By CCN Markets: Tesla stock is wildly over-valued and should be cut in half, according to Robert Medd of Bucephalus Research.

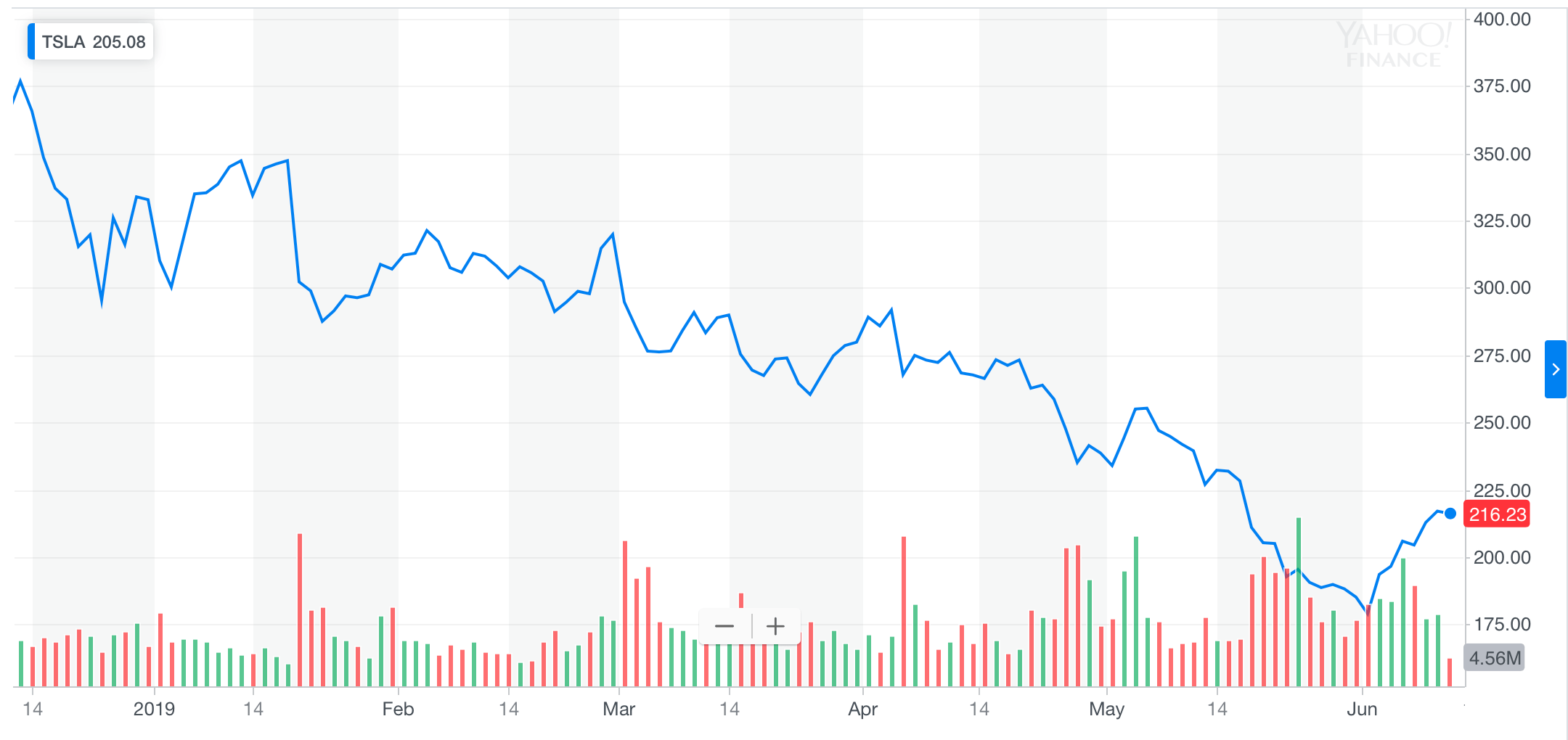

Despite falling 35 percent in 2019 already, Medd believes Tesla stock has much further to crash. According to an interview with CNBC, he said Elon Musk is to blame for misleading investors over demand and failing to pay bills.

“[Elon Musk] talks about selling lots of cars [but] there are lots of pictures of car parks full of Tesla models. Well if demand’s so great, why are they there? … He hasn’t been paying his bills… There are issues over the accounts.”

Elon Musk defends Tesla stock at shareholder meeting

Despite Medd’s damning assessment, Tesla shares jumped in pre-market trading on Wednesday. Elon Musk reassured shareholders at the annual Tesla meeting that demand for the Model 3 is high. He also hinted that Tesla could hit a “record quarter” when it next reports earnings.

Medd isn’t convinced. He compared Tesla to rival car-makers like BMW and said the margins don’t add up to such a high stock valuation.

“Even if you believe his accounts, they are currently manufacturing at scale and they aren’t making any better growth margins than BMW … so you sit there and go ‘how on earth are they going to go from losing money on industry style margins to actually making money’ and I don’t see how they can do that.”

The bull case for Tesla stock

Wall Street remains split on Elon Musk and Tesla. While Medd lays out the bear case, others believe Tesla is undervalued.

Even Roth Capital analyst Craig Irwin, who calls himself a Tesla critic, thinks traders have pushed the stock down too far.

“I think they deserve a lot of credit for being the leader. They’re number one in dollar volume as far as vehicle sales. Number four in unit sales. They deserve credit for this and I think investors have just been too bearish.”

[embedded content]

[embedded content]

Meanwhile, author and analyst Eddie Yoon said yesterday that Tesla is poised for a “Netflix-style recovery.” He thinks the electric car momentum is only just getting started and Tesla will benefit from a generational shift to EV.

“Irrespective of what the quarter to quarter numbers say, the category itself has a tailwind behind it… [EV] is about 2% of the market right now, probably has a tailwind to get to 20%.”

And, of course, there’s the wildly optimistic $4,000 price target from Tesla perma-bulls Ark Invest, who say Tesla is 3-4 years ahead of the competition.

What about a Tesla / Apple buyout?

Robert Medd also laughed off the rumors about Apple buying Tesla, but is convinced a tech company will inevitably swoop in and snatch it up.

“You’d have to be nuts to rely on Apple to bail you out if you’re an owner in this. Yes, I could quite happily see eventually the company will need restructuring and some tech company will step in and buy out. They have a lot of good IP, they have an awful lot of data, an awful lot of knowledge. The question is what is it worth?”

Source: CCNThe post appeared first on XBT.MONEY