2020 has been so far a challenging year. Issues such as the Australian wildfires and the global COVID-19 pandemic have harmed the planet and its inhabitants. The financial world has also suffered, especially during the first several months.

The effects are evident within different sectors of the financial industry. While some have felt adverse consequences during these uncertain times, others have thrived and reached for the stars.

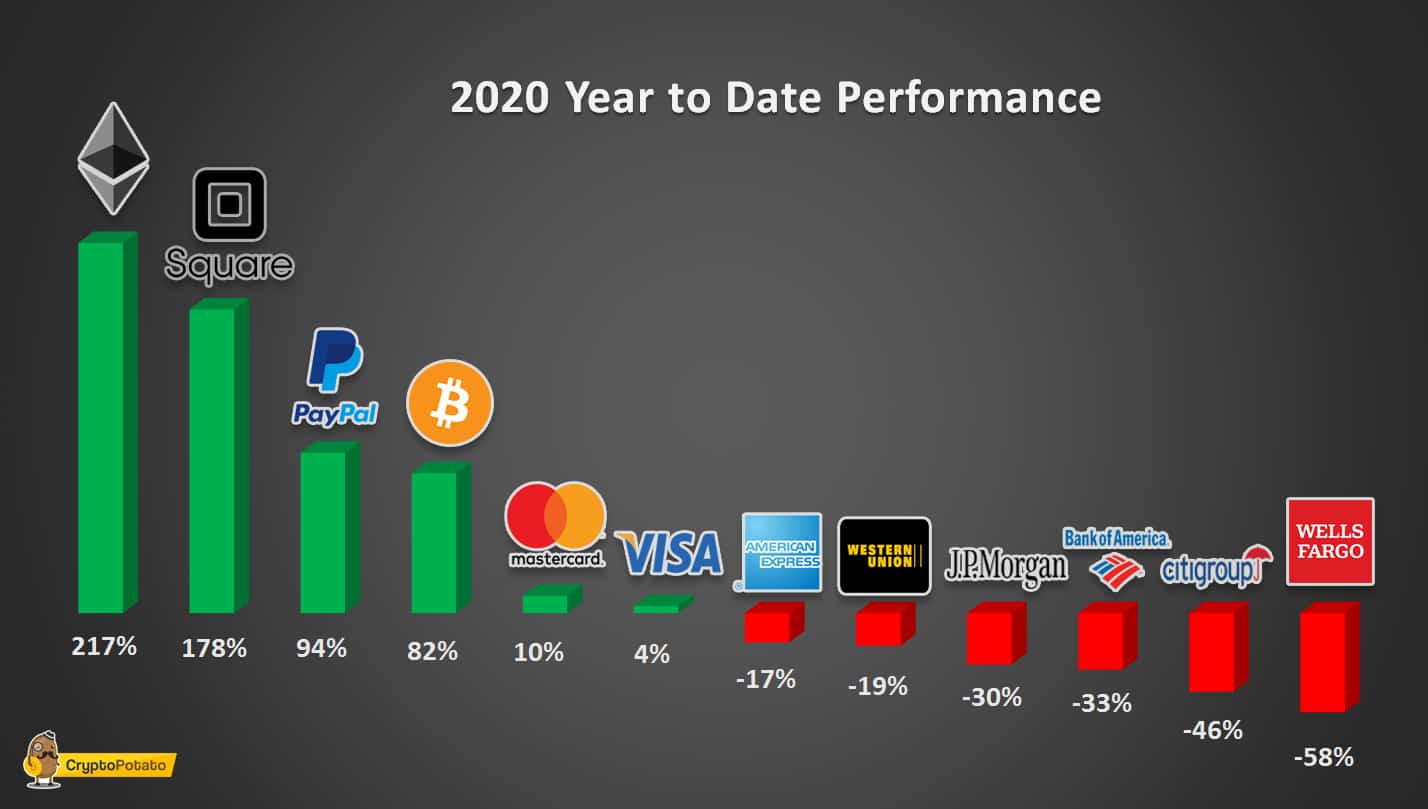

BNN Bloomberg’s senior anchor, Jon Erlichman, recently published some stocks’ price performances for banks and fintech companies and the two largest cryptocurrencies – Ethereum and Bitcoin.

CryptoPotato exemplified it with the graph below. It concludes that innovative fintech companies such as Square and PayPal have massively outperformed the old dogs – the banking sector. Bitcoin has also experienced a notable YTD price surge, while Ethereum has trumped them all with a substantial triple-digit surge.

YTD: Bank Stocks Haven’t Enjoyed 2020

The stocks of some of the world’s largest banks were on a roll since the previous financial crisis over a decade ago. Bank of America shares had increased approximately ten-fold since 2009 to their highs in February 2020 of about $35.

In the same period, Citigroup stocks went from $15 to $80, JP Morgan Chase & Co (JPM) from $20 to $140, and Wells Fargo (WFC) surged from $11 to above $50.

However, the COVID-19-prompted crisis took the world by storm this year. March alone saw price slumps not seen in decades. Most of the aforementioned bank stocks lost about 50% of its value in merely days.

Although their shares have picked up from the March bottoms, the graph above demonstrates that their year-to-date performance is still in the red. JPM is down by 30%, Bank of America by 33%, Citigroup by 46%, and Wells Fargo has it the worst – 58% YTD dump.

Other financial service corporations, such as Western Union (-17%) and American Express (-19%), have also lost significant chunks of value since the start of the year.

It’s worth noting that one of the most old-school investors and biggest supporters of the banking sector, Warren Buffet, sold the majority of his bank stocks this year.

Financial Companies In The Green

Although the crisis reached all companies on the graph above, some have not only recovered but actually increased in the following months. MasterCard stocks plummeted from $345 to $203, while Visa’s nosedive started from $213 and ended at $135. Nevertheless, both companies’ shares are slightly in the green on a year-to-date basis.

Two other financial service companies, but primarily focusing on online endeavors, have marked substantially more impressive YTD results.

PayPal’s stocks (PYPL) started 2020 at $110 and have increased by 94% since then, despite the mid-March slump to $85. Jack Dorsey’s Square’s yearly gains have even seen triple-digit percentages. The 55% dump in March was only a brief obstacle in SQ’s way towards a 178% surge since January 2020.

Interestingly, both firms have embarked on cryptocurrency-related activities in recent months. Square purchased $50 million worth of Bitcoin, while PayPal announced that it will enable its US-based customers to buy, sell, and store several digital assets.

What About Bitcoin And Ethereum?

The cryptocurrency market was not exempt from the mid-March madness. Some alternative coins lost up to 80% of value in hours. The two most well-known representatives, namely Bitcoin and Ethereum, dipped to $3,700 and below $100, respectively.

Percentage-wise, those developments equaled about 50% of losses. However, the rest of the year has been significantly more positive for both. Bitcoin, regarded by some as a safe haven tool with similarities to gold, has overcome its massive slump.

Whether it’s the growing interest from institutional investors, the third halving, or giant companies buying BTC for its store of value characteristics, Bitcoin has surged by more than 80% YTD. Just a few days ago, the primary cryptocurrency charted a new yearly high of over $13,000.

Ethereum, on the other hand, has been widely utilized this year in the ongoing decentralized finance trend. Its blockchain operates as the underlying technology behind most DeFi projects.

This increased utilization led to some unfavorable consequences such as slow transactions and high fees and highlighted a few of the network’s weak points. Price-wise, though, none of that matter as ETH has been on a roll during most of the year, especially since the summer.

As a result, the second-largest cryptocurrency has become the best-performing asset from the ones mentioned above, with an increase of over 200%.

What Could All Of This Mean?

The world is undoubtedly going through changes, primarily prompted by the COVID-19 reality. Social distancing and people working from home have driven society into becoming even more digitally-focused.

The financial world won’t be left behind. People seek more online ventures, and digitally transferred funds will eventually become the new normal.

As such, the decline of traditional financial institutions like banks, and the rise of innovative technologies, including cryptocurrencies, could be just the start of the mass transition to the online world.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato