The consequences of the nationwide Chinese crackdown on Bitcoin mining are more than evident in a few short weeks. The hashrate has dropped dramatically by nearly 50% from its peak, the number of daily issued coins has declined, and the Puell Multiple has reached a multi-month low.

The Effects of the Chinese Crackdown

Although Bitcoin has been banned in China for years, the Asian Superpower doubled down on its stance just recently. It went further this time by ordering several regions to halt BTC mining due to environmental issues.

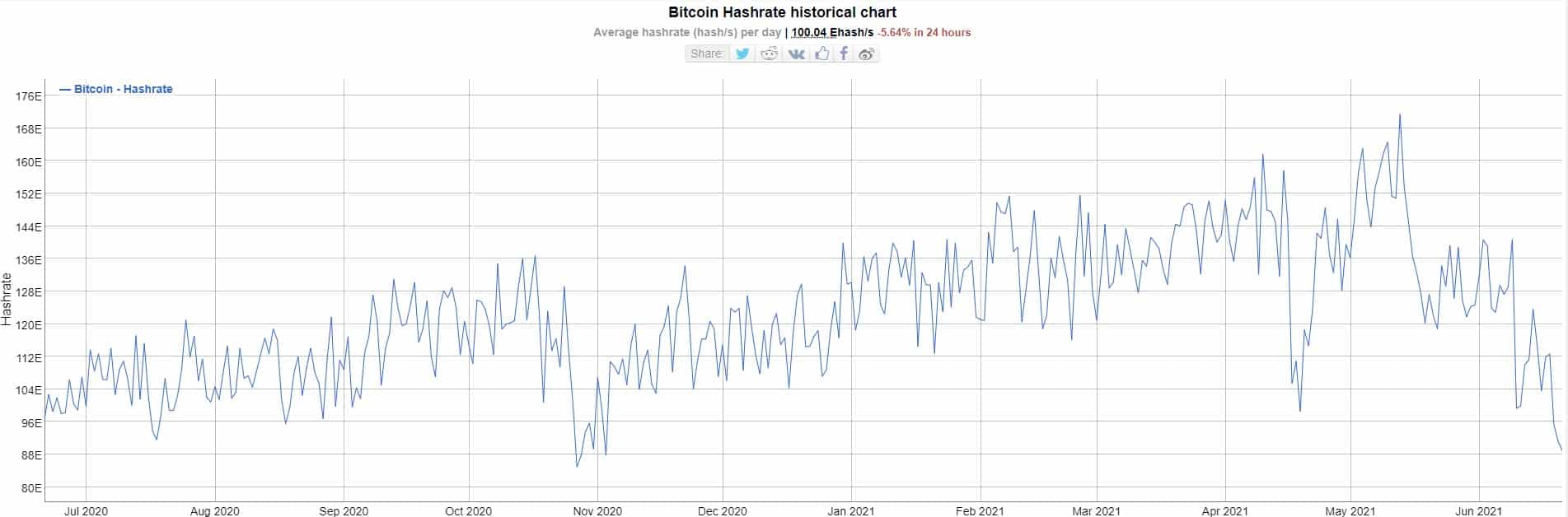

Being responsible for over 60% of all Bitcoin mining until that moment, this decision had an immediate impact on the network’s hash rate. The metric, which is a measuring unit of the processing power on Bitcoin’s blockchain, dropped to around 100 Ehash/sec for the first time since November 2020. On a shorter scale, this represents a near 50% decrease since the peak in May.

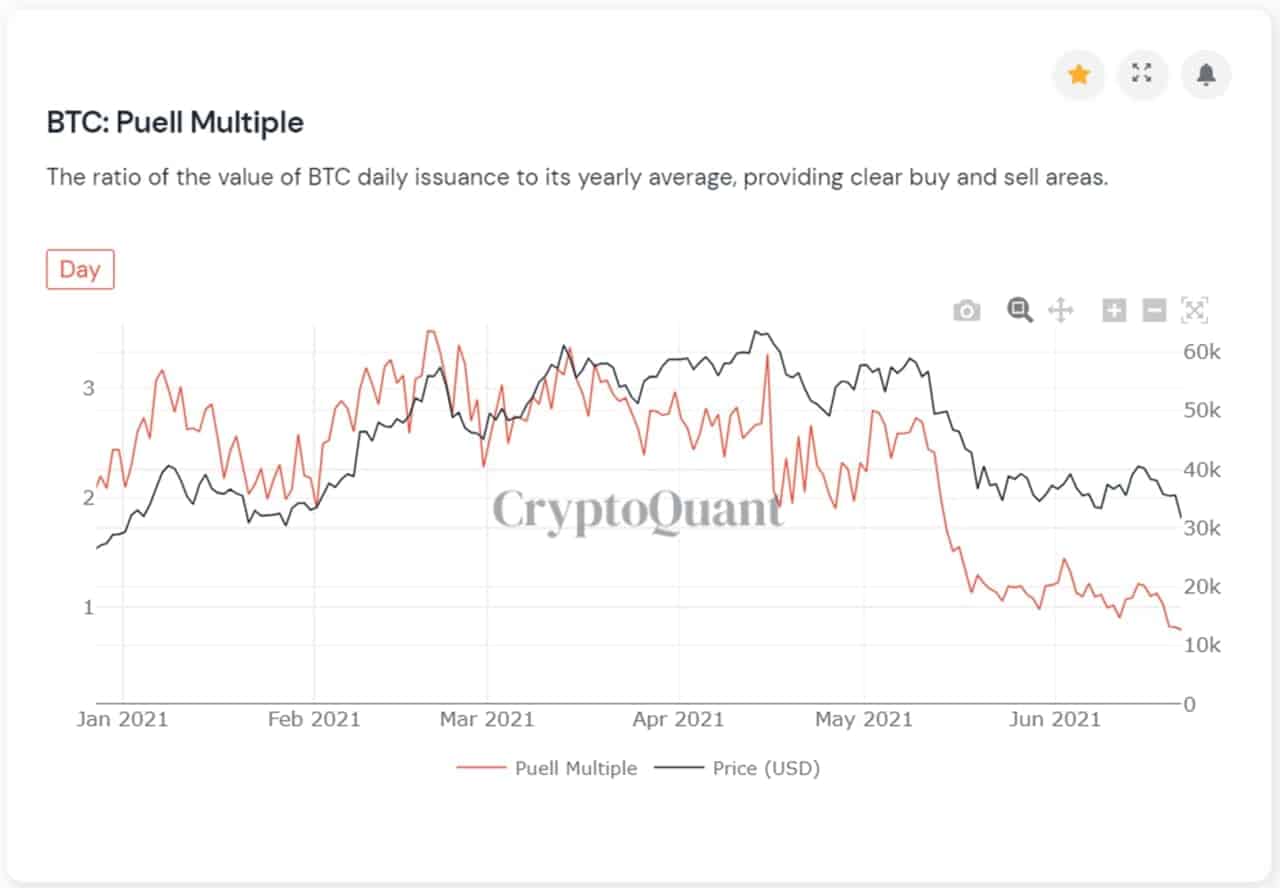

While miners complete their transition from China to other nations and the largest blockchain network goes through its next mining difficulty readjustment, the number of daily issued coins has reduced. According to CryptoQuant, this has led to an eight-month low of the Puell Multiple metric.

It’s defined by dividing the daily value of the issued bitcoins in USD by the 365 days moving average of that USD daily value. The analytics company said the Puell Multiple is now down to 0.81.

ADVERTISEMENT

CryptoQuant’s chart sees 0.5 as the bottom and 4 as the top of this metric’s performance, which means that BTC is nearing its low. In previous similar scenarios, the asset’s price has indeed reacted in a positive way after dropping so low.

Bitcoin Below $30K

Although the Puell Multiple could serve as a sign of a positive trend reversal in the long run, the current state of BTC’s price is far from optimistic.

As reported earlier, the primary cryptocurrency dumped below $30,000 for the first time since January. This comes after the aforementioned crackdown from China and multiple reports outlining various bearish signals.

Bitcoin is down by more than 50% in roughly two months after it peaked at $65,000 in mid-April. Moreover, it risks going into a negative territory YTD as it entered 2021 at just over $29,000.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato