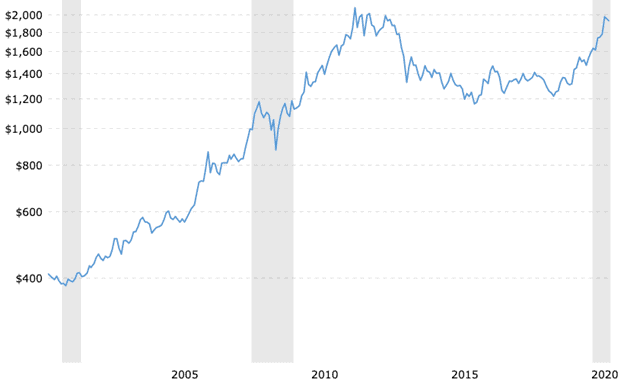

In the last 50 years, gold has climbed from $410 an ounce up to around $1,900 an ounce today and has earned a reputation as one of the most reliable investment assets.

Although gold is rapidly growing in popularity among investors, during times of a recession, its popularity tends to skyrocket — and it’s not by accident either. There are several reasons why investors scoop up gold in droves during a recession; here’s a look at the main ones.

Post Recession Price Action

As we’ll cover later, gold is used as a safe bet for many investors, who are simply looking to maintain their portfolio’s value if their other investments falter.

On the other hand, many investors turn to gold due to its long-term price growth, which has followed a rather predictable pattern for the past two decades — this is strongly related to recession cycles.

In 2001, at the start of the recession, gold was valued at ~$388. When the recession ended a year later, gold saw its value more than double by 2007, following which most countries experienced another longer recession, and gold dropped from $1178 to $876. Then, as the recession subsided, gold once again went on a meteoric rally and climbed to over $2,000 in 2011 (all figures adjusted for inflation).

The common theme here? Gold experienced gains of more than 100% in the 2-7 years following the last two recessions. And now, as many countries enter into another recession, many investors are once again turning to gold, likely with the expectation that further growth may be on the horizon once the recession ends.

Gold Is a Safe Haven Bet

Gold is also seen as an effective hedge against fiat markets since its value isn’t directly correlated to the value of the US dollar or other major world currencies.

Even during times of significant economic decline, gold has been known to maintain or improve its value better than most assets, which is why many economists argue that every portfolio should contact at least a small proportion of precious metals like gold. For example, during the 2007-2009 financial crisis, gold fell by a maximum of ~25%, whereas the FTSE 100 index (^FTSE) dropped by ~48% and the Dow Jones Industrial Average (^DJI) fell by ~50% in this time.

Part of this resistance to decline may be explained by gold’s intrinsic value. For one, it’s extremely scarce and difficult to obtain. According to recent estimates, it costs well over $1,000 to extract and refine each ounce of pure gold, currently more than half of its current market value.

Beyond this, gold has major utility in several industries, with around 78% of gold mined worldwide being used for created jewelry. In contrast, another large chunk is used for catalysts and conductors in the electronics and engineering industries.

Because of its increasing utility and strength as a hedge, fiat holders tend to flock to gold whenever traditional markets show signs of a struggle.

This effect is also seen in cryptocurrency markets. When major markets like Bitcoin (BTC) and Ethereum (ETH) begin to decline, or when USD-pegged stablecoins like Tether (USDT) begin to see their purchasing power weaken, holders frequently turn to gold-backed coins like CACHE Gold (CACHE) instead.

Since each CACHE can be redeemed for 1 oz of investment-grade gold, buying, selling, and trading CACHE tokens is equivalent to trading real gold — but without the costs of storage, postage, and insurance.

However, it’s important to note that the correlation between Bitcoin, Gold and the equity markets is shifting. While it’s common to see Bitcoin and Gold rising together, Bitcoin had weeks during 2020 when it decoupled from Gold, and from the global markets.

Gold is Bank-Run Proof

When the fiat economy struggles and both central and private banks are on the brink of collapse, there is always the risk of an event known as a “bank run,” which occurs when a large number of customers try to withdraw their funds over a short period of time.

Depending on the size of the bank run, this can put some banks in peril since the vast majority of banks are operating with a fractional reserve — which means they only keep a fraction of customer funds in vaults and use the rest to for lending and investments.

When the bank is on the verge of collapse, it may be subject to a bail-in or bail-out to restore operations. When a bail-out occurs, the government funds the bank with public money, which then needs to be repaid by the bank. However, for bail-ins, these banks are essentially refinanced by unsecured depositors, who lose much or all of their deposits and become equity holders in the failing bank instead — not an ideal situation!

To avoid this situation, many fiat holders instead withdraw their cash and convert it into gold since it cannot be locked-up during a liquidity crunch or seized as part of a bank bail-in.

* Disclaimer: This is a contributed article and should not be taken as investment advice

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato