In a January 7, 2020, report from Coinmetrics, analyst Antoine Le Calvez revealed several supply and distribution failures within the Stellar Lumens network. Specifically, who really profited from the monetary inflation process?

Failed Tokenomy, but not Scandalous

Stellar Lumens was first launched in July 2014 following the second wave of major cryptocurrency projects including Monero, Ethereum, and Cardano.

In its roughly 5 years of existence, the protocol has competed with the likes of Ripple’s XRP within the remittances and cross-border space. Like XRP, Stellar also leverages a controversial inflationary mechanism. There are a few differences, however.

Primarily, Stellar’s inflation mechanism is built-in, whereas Ripple, the company, periodically dumps chunks from its 100 billion supply. The two dilute the token supply, but in markedly different ways. In a brief interview with Le Calvez, he told Crypto Briefing that one needs to consider the difference between “base supply inflation, that is how many brand new tokens are created and circulating supply inflation.”

Both XRP and Stellar use circulating supply inflation, which refers to the number of tokens held outside of foundations, but only Stellar has a base supply inflation of 1% baked into the protocol. This means that new lumen tokens (XLM) are created and distributed every year.

The reason to include this feature is two-fold.

In 2018, Jed McCaleb, a co-founder of Stellar and, interestingly, also a founder of Ripple, told the Stellar developers’ community that he wanted to “address some criticisms of cryptocurrencies being deflationary” and to stimulate incentives for collaboration within the network.

These newly-minted tokens were distributed within the community via something called “inflation destinations.” Like voting, Stellar account holders could elect other accounts to receive these tokens. The idea went that the community would naturally vote for the accounts that represented the most promising development.

In his report, Le Calvez writes:

“Votes were tallied weekly and each inflation destination account that got voted by at least 0.05% of the supply would receive a share of the inflation pool proportional to the total balance of all its designating [accounts].”

In September 2019, however, this feature was disabled by the Stellar Development Foundation (SDF). The reasons were manifold, but the primary held that the inflation model was not serving the development of Stellar-based projects.

The Foundation’s post reads as follows:

“Five years and several million accounts later, it’s clear that inflation doesn’t serve this purpose. Rather than sending inflation to projects building on Stellar, the majority of users join pools in order to claim that inflation for themselves — if they set their inflation destination at all.”

Indeed, very few Stellar accounts even participated in this experiment. According to Le Calvez’s analysis, only 18.3% of all accounts designated an inflation destination. Of this fraction, the variety of address types included exchanges (like Binance and Poloniex), whale accounts, inflation pool participants, and, of course, addresses linked to the SDF.

The most striking piece of data is that the scheme allowed the SDF to receive 98% of all XLM inflationary funds. This is because the Foundation was also in control of 80% of the token supply, meaning they likely set themselves as the inflation destination.

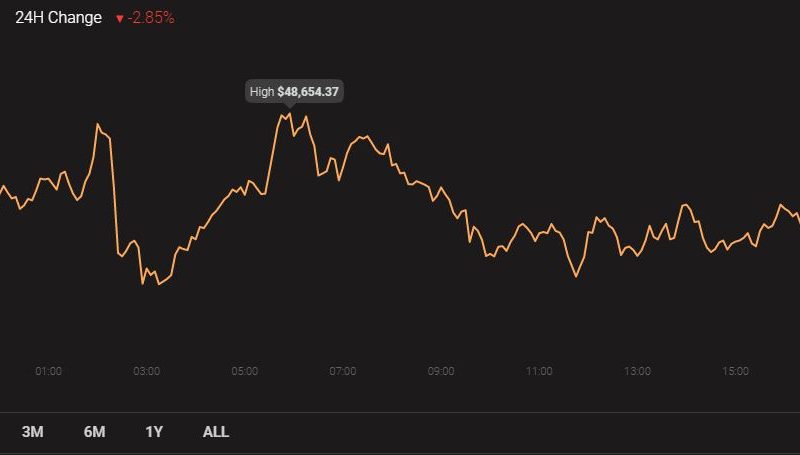

Source: Coinmetrics

It is this portion of the analysis that has drawn the most vitriol: one of the primary beneficiaries of the Stellar Lumens inflationary model was a tightly-linked subsidiary.

@hsinjuchuang dump your Lumens.

That project is a total joke now.

The @StellarOrg team should be ashamed of themselves.

— Richard (@ricburton) January 7, 2020

Unfortunately, proving malpractice is difficult. Instead, and perhaps more reasonably, one can view the model as a true crypto experiment.

Since halting inflation last year, the SDF burned 5 billion XLM from their fund along with another 50 billion XLM slated for airdrops. One can see from above that the Foundation earned 5.4 billion XLM from the inflation process alone. Of the now 50 billion XLM in circulation, the SDF controls less than half.

Thus, Le Calvez concludes that far from a scam, the model instead reveals “that each network has idiosyncrasies that have to be taken into account.”

And as we hurtle into 2020, expect these experiments to undergo even greater investigation as the cryptosphere attempts to master these exact idiosyncrasies.

The post appeared first on CryptoBriefing