The Ethereum network is close to reaching its maximum utilization. It appears, however, that one of the most heavily transacted tokens on the network is the most popular stable coin Tether (USDT). As such, the network is facing a serious issue as it may not provide enough room for developers of DApps, which is its original designation.

The Problem With Ethereum And Tether

According to Etherscan, the network utilization of Ethereum is currently around 92%. Needless to say, it’s operating almost at full capacity. One would think that this is because there are far too many decentralized apps built on top of it, but a closer inspection reveals that this is not really the case.

As Cryptopotato reported a couple of days ago, one of the main challenges that Ethereum is facing is the growing usage on behalf of the popular stable coin Tether (USDT). According to its transparency page, about $1.5 billion worth of USDT circulates on Ethereum’s blockchain, representing around 40% of Tether’s entire circulating supply.

What is more, however, the transaction count of ERC20-based USDT is also steadily increasing. In fact, it’s even setting new records.

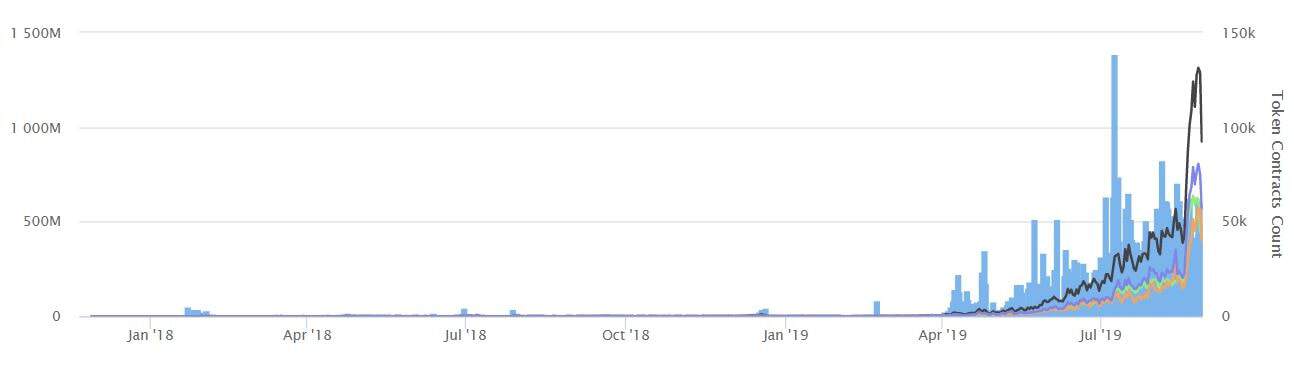

USDT Transaction Count. Source: Etherscan.io

As seen on the chart, the total transaction count for ERC20-based USDT reached its all-time high just a few days ago, on August 26th – upwards of 131,000 transactions. While it saw a notable drop, the transaction count yesterday was also more than substantial standing at around 92,000 transactions.

As Ethereum’s network is only capable of handling a certain, rather low number of transactions per second, this is inevitably increasing the overall utilization of the network.

In other words, if Tether continues to take up the network’s capacity, developers won’t have enough room to build decentralized apps (DApps).

A Growing Problem

As mentioned above, USDT peaked at around 131,000 transactions carried out on Ethereum’s network on August 26th.

According to DApp-oriented metrics website State of the DApps, there are currently 2,582 decentralized applications built on top of Ethereum, making it the predominant leader in the field. Combined, they share upwards of 17,600 daily active users.

Interestingly enough, however, all of those DApps accounted for approximately 68,430 transactions in the past 24 hours. USDT accounted for more than 92,000 transactions and one can easily see how this can become a problem.

Commenting on the matter was Jeff Dorman, CEO at an LA-based asset management fund, who said:

So the biggest implication today is simply that developers may be incentivized to wait until this transition happens before fully committing to build on Ethereum. […] Tether isn’t helping.

At the same time, there’s a growing competition for transaction space on Ethereum’s network and it is already expensive enough, according to Vitalik Buterin. If it keeps up with the current pace, however, it will be even more expensive.

What’s The Solution?

The obvious fix for a situation of the kind is to increase the number of transactions per second that the network could handle. In other words, the network needs to scale.

We already know that the team is working on two solutions to solve that issue, namely, Sharding and Plasma.

Last year in May, Buterin explained that Sharding and Plasma could scale Ethereum by 10,000 times. Sharding is a layer-one scalability solution which is intended to improve the existing blockchain directly. As it stands, every node which runs on the Ethereum network needs to process every single transaction which goes through it. While this offers a higher amount of security, it also implies that the network itself can only be as quick as every individual node. Here’s where Sharding steps in. It describes a condition where the network would be split into smaller partitions, referred to as shards. They would contain independent transaction history and each individual node would only have to process the transactions for certain shards. This would allow the overall throughput to be better because no single node would have to do all the work.

Plasma, on the other hand, is a layer-two scalability solution. Instead of improving the existing blockchain directly, it takes a special construction connected to it and provides greater throughput. In essence, it’s a solution for carrying out off-chain transactions. In short, Plasma’s intention is to enable the Ethereum blockchain to continue handling the smart contracts that it was intended for, while only broadcasting the entirely completed transactions without having to validate them on-chain.

In any case, it remains interesting to see how Ethereum will handle the scalability issue and the growing network utilization.

More news for you:

The post appeared first on CryptoPotato