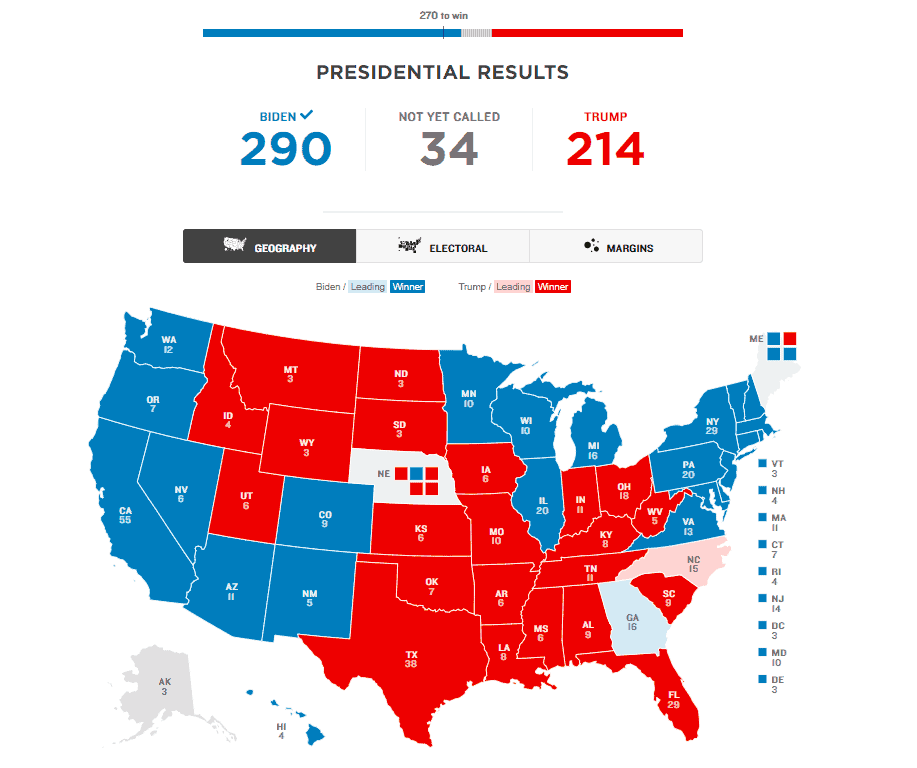

The uncertainty seems to have come to an end: Biden is the new president of the United States after winning the decisive electoral votes of Georgia and Pennsylvania. At this moment, Biden has 290 votes out of the 270 needed to win the presidency, while Trump has only 214. And with only 34 votes in dispute, the chapter is practically closed.

Bitcoin’s Sell The News In Reaction to Biden Winning

The new president was quick to change his Twitter bio and send a message to the nation, thanking them for their support, and promising to unite the Not-so-United States:

America, I’m honored that you have chosen me to lead our great country.

The work ahead of us will be hard, but I promise you this: I will be a President for all Americans — whether you voted for me or not.

I will keep the faith that you have placed in me. pic.twitter.com/moA9qhmjn8

— Joe Biden (@JoeBiden) November 7, 2020

Celebrations spread everywhere. However, Donald Trump did not give up and also claimed victory in a tweet. (with capital letters). Yesterday he assured that he would dispute the elections in court for being fraudulent.

I WON THIS ELECTION, BY A LOT!

— Donald J. Trump (@realDonaldTrump) November 7, 2020

The markets are taking note of this and were quick to react, especially Bitcoin, which is already feeling the “Biden Effect” and lost $850 right after Biden’s announcement, as a classic “sell the news” event.

