Bitcoin couldn’t succeed at conquering $12,000 so far and got rejected. Although many top 10 alts are retracing slightly today, the rest of the market is in the green, including another all-time high from a top 20 coin – Tezos (XTZ).

Lower-cap Altcoins And Tezos To The Rise

The majority of top 10 coins have pulled back a bit since yesterday, including Ethereum (-0.3%), Bitcoin Cash (-1.5%), Chainlink (-2%), Bitcoin SV (-1.2%), Cardano (-1.7%), and Binance Coin (-1%). Ripple is the only coin in green after a 2.5% increase to above $0.30.

However, the situation further down in the market cap ranking seems quite different. One valid example is Tezos. After watching Chainlink painting several consecutive all-time highs, XTZ decided to follow LINK’s footsteps. Earlier today, XTZ exceeded the previous high and reached $4.41 (on Binance).

Naturally, this increase has affected the coin’s total market cap, and Tezos now occupies the 11th spot.

Other massive gainers include JUST (52%) and yearn.finance (43%). Both of them pump hard after announcements from the leading cryptocurrency exchange Binance that it will list them on its platform.

Terra (30%), Blockstack (20%), Hedera (19%), Theta (18.5%), Swipe (18%), IOTA (16%), Siacoin (12.5%), Aragon (12%), and Matic Network (12%) also gain double-digit percentages.

Band Protocol (11.5%), Kava (-8%), and Balancer (-7%) are the three most notable losers in the past 24 hours.

Bitcoin Fails (Again) At $12k

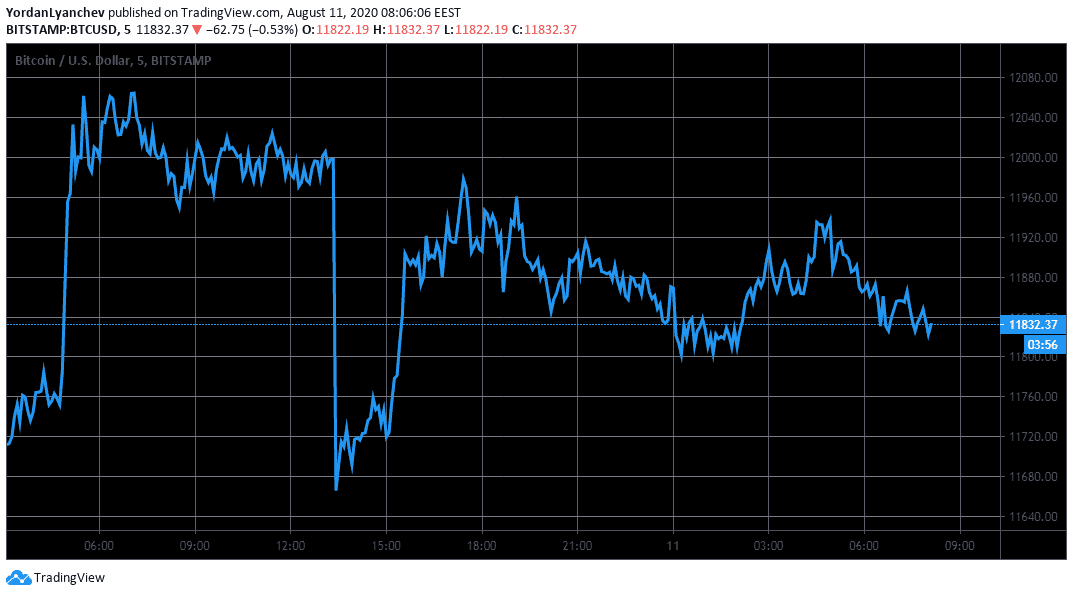

As CryptoPotato reported yesterday, Bitcoin took a second swing in two weeks at $12,000. However, the resistance and the psychological level turned out too much for the primary cryptocurrency. Instead of marching above it, BTC reversed and dumped by about $500 in a matter of minutes.

This drop to $11,500 could be a typical buy the dip situation as the bulls didn’t allow any further declines and pushed the price upwards again. This time, BTC stopped before facing $12,000 and has pulled back to the current level of $11,800.

This serves as support now in case Bitcoin tanks again, followed by $11,500 – $11,600. Further below lie $11,200 and $11,000, before the previous 2020 high from February of $10,500.

Should BTC ascend in value, it has to decisively overcome $12,100, which is the current 2020 high from a few weeks ago. The next resistance levels would be at $12,300, $12,500, and $12,900.

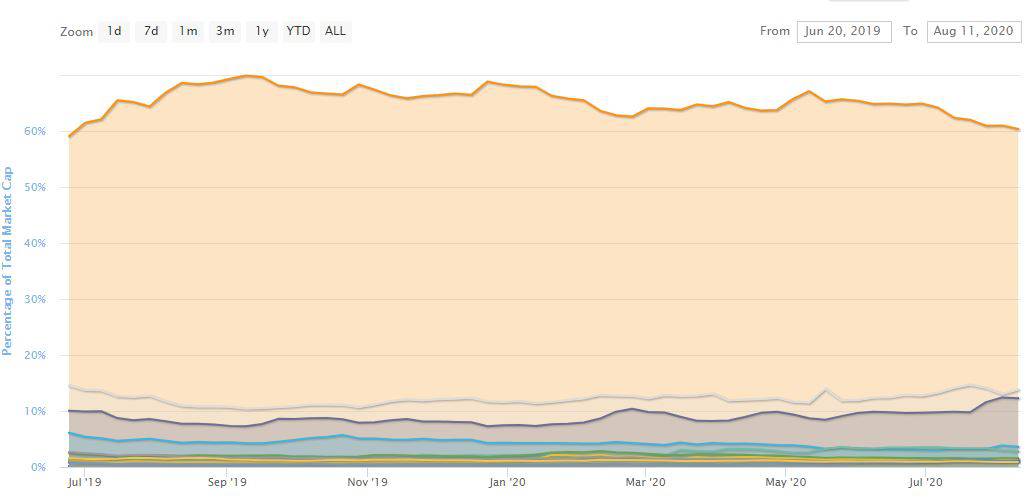

As Bitcoin has retraced slightly since yesterday, while some alternative coins have gained significant chunks of value, this has impacted the BTC dominance over the market. The metric has dropped to 60.2% and threatens to dip below 60% – a level not registered since June 2019.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato