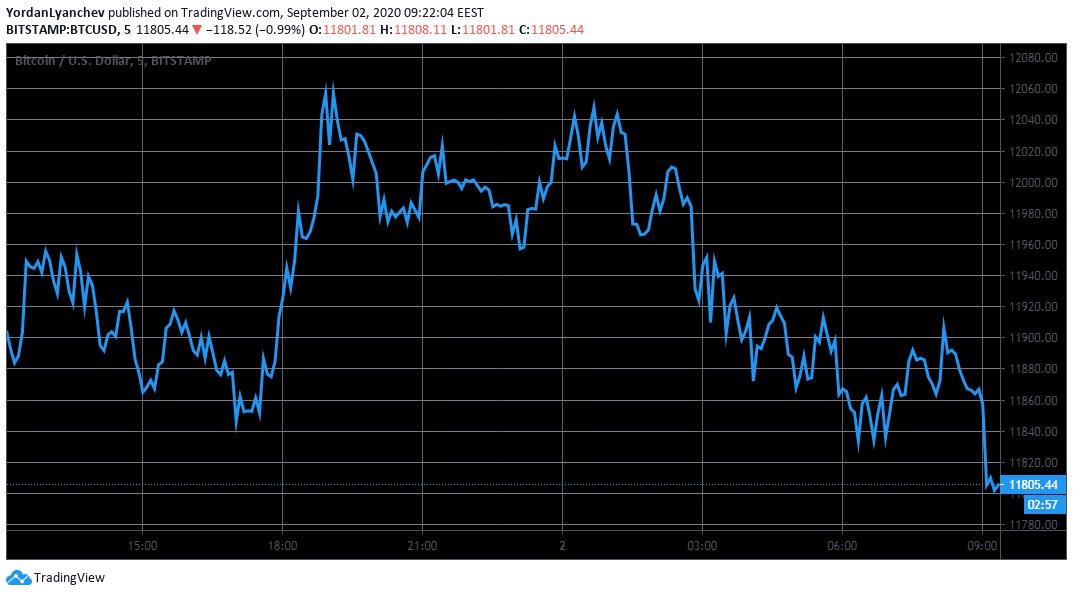

Bitcoin briefly jumped to above $12,000 but has retraced since then. In the last few hours, the entire market appears to be taking a break.

Bitcoin Tested $12K To No Avail

The past 24 hours have been rather impressive for the cryptocurrency field, with the entire market cap gaining over $13 billion from yesterday’s bottom at $374 billion to about $387 billion as of writing these lines. It even reached $394 billion a few hours back as Bitcoin spiked towards $12,000.

The primary cryptocurrency marked an intraday high of about $12,060 (on Bitstamp). However, it failed to sustain its run and, after a few hours, retraced to its current price of about $11,810.

As it happened several times this year, the resistance and psychological level of $12,000 turned out to be a bigger bite than Bitcoin can chew. However, if BTC finally conquers it, the asset could face the next resistance lines at its YTD-high of about $12,450 before potentially heading towards $12,800.

On the other hand, if Bitcoin drops, it can find support at $11,650, $11,450, and $11,000.

Gold, which has also been recovering from the sudden pump and dump following the US Federal Reserve announcement regarding its targeted average inflation of 2%, also surged during yesterday’s trading session. The precious metal exceeded $1,990 per ounce, but before it had the chance to challenge $2,000, it reversed and decreased back down to $1,965.

The Entire Market is Bleeding in the Last Hours

Ethereum has been one of the most impressive large-cap alts in the past week. Driven largely by the DeFi craze, ETH surged to about $487 but has since retraced to where it currently trades at $475. In fact, over the past few hours, most of the DeFi coins such as YFII, SUSHI, YFI, YAMv2, and so forth, are all dropping in the past few hours.

YFI is currently trading at around $30,500, YFII retraced from about $9,200 to $7,800 and SUSHI is down to about $7,20.

As a result, the entire market lost about $7 billion in the last few hours, despite being up in the past day.

A few other alts are dropping by double-digit percentages – bZx Protocol (-20%), Arweave (-14%), Ampleforth (-11%), Solana (10.5%), and Aragon (10%). Nevertheless, the gains outperform the losses in the altcoin market, which continues to reduce BTC’s dominance to 56.4%.

Interestingly, a few days after announcing a partnership to deliver on-chain oracles for DeFi, Tron and Band Protocol are still pumping. TRX jumps by 20% to $0.036, while BAND is up by 14% to $15.5.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato