Cryptocurrency investors have withdrawn approximately 45,000 bitcoins from the derivatives exchange BitMEX following the recent charges brought by the US CFTC. A sizeable portion of the massive amount has ended up on two rival exchanges – Gemini and Binance.

CFTC Charges Against BitMEX Owners

As CryptoPotato reported last week, the US Commodities and Futures Trading Commission pressed charges against the owners of the popular derivatives exchange BitMEX. The CFTC charged Arthur Hayes, Ben Delo, and Samuel Reed with illegally operating a derivatives platform.

The US Attorney for the District of New York indicted the trio above and Gregory Dwyer on federal charges of violating the Bank Secrecy Act and conspiracy to violate the Bank Secrecy Act.

The exchange issued an official response and “strongly disagreed” with CFTC’s “heavy-handed” decision to bring these charges. BitMEX claimed that it will “defend the allegations vigorously” and promised that all funds stored on the exchange are safe.

The Withdrawals Start

Despite reassuring that all funds are safe, cryptocurrency investors didn’t wait long and started taking out their Bitcoin holdings from BitMEX.

In the first 24 hours following the controversial developments, traders withdrew about $336 million worth of Bitcoin from the exchange. The amount came in three significant batches and represented about 13% of all bitcoins stored on BitMEX.

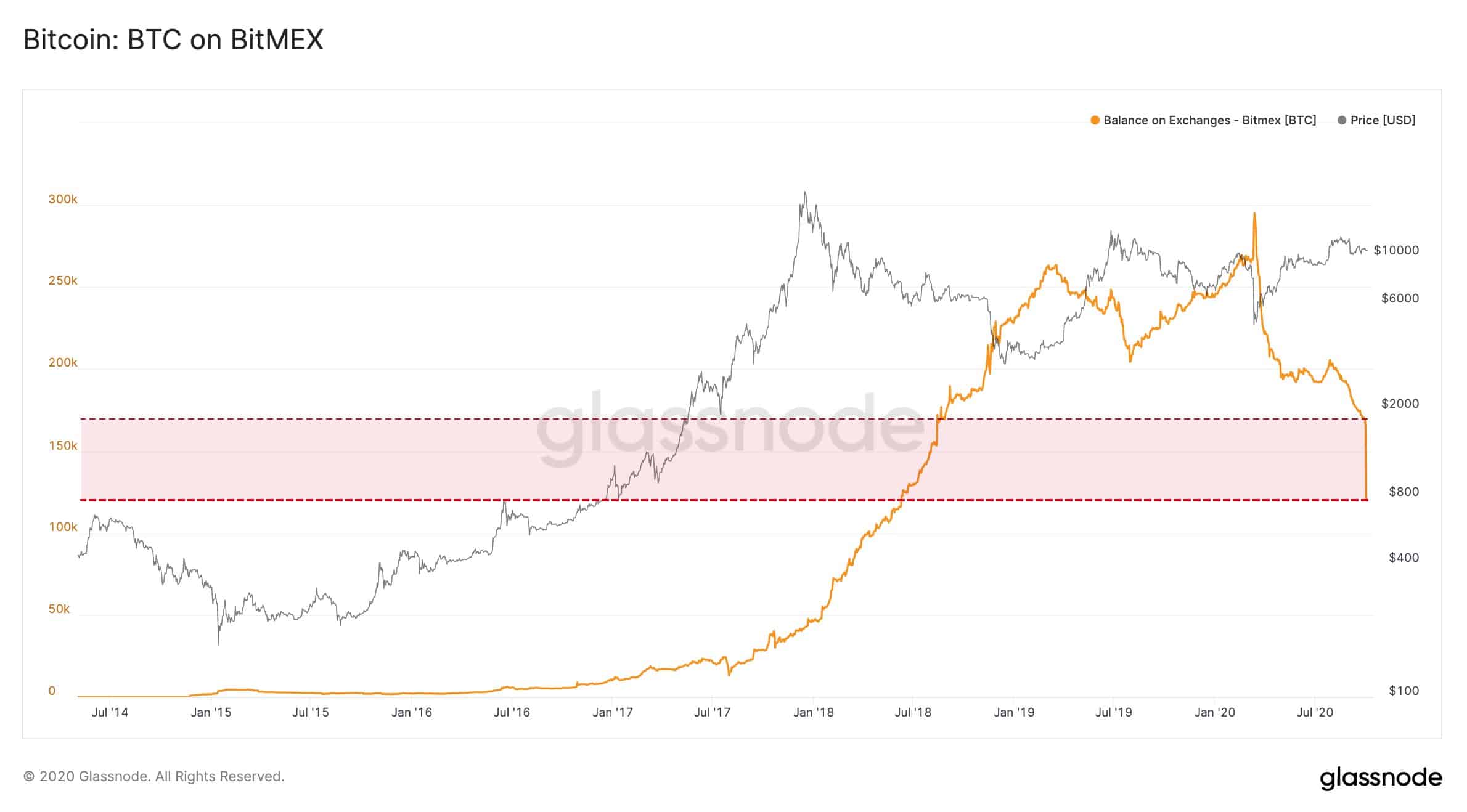

The situation only worsened in the following days, according to updated data from the analytics company Glassnode. The total amount grew to 45,000 bitcoins, and the balance on BitMEX dropped to 120,000. This represented a 27% decrease in a few days.

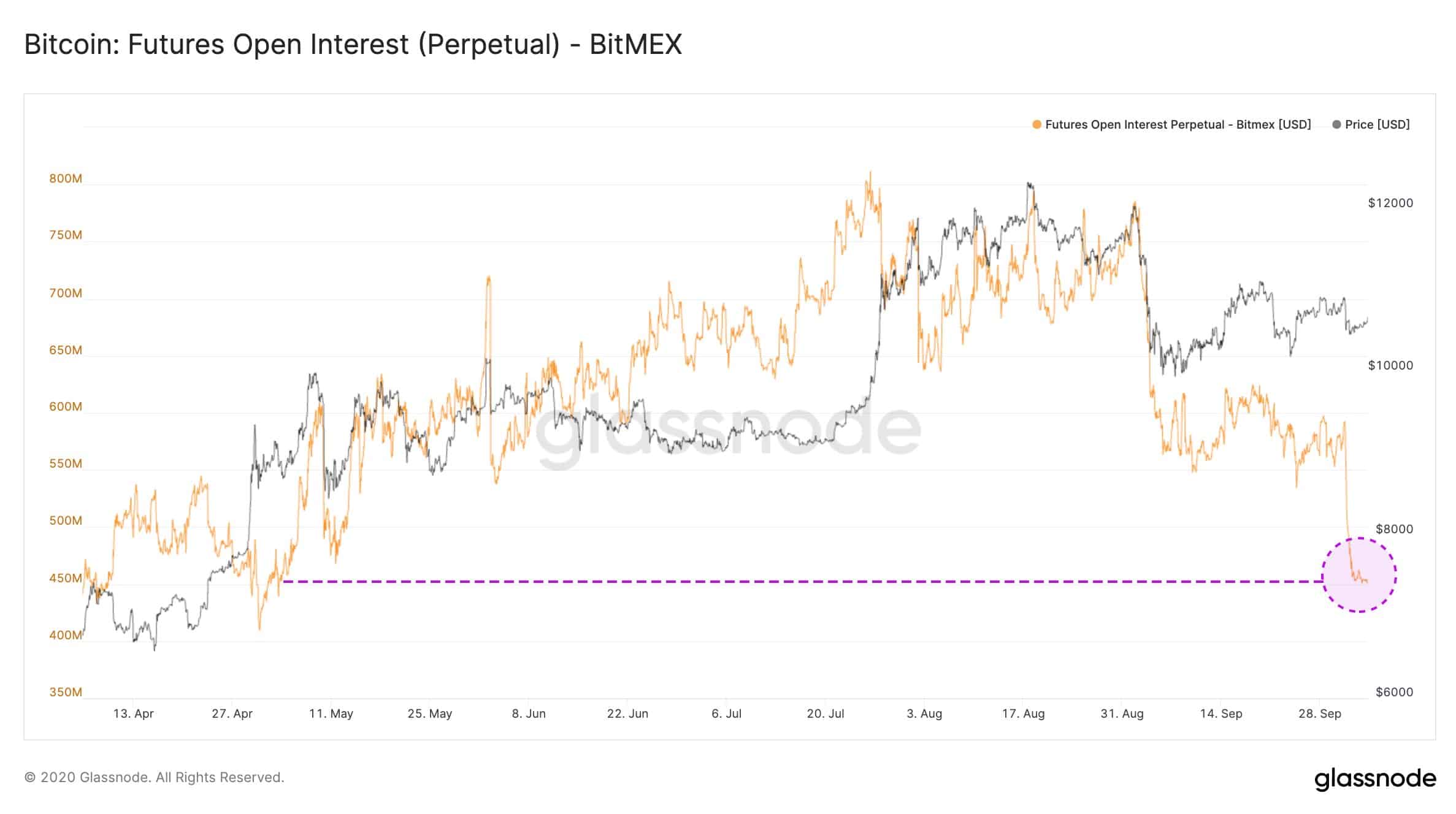

Somewhat expectedly, the Bitcoin open interest in perpetual futures contracts on BitMEX felt a substantial decline as well in the same timeframe. It dropped by about 24% from $590 million to $450 million. Glassnode noted that such low levels were not visible since May 2020.

And The Winners Are…

As 45,000 bitcoins had left BitMEX in a matter of days, a considerable portion of this massive amount was expected to end up on other exchanges. The question remained which platform(s) would receive the most significant shares.

Glassnode followed the bitcoins and concluded that “around 30% of those funds were transferred to Gemini and Binance in equal amounts.” This means that the number of bitcoins on those two exchanges grew with 13,500. To put it in USD perspective – about $145 million.

The post appeared first on CryptoPotato