The coronavirus which started from Wuhan, China, earlier in January, shows no signs of slowing down. With over 910 people dead already, countries across the world are taking measures. The UK has officially declared it an “imminent” threat. Asian and European stocks continue to feel the pressure as they struggle into the weekly opening. At the same time, Bitcoin’s price dipped today, though most analysts are on par with it being nothing but a healthy correction after a notable increase.

Coronavirus Continues To Spread

Despite China taking a lot of measures to contain the virus within a limited parameter, the number of cases continues to escalate. Data shows that as of today, over 40,000 cases have been recorded, while more than 910 people died from the virus.

Disturbing news came from the UK today as the government has declared the coronavirus “a serious and imminent threat to public health.” Four more cases have reportedly been confirmed, which increases the total number of people infected with the virus to eight.

The country will be taking measures to delay and to prevent the further transmission of the virus. More worryingly, a British businessman who is feared to have the virus has forced authorities into a lot of emergency tests of hundreds of people. Since he’s not under quarantine, it is feared that he may have already passed it on to at least seven more people.

Asian And European Markets Struggle

It appears that both Asian and European markets struggle as both the Nikkei 225 and the FTSE 100 closed the trading days in the red. While the declines are minimum, Nikkei is down 0.6%, while the FTSE is down 0.27%.

However, this shows that there is tension on the stock markets and it’s not entirely out of the question for it to be closely associated with the spread of the coronavirus.

As Cryptopotato reported back in January, global markets were tumbling as the spread of the virus was catching speed. This is only natural. China is the world’s second-largest economy by GDP and is currently being locked out from the rest of the world. This causes a lot of tension, as well as physical losses for companies across a broad range of industries.

Bitcoin: Is It Really a Safe Haven?

While it’s unclear whether Bitcoin’s price has reacted the way it does because of the epidemic, it’s certain that it has demonstrated a negative correlation to traditional markets. In other words, it’s entirely possible that investors turn to it in times of economic uncertainty. This has been determined plenty of times in the past.

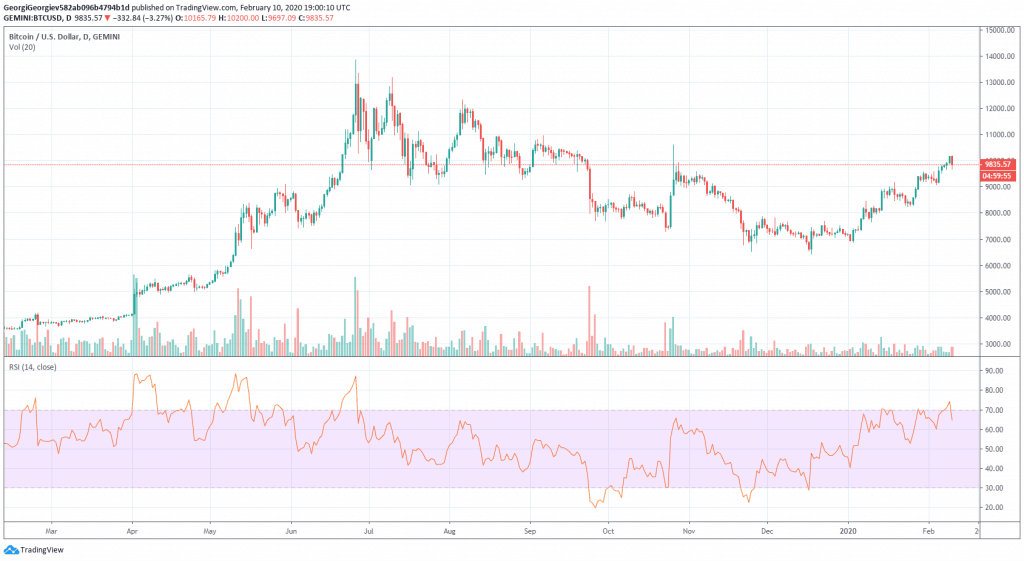

Today, Bitcoin’s price took a hit, dropping about $500 in a violent red candle before making a recovery and stabilizing above $9,800.

BTC/USD. Source: TradingView

Despite being 2.4% down on the day, the majority of prominent analysts on the market agree on it being a healthy correction. They also share the view that the bullish trend of 2020 is intact and see this more as a “buy the dip” opportunity.

The post appeared first on CryptoPotato