- Following the breakout of the $2 mark, Tezos’s price could reach $2.5 in a few days if buyers continue to show interest.

- Against Bitcoin, an inverse head-and-shoulder pattern could produce a massive rise for Tezos in the short-term.

- Tezos is the best-gainers over the last 24-hours among the top 20 cryptocurrencies by market cap.

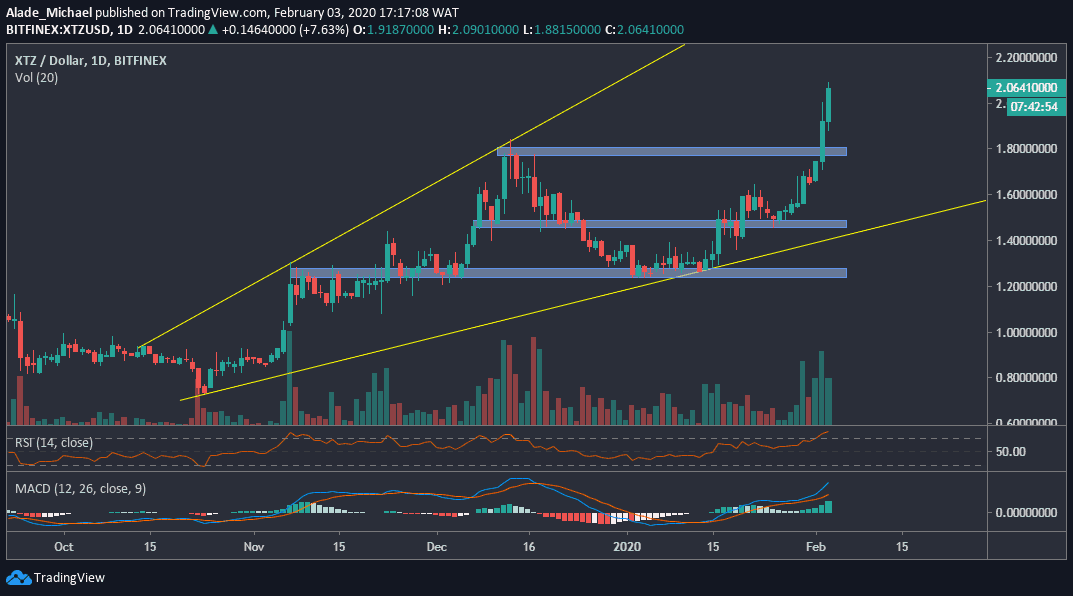

XTZ/USD: Massive Gains Ahead for Tezos as Buyers Target Wedge’s Resistance

Key Resistance Levels: $2.2, $2.5. Key Support Levels: $1.8, $1.47

Over the past few days, Tezos’s volatility has witnessed a significant increase to the bullish side. The latest gain of almost 18% has pushed Tezos position to the 11th place on the top cryptocurrencies by market cap. Meanwhile, Bitcoin is showing a sign of indecision for some days now.

It appears that Tezos is enjoying the latest Bitcoin’s mini-rally. The ascending broadening wedge spotted on the daily chart could be another reason for the current surge in Tezo’s price.

The XTZ price is heading for the wedge’s upper boundary, which may open the door for more bullish action in the next few days. XTZ’s further target now lies at $2.5 as long as the bulls keep showing commitment.

Tezos/USD Short Term Price Prediction

After dropping to wedge’s lower boundary on January 2, Tezos regained momentum following a rebound from the long blue support zone of $1.24. This bounce has brought buyers near $2.2 and, at the same time aiming the wedge’s resistance around $2.5 or even above. As a result of the past few days rally, XTZ is now holding support at $1.47 and $1.8 – the recent blue support areas.

Looking at the daily volume, Tezos appears to be gaining more bullish momentum. We can expect the price to keep increasing once the market continues to follow the bullish sentiment.

The technical indicators: the price of XTZ has entered the overbought region on the daily RSI. This suggests that this market is overvalued at the moment, although buyers are still showing strong commitment.

However, it’s important to keep in mind that the bullish momentum may end soon, which could cause a notable drop in price. In the same direction, the daily MACD is positive, with no sign of bearish at the moment. A negative sign might introduce sellers back in the market. But as of now, Tezos remains bullish on the short-term trend.

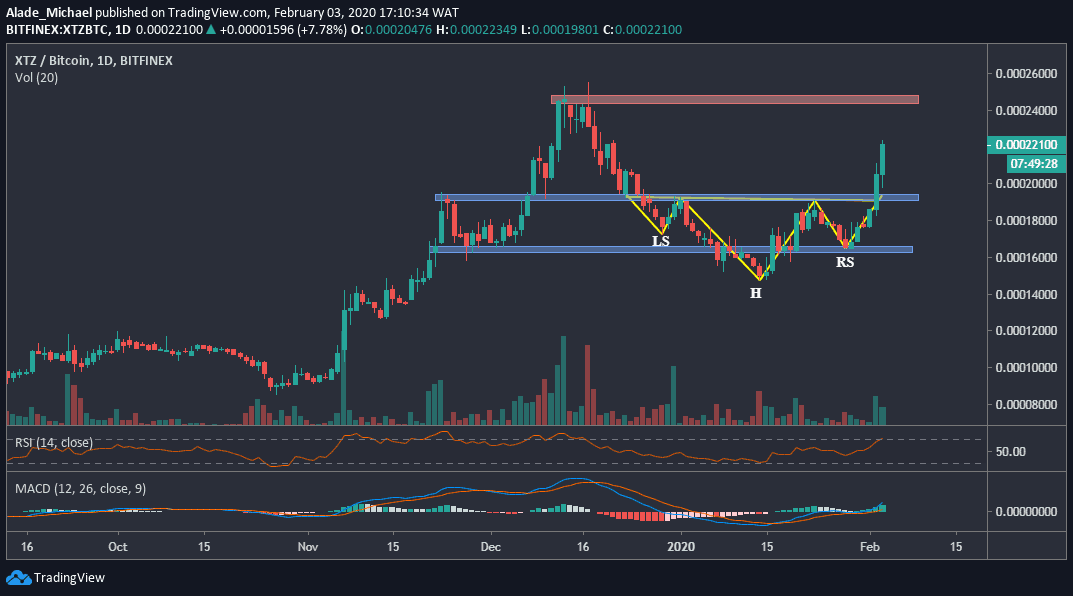

XTZ/BTC: Inverse Head-and-Shoulder Breakout Set Tezos on Bullish Track

Tezos has seen a dramatic climb over the past five days of trading against Bitcoin as well. At the time of writing, the price of Tezos is up by 18.85% against Bitcoin. Following a daily long opening, XTZ has managed to reach 22150 SAT level but now trading around 22100 SAT level at the moment.

XTZ is currently under bullish control. Due to the latest surge in price, Tezos’s market cap is roughly estimated at 153,450 BTC with a trading volume valuation of 13,183 BTC against Bitcoin pair. If these statistics keep rising, the price of Tezos is predicted to grow stronger. The reverse will be the case if statistics drop.

Tezos/BTC Short Term Price Prediction

Yesterday, Tezos broke-out the inverse head-and-shoulder pattern that was formed on the daily chart. This breakout has triggered a strong buy over the past few hours, bringing Tezos’s price to around 22100 SAT levels at the time of writing. Though, the price range for this breakout is 24500 SAT level – where the red resistance zone lies. A surge above this resistance could send XTZ straight to the 30000 SAT level.

In case of a drop, the neckline and right should are expected to provide support for the XTZ/BTC pair. As of now, the buyers are still present in the market. The volume is currently low, but we can expect it to increase as soon as demand rises.

On behalf of the technical indicators: Tezos is currently testing the daily RSI 70 level as there’s more room for buying pressure if the price climbs further. But if the mentioned RSI level rejects price, XTZ could correct a bit to the downside.

The latest positive cross on the MACD, suggests a big bullish move is coming up soon. Nonetheless, the XTZ bulls are still gaining control against the Bitcoin pair.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato