 |

11/9/2021 |

$26,513.91 |

5/12/2022 |

33.83% |

|

$19,811.93 |

12/16/2017 |

$3,190.11 |

12/15/2018 |

174.39% |

|

$1,162.64 |

11/30/2013 |

$164.44 |

1/14/2015 |

422.03% |

|

$31.50 |

6/9/2011 |

$2.01 |

11/14/2011 |

Ether’s Major Cycles

Ether has experienced two cycles. The first one started when the coin first freely traded after ICO distributions were made, and the second commenced after Ether bottomed following the 2017 / 2018 ICO boom then bust.

|

Highs |

Date |

Lows |

Date |

Low / Prev. ATH |

|

$4,859.50 |

11/9/2021 |

$1,761.24 |

5/12/2022 |

24.14% |

|

$1,418.81 |

1/13/2018 |

$82.83 |

12/15/2018 |

Don’t take these levels as an exact science. There could be an exchange that traded at a higher or lower intraday level than what’s observed on Glassnode. The point is to be generally correct, and with a bit of fudging around the edges we can approximate a range that corresponds to what we believe is the local bottom. For Bitcoin, that’s $25,000 to $27,000. For Ether, that’s $1,700 to $1,800.

During this cycle, the secular bull market for now has held in both cases. And more importantly, the local low is quite close to the previous all-time high. That is encouraging because it means a sufficient amount of pain was felt by those who had to sell for one reason or another. The unfortunate part about markets is that most traders go big near the top, and must sell close to the bottom.

If I had a natural language processor which ingested all articles about crypto featured in the mainstream financial press, I could chart a linguistic sentiment indicator. Maybe someone reading this has constructed said model and would be so kind as to share it with the broader community. Even without a robust model, cursory searches of click-baity articles run by outlets such as Bloomberg, The Financial Times, The Wall Street Journal, etc. tell me that the editorial boards are gloating at the pain inflicted on crypto traders globally.

“See, I told you those JPEGs and cryptos were trash…”

“Bitcoin is worthless, blah blah blah.”

“DeFi heralds nothing but a new way to speculate … it’s just a casino … yada yada yada.”

“Isn’t it great how much energy the world is saving because the crypto market cap is down 50%.”

I’m sure you have read something similar recently.

When the market is topping out, the stories are about internet-age Horatio Algers. When the market is bottoming, it’s about how the repo man took Mr. Alger’s Lambo so he could pay back loans he took out to run a carry trade on the Anchor protocol.

My bottom checklist:

- Bitcoin / Ether move increasingly in a less correlated fashion vs. the Nasdaq 100.

- The current price levels are very close to the previous cycle’s all-time highs.

- The mainstream financial media gloats about how stupid and greedy plebs were who attained short-lived wealth investing in crypto.

Three strikes, you’re out!

And now for the bonus round – during the meltdown of TerraUSD, the Luna Foundation Guard (LFG) sold approximately 80,000 Bitcoin. They were forced to part ways with Lord Satoshi in order to defend the UST peg. The heretics always perish.

While the transfers out of the LFG wallet are public knowledge, it is still unconfirmed whether the coins were actually sold. I have no reason to doubt the veracity of LFG’s public disclosures, so let’s assume 80,000 Bitcoin was sold during the TerraUSD meltdown.

At the bottom, a typically impervious strong hand can be forced to sell because of uneconomical arrangements festering in their trading books. The LFG is such a seller. To puke 80,000 physical Bitcoin is quite a feat. After contemplating the nature in which these Bitcoins were sold, I am even more confident that the $25,000 – $27,000 zone for Bitcoin is this cycle’s bottom.

Choppa Fellas

The politics must align with the macroeconomic environment to produce the catalyst for crypto to exit the current bear market. While the bottom is in (I hope), it doesn’t mean prices will automatically resume a quick ascent towards $70,000 and $5,000 for Bitcoin and Ether respectively.

The market will stage impressive bear market rallies that traders nursing massive losses will sell into. Right now, many traders are sitting on positions that are down 50% to 90%. These traders are in a loss reduction mindset. They want to exit at a less bad price. They are not mentally primed to ship more capital in at these “bargain” prices. Therefore, any rally will be sold into, until the underbrush in the forest is clear and the diamond-handed apes can emerge safely from hibernation.

This choppy price action will eviscerate the capital of short-term traders who half-heartedly believe this is the bottom. These folks want to catch the knife and exit for a quick profit. But because they lack conviction in their position, they will get shook. And the market will quickly relieve them of their capital.

This is why the politics and macroeconomic picture must coalesce before the crypto market can march meaningfully higher. Be patient, reduce the noise of the market, and focus on what matters.

Accumulation

In “Five Ducking Digits”, I laid out a thesis for why I believed Ether could hit $10,000 by year end. In light of the recent carnage, many readers wonder if I still believe in that target. In short, yes! However, because the resumption of the bull market is a political affair I have less confidence in my timing estimate.

My political theory rests on an assumption that the core tenets of inflation that American voters (or any citizen, for that matter) care about – fuel and food – will not materially soften as the Fed continues bashing a crowbar into the dome of risky-asset markets. As a result, no one is going to be happy come election day. Those who hold financial assets feel poorer, and everyone still pays more and more to fill up their car and fridge. The baby boomers are the largest and wealthiest generation, as well as the most important voting block. They own a large percentage of global financial assets and are now embarking on retirement, which means subsisting on a fixed income. Poorly-performing financial assets and rising fuel and food inflation are the two worst things a financial asset-heavy retiree can experience. The boomers will rage against the machine and set us free from the cage of tight central bank liquidity.

The Fed will not be coy about its about-face. The pivot will be clearly telegraphed, and those waiting for a signal that it’s on like Donkey Kong will receive it. For patient traders whose time frame spans many years, it pays to wait. You don’t want to sell filthy fiat and buy Bitcoin / Ether early only to get shook due to a lack of confidence in your investment thesis. It is better to wait for the all-clear signal from the high clergy of the devil that it is time to join the crusade.

For those who must trade on a shorter day, week, month, or quarter time frame, good luck. Please affix a sturdy pair of Depends upon your bottom, and prepare to babysit your Bitcoin!

Related

The post appeared first on Blog BitMex