CorionX, a platform designed to incentivize and promote the global adoption of stablecoins and decentralized finance platforms, has announced it will be partnering with Syscoin to help tackle two of the biggest barriers to entry to DeFi — awareness and cost.

Breaking Down Barriers to Entry

As part of the partnership, CorionX will begin using Syscoin’s Bridge solution to help users experience the benefits of stablecoins and DeFi, without incurring exorbitant transaction fees while doing so. Syscoin Bridge is a solution that allows users to store their tokens on multiple blockchains and complete cross-chain value transfers.

“This Solution will provide cheaper and faster transactions enabled by Syscoin’s unique Z-DAG Protocol, and more robust security offered by Syscoin’s blockchain which is bitcoin-core-compliant and merge-mined,” said CorionX in the press release.

Moreover, the Corion Foundation and the Syscoin Foundation will work together to advocate decentralized technologies like stablecoins and DeFi and will help educate and inform the next wave of users. To achieve this, the two foundations will spread awareness via a series of webinars, seminars, training sessions, and other interactive means.

“This partnership will expand crypto and stablecoin use-cases, and help millions of people and crypto communities use CorionX and Syscoin services worldwide. It presents an amazing opportunity for both partners to empower the crypto community to make scalable transactions, experience user friendly DeFi, and to make cryptocurrency savings and investment more mainstream.” — Miklos Denkler, Corion Foundation Board Member.

CorionX will also help promote the adoption of stablecoins with its native ERC20 token: CORX, which will be used to reward stablecoin users, incentivize adoption among retailers and used to pay the fees for leveraging CorionX’s infrastructure.

Addressing a Major Growing Pain

The DeFi industry has been expanding at record rates for the last three months, and more people than ever before are using stablecoins as their primary means of interacting with the DeFi platforms and protocols.

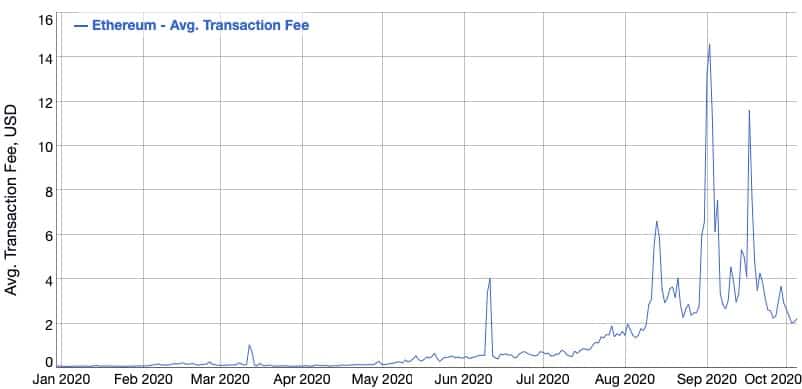

Since stablecoins are, for the most part, based on the Ethereum blockchain, stablecoin holders also have to pay a variable amount of ether (ETH) each time they make a transfer or interact with a smart contract. But since demand has massively increased as of late, transfers are getting increasingly expensive, making it cost-prohibitive for many smaller transactions and DeFi interactions.

Nonetheless, stablecoins and DeFi represent an attractive proposition for users. Stablecoins benefit from the speed and security of blockchain, while remaining relatively non-volatile, while DeFi platforms promise to restore financial sovereignty to users, helping more people be their own bank, take control over their finances, and access potentially lucrative investment options and services.

However, the rampant popularity of stablecoins and DeFi has also caused a major issue — high fees. Since the number of Ethereum transactions have skyrocketed (most of which are DeFi and/or stablecoin related), fees have also increased in tow due to competition for block space, making low-value transactions a no-go in many cases as the fees are too high to make them worthwhile.

To make DeFi more accessible and allow more people to experience its benefits, the industry needs a way to bring the fees right down — and that’s exactly what CorionX is looking to achieve with its partnership with Syscoin.

The post appeared first on CryptoPotato