Veteran market strategist Jeff Saut recently made a bold prediction that the S&P 500 index will skyrocket in the upcoming year to over 4,000.

Having in mind Bitcoin’s increased correlation with the prominent US index, such a surge could be considerably beneficial for BTC’s price as well.

Saut: The S&P 500 Above 4,000 Within A Year

Saut, who is Capital Wealth Planning’s chief investment strategist, has been traditionally bullish on the US economy and the S&P 500 in particular. In his latest appearance on CNBC’s Squawk Box, he discussed the country’s current economic situation and how the US is handling the COVID-19 crisis.

When asked about the increasing number of confirmed cases and the potential damages on the economy, Saut said:

“You live in New York City. Go to the restaurants; they are full. Restaurants in St. Petersburg are full. The economy is doing a lot better than most economists think. I think the economics are going to come out strong, and earnings are going to do better than most people think.

People are woefully underinvested. There’s $5 trillion in money market funds. I think the markets are going up a lot more than people think.”

Saut added that the most popular US indexes could stall in the upcoming months, especially in the fall. However, he believes that “you are going to get a rocket ship” after the fall this year and “actually, I think the S&P is going to trade above 4,000.” He also specified that this price surge could occur “within the next twelve months.”

It’s worth noting that the S&P 500 is currently trading at 3,179 after yesterday’s 1.6% increase. If the index is indeed to exceed 4,000, it has to surge by over 25% in the next year.

Will Bitcoin Follow?

Bitcoin performed differently than the stock markets for years. Being fundamentally different from equities while simultaneously similar to gold, speculations rose that BTC is actually a safe-haven asset.

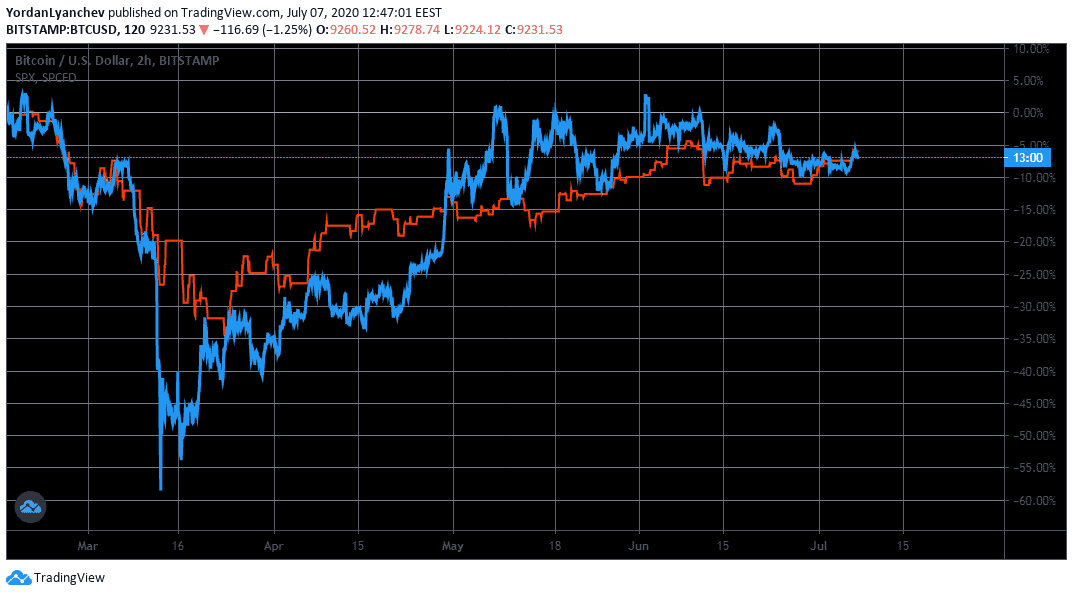

However, the outbreak of the COVID-19 pandemic altered this narrative to some extent. The primary cryptocurrency demonstrated increased levels of correlation with most stock market indexes and the S&P in particular. Apart from a few examples of short-term decoupling, Bitcoin and the popular index have charted similar price movements.

This raises a valid question if BTC would follow the S&P in such a decisive bull run. A similar increase of 25% will take Bitcoin from its current level of $9,300 to $11,700. However, if the S&P 500 registers a new all-time high at 4,000 and the primary cryptocurrency follows its footsteps, BTC could increase beyond the 2017 ATH of nearly $20,000.

It’s worth noting that despite the similarities in their performances after the mid-March market crash, the S&P is still in the negative since the start of 2020, while BTC is up by almost 30%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato