Launched just last week as a fork of Uniswap, SushiSwap has gained traction as the hottest thing in DeFi at the moment. It aimed to build on the popular token swapping protocol but offer a native token as a reward to liquidity providers.

Uniswap only offers a 0.3% share of its trading fees to those that deposit collateral on the platform. Clearly, this isn’t enough for avaricious yield farmers who, over the past few days, have been moving their liquidity over to SushiSwap.

Sushi TVL Tops a Billion Bucks

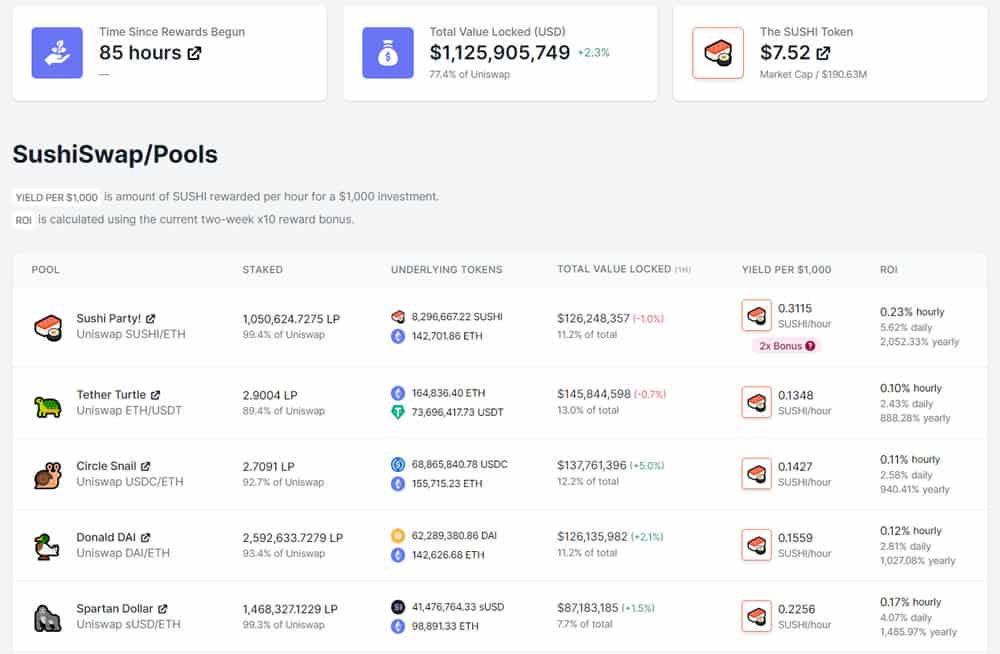

SushiSwap uses Uniswap liquidity pool tokens as an earning mechanism for its own 13 liquidity pools. In what has been termed ‘vampire mining,’ liquidity farmers have been loading up these pools so much that the total value locked has now exceeded $1.1 billion according to the Zippo sushi dashboard.

This equates to around 77% of the liquidity on Uniswap being moved in just 85 hours since rewards were launched. SUSHI token prices are trading at over $7.60, according to Coingecko, which is an increase of nearly 1000% over the three days.

As reported by CryptoPotato, Uniswap trading volume has also surged, even eclipsing that of Coinbase. DeFi Pulse is reporting that Uniswap TVL has also topped a billion dollars. Still, it could be including that of the SushiSwap fork as there is often some duplication when using this metric.

According to those figures, Uniswap is now the third most popular DeFi protocol in terms of TVL, eclipsing Curve Finance, Synthetix, Yearn Finance, and Compound. A 45% surge over the last 24 hours has sent it skywards, making Uniswap (and SushiSwap combined) the fourth billion-dollar DeFi protocol.

The influx of crypto collateral has resulted in another all-time high in TVL for all of the DeFi space as it tops $8.6 billion, according to Defipulse.com.

Sushi Smart Contract Audits Inbound

There was some initial concern from industry observers regarding the unaudited nature of SushiSwap smart contracts. These apprehensions are justified considering the fiasco that happened with Yam Finance over unaudited smart contracts and buggy code.

A security audit by PeckShield will be the first, followed by a Quantstamp audit the team confirmed.

PeckShield is starting the security audit of $SUSHI smart contracts. #SushiSwap @SushiSwap @NomiChef

— PeckShield Inc. (@peckshield) August 31, 2020

Audits are an essential process for launching any smart contract-based project, especially one that attracts over a billion dollars in less than a week.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato