Tether- the issuer of the biggest stable coin USDT, dropped a huge announcement that’s gonna make transactions dirt cheap and super efficient. Are you ready to learn how Tehter is going to do that, let’s dive in.

Tether’s Big Move to Aptos

On August 19, Tether made an announcement that they’re taking its stablecoin -USDT, to the Aptos blockchain. This is not just a random update but a strategic partnership.

Aptos is known for its speed and scalability, which means super low gas fees. Imagine doing transactions for just a fraction of a penny! Tether’s CEO Paolo Ardoino couldn’t hide his excitement, saying Aptos’ tech will make transactions faster and more cost-effective.

The Numbers Behind the Move

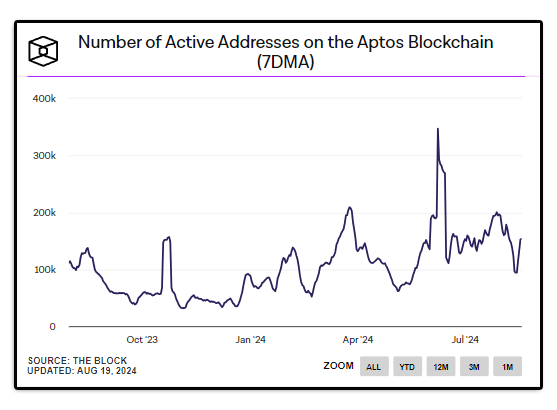

Why would Tether choose Aptos? Well, Aptos has been on fire this year. Daily active users jumped from 66,560 in January to a whopping 346,883 by june.

Moreover, on August 15th, the network handled 326 million transactions in a single day, hitting over 12,000 transactions per second at peak times. These numbers show Aptos can handle massive volumes like a champ.

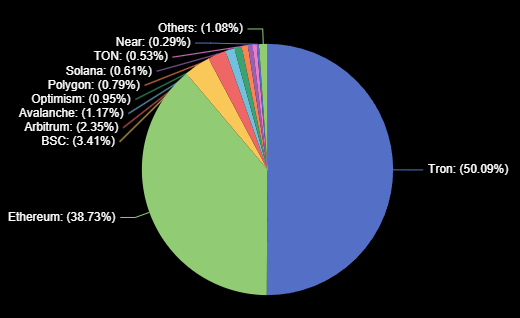

DeFillama data shows that most of Tether’s $116 billion supply is on TRON and Ethereum, which hold 88% of the total. Moving to Aptos could spread this out and boost liquidity across different networks.

Nansen Teams Up with Aptos

Adding more fuel to the fire, Nansen, a top blockchain analytics provider, teamed up with the Aptos Foundation in July. This partnership is all about bringing the best on-chain data and analytics to Aptos. Bashar Lazaar from the Aptos Foundation said this will help builders, projects, and protocols make the most of on-chain data.

A Broader Perspective

Tether’s been shifting its focus to “enhancing community-driven blockchain support.” They recently cut support for EOS and Algorand. Bringing USDT to Aptos shows Tether’s push for innovation and making digital currencies more user-friendly.

Now with USDT live on Aptos, things seem to be getting better for both. This partnership might just change the game in the digital currency space, setting a new benchmark for transaction costs and efficiency.

Also Read : 75% of Bitcoin Locked Up: Is the $100K Surge Just Around the Corner?

The post appeared first on Coinpedia