(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The COVID pandemic, and most importantly, the global policy response to it, pulled forward decades worth of societal trends in a very short period of time. Almost everyone across the globe was sequestered in their homes for the better part of two years, driving a torrent of inflation that is here to stay.

The inflation is entrenched because a large number of jobs are now being done from home, and the wealthy computer desk jockeys working these jobs now require a different mix of goods. The global supply chain was not prepared for the wealthiest and largest consumers to ditch their one- to two-hour daily commute in favour of strolling into their home office clad in the latest Lululemon jammies. If you’re one of these keyboard warriors, your consumption basket in and around the office is completely different from the basket of goods you enjoy inside your place of abode. That is why inflation, at least from a goods perspective, will remain sticky.

On the energy spectrum, wealthy Western citizens decided to underinvest in fossil fuels, which provide a high return relative to the energy invested in them, and invest heavily in renewable energy, which has a much lower return relative to the energy invested. As wealthy Westerners aim to fight the good fight against carbon emissions, the success of their wind and solar buildout – and the accelerated retirement of internal combustion engine vehicles accompanying it – is predicated on developing countries polluting their local environments in order to produce nickel, copper, cobalt, and other key industrial commodities. Unfortunately, pulling a vast amount of industrial metals out of the ground requires miners to burn fossil fuels. The demand for hydrocarbons continues to rise as CAPEX falls. This bass-ackwards energy policy does and will continue to produce high and rising fuel prices.

Whether it’s goods or energy, the price is rising on the things we need in this post-pandemic existence. Against that backdrop, short of direct military confrontation, the West did not have a surfeit of easy policy responses to Russia’s invasion of Ukraine. On the one hand, Russia produces the stuff they need in vast quantities – i.e., fossil fuels, various industrial metals, and foodstuffs. On the other hand, the West believes it has an interest in deterring militaristic actions on its borders and had to respond to the wartime actions. Short of sending the poor, the young, and the male to die on the battlefield, the response was a package of financial sanctions. I discussed this at length in “Energy Cancelled”.

What’s interesting is that the West’s financial response was not built on a model accounting for the macroeconomic outcomes that might occur in worst case scenarios. Instead, it appears as though they approached the situation as a financial fiduciary would. That is, they looked at past history as a gauge for future results, and tailored their response to the 95th percentile of outcomes – essentially weighing the outcomes with a 5% or less likelihood of occurrence as too unlikely to be worth accounting for.

The issue is that in times of crisis like pandemics and wars, the tails are immediately stressed. What has never happened before suddenly becomes what is happening right now. A system that fails to evaluate the function or f(x): of their actions at the maxima and minima is a system that breaks. Entropy and its accompanying volatility are the natural states of the universe, not order and calm.

It is trivially easy to spot a policy that uses confidence intervals rather than outcomes at the extreme. These policy options are pleasant; everything is possible, and no sacrifice is required. These solutions are akin to short call options; a small gain now is exchanged for a large loss later.

However, policies that account for extreme, unlikely scenarios at the maximum and minimum – i.e., long call options – can better position an economy for long-term success. They require citizens to sacrifice today, but offer a larger payoff tomorrow.

The unfortunate fact is that most citizens of the world’s largest economies assembled a portfolio of short call options on the volatility of the universe. The central bankers’ printing presses are employed as crude cudgels in an attempt to smother the inherent instability of our existence. COVID-induced inflation mixed with a major global conflict has created a dangerous cocktail that threatens to plunge hundreds of millions of souls into starvation.

The function that concerns personal and institutional capital allocators is how countries that are not in the Western axis of power will respond to the fallout of financial sanctions on Russia. This essay will approach the financial response of one large country (China) and one small country (El Salvador) in an attempt to stress the function of f(x): in ways to inform us of the possible end game.

Preach Brotha

Why do the acolytes of Lord Satoshi preach the gospel with such passion? Because we know that in order to create circular self-sustaining pockets of economic action that use Bitcoin as the sole payment method, we must infect as many minds as possible with our memetic narrative.

This is especially important because of how successful Bitcoin has been from a price appreciation standpoint. The meteoric rise of Bitcoin from nothing to a $1 trillion dollar plus asset in the span of a decade created the HODL culture. HODLers will not sell their Bitcoin at any price. And these folks, myself included, spend fiat and save Bitcoin. Fiat depreciates in real terms year after year, while Bitcoin is the best performing asset EVER created.

However, Bitcoin– unlike gold– must be used to have value. Miners spend energy to maintain the Bitcoin network. To cover their costs, miners must receive payment in a token that is socially valuable. Bitcoin therefore must move, and movement between parties is the antithesis of HODL culture. HODL culture taken to its f(x): maxima would result in the complete destruction of Bitcoin. Once all bitcoin has been minted and miners no longer receive sufficient income from network rewards in the form of newly minted Bitcoin, they must rely on transaction fees instead. If no Bitcoin changes hands because we all sit smugly clutching our USB sticks, then there will be no hashpower supporting the network. No network … no value.

Therefore, as a loyal subject of Lord Satoshi, I must do my part to evangelise the good word, and hopefully they can influence their domestic policy makers to create a fertile environment that promotes a farm-to-table Bitcoin economy.

Unfortunately (but thankfully, if you are one of Satoshi’s disciples), the West’s decision to financially cancel the largest global energy and commodity producer is the biggest advertisement for the existential need of Bitcoin in a sovereign’s currency savings portfolio. The goal of this essay is to examine from a theoretical point of view the issues capital account countries face and their policy options. Hopefully, I am able to fully communicate why Bitcoin deserves a place in a sovereign’s portfolio.

Once we infect the portfolios of sovereign countries, we can expect them to act in their own financial best interests. That is why crypto is so powerful. When you embed a digital token into a business model, the consumers become owners. As owners, they will want their token to appreciate, and will therefore shout from the rooftops so that the project may acquire more users. More users, more owners, token number go up – wash, rinse, repeat.

A country that decides to include Bitcoin in its mix of savings will put forward policies that encourage its use. For if we have done our job as preachers and teachers, everyone who holds Bitcoin understands it’s their duty – in small and large ways – to sponsor its actual usage.

The Doom Loop

The assets that capital account surplus countries purchase with their savings are extremely important to the economic survival of the West (that is, the US and EU). That is because each of these economic blocs requires the savings of foreigners to pay for their dissaving at a federal level. A country can do one of three things to finance its deficit:

- Sell debt to domestic entities. This crowds out local business as capital is lent to the government, not productive private enterprises.

- The central bank can print money and purchase debt issued by the government. This is inflationary as more money is chasing the same amount of real goods.

- Sell debt to foreigners. This keeps domestic interest rates low without expanding the money supply, which creates inflation.

Up until now, the West got away with mostly option 3 and a smidgen of option 2 without stoking too much inflation. Happy days!

A quick caveat about the EU

As of 2021, the EU as an economic bloc ran a current account surplus with the world. Germany is far and away the biggest net exporter in the EU. Globally, it is second behind China in its 2021 current account surplus. The EU ran a EUR 40.663 billion surplus in 2021 (source: Eurostat). Germany ran a EUR 172.7 billion surplus in 2021 (source: Bloomberg). For the EU as a bloc to run a deficit would require a 23% reduction in German exports, or a 23% rise in imports. This is crucially important as it pertains to EU energy policy vis-a-vis Russia.

Germany depends on Russian gas for somewhere between 50% to 60% of their electricity generation. Cheap and plentiful energy is required to power the industrial powerhouse that is Germany, and to produce goods at a reasonable cost. This is why Germany is, for now, dead set against a complete embargo on Russian energy. It would completely cripple its manufacturing base. If you assume Germany could replace Russian energy from some other source instantly, it would likely be via the US – which would cost an additional 30% to 40% more.

With higher costs, Germany must now charge a higher price for its goods vs. the rest of the world. And where will all that unused Russian energy go? China would love to receive natural gas and oil at steep discounts. Part of these discounts would pay for the hassle of seaborne shipping of gas and oil from the Russian ports to the Chinese ports that can handle these energy flows. But in any event, China net-net would probably save money on its energy import bill. So China’s exportable goods would become even more price competitive vs. Germany.

The point is that if Germany follows the politics of the EU, which lean towards an embargo on Russian energy, then Germany will not have the same gargantuan current account surplus it enjoys now. It will sell less goods, either because they cannot be produced due to lack of energy, or because due to higher energy input costs, these goods’ final price is not nearly as competitive vs. cheaper Chinese and Japanese goods.

