Stablecoins issuance is not artificially inflating the prices in the cryptocurrency market, despite some controversial beliefs, suggested new research on the matter.

At the same time, the paper acknowledged their vital role in the digital asset field and predicted that it’s only prone to grow in time.

Tether Do Not Inflate The Crypto Market

Last year, two academics updated a study and claimed that the most widely used stablecoin – Tether (USDT) – was behind the 2017/2018 parabolic price increase in which Bitcoin reached its ATH of $20,000. Almost immediately, Tether responded by refuting all allegations, saying that USDT has never been involved in any price manipulation.

While this argument is left without a conclusive answer, recent research supported Tether’s position.

The authors of the report were Ganesh Viswanath-Natraj – assistant professor of finance in Warwick Business School, and Richard Lyons – chief innovation and entrepreneurship officer at UC Berkeley.

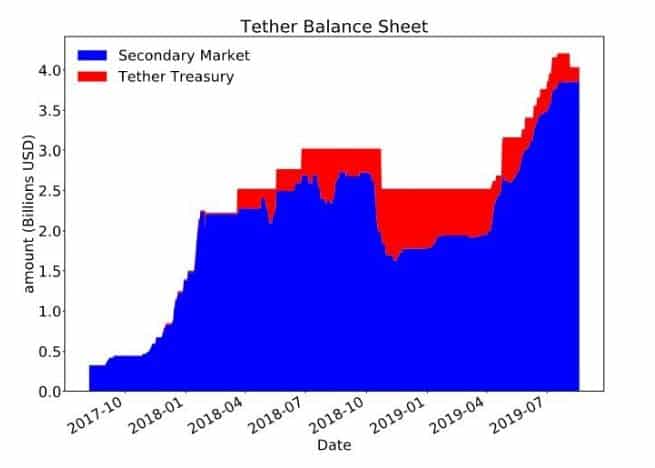

They referred to one significant change in the Tether issuance process. Prior to 2018, all coins “created via grants were immediately distributed to Bitfinex and on to the other exchanges for trading in the secondary market.”

However, ever since 2018, Tether Treasury retains a fraction of all USDT in circulation. The Treasury can use these reserve holdings to sell them for dollars in case the Tether price in the secondary market is above parity.

By evaluating this “more precise measure of Tether inflow to the secondary market,” the total supply, and the shock effects on Bitcoin’s price, the authors found “no systematic evidence that stablecoins issuance affects cryptocurrency prices.”

Safe-Haven Role

By referring to the events in mid-March when the cryptocurrency market plunged by up to 50% in 24 hours, the research said that “stablecoins consistently perform a safe-haven role in the digital economy.” As they are especially attractive to traders in times of intense volatility, the market capitalization of most stablecoins surged at that point, while Bitcoin and altcoins took a sharp dive.

Back in Q4 of 2017, before the massive price pumps, the total market cap of all stablecoins equaled at approximately $1.25B, per data from CoinMetrics. At the time of this writing, it’s exceeding $9 billion – meaning a 620% surge in just over two years.

As such, it’s no surprise that their role in the market continues growing. For instance, ERC-20 stablecoins are responsible for 80% of the daily adjusted transferred value on the Ethereum blockchain. Thus, the whole network recently came into full parity with Bitcoin.

The post Tether Doesn’t Inflate Bitcoin Price, New Research Says appeared first on CryptoPotato.

The post appeared first on CryptoPotato