Scalpers Had a Hard Time as Bitcoin Crashed in Hours…

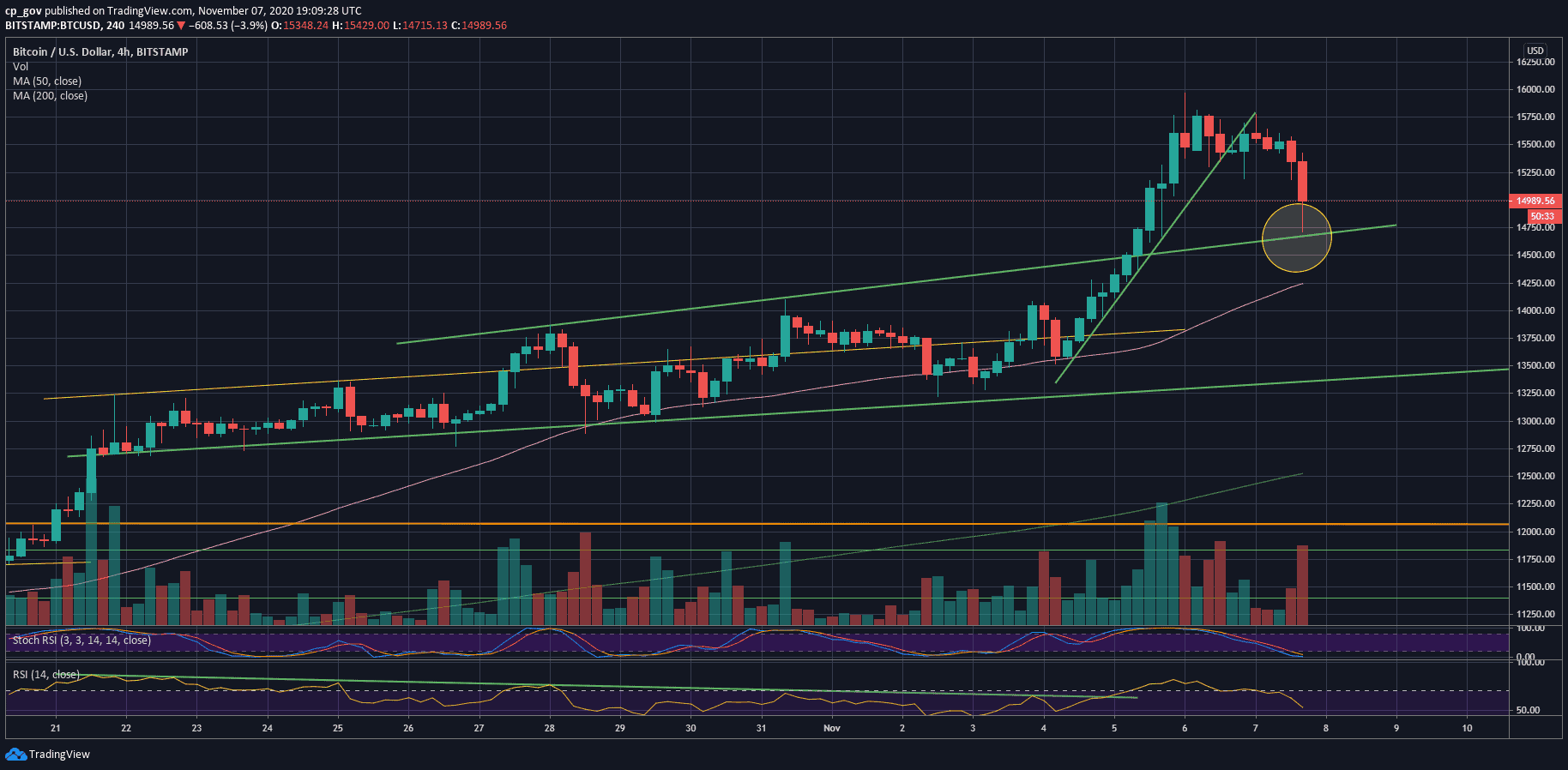

Today, the story is different. Between 5 pm and 7 pm UTC, the currency simply plummeted from over $15400 to a current low of $14700 (Binance). It later corrected a little to $15000 and then fell to $14555 at the time of writing, as the current daily low.

On the following 4-hour chart, the $14600 – $14700 is marked as a possible strong support area, that might hold Bitcoin price.

But Swing Traders Have Time to Think

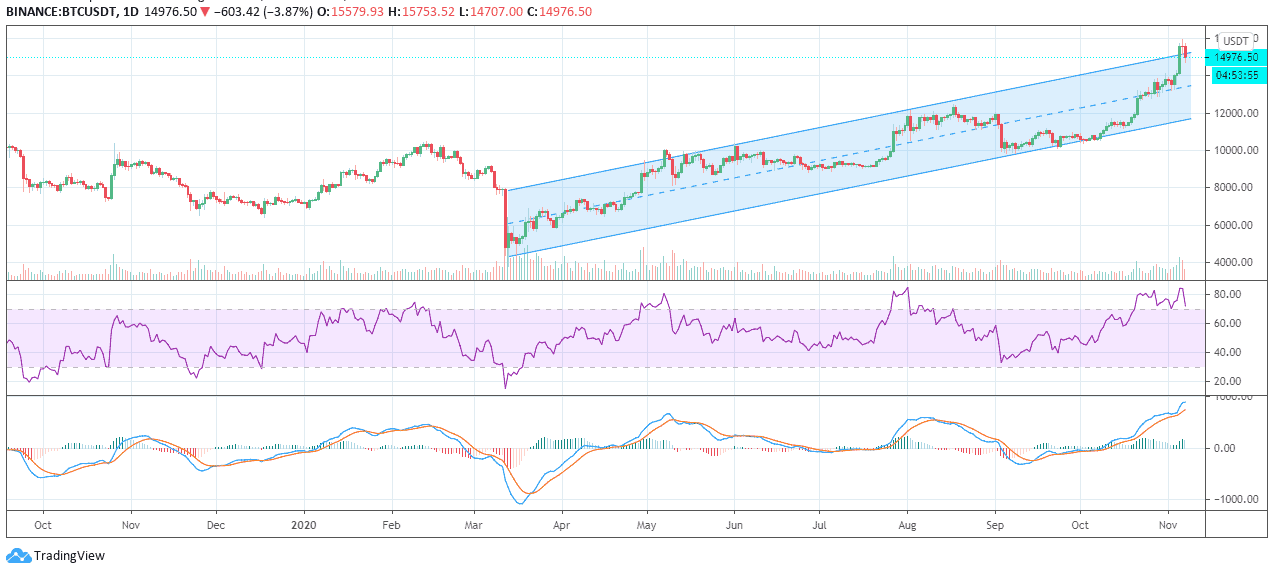

Charts with candles set to 1-day seem to point to a healthy correction — even if the fall was due to nervousness as Mati Greenspan points out. Bitcoin has been in a healthy bullish channel since March 2020, giving confidence in its appreciation without fear of a possible bubble.

When it touched $16,000, it not only broke that channel but brought other indicators into an overbought zone with the possible danger of a further decline.

BTC now returned to the normal channel, and the indicators recovered a little. This could point to a normalization of operations in the short term. However, it implies a substantial risk for scalpers and daytraders with leveraged positions.

How Will Biden Impact the Bitcoin Markets?

It is still too early to move pieces on the chessboard. Before the elections, the general consensus was that an eventual victory for Trump would be good for the markets. At the same time, Biden would not be very investor-friendly.

However, the now-elected president has announced his intentions to issue another stimulus plan, which could mean more market growth.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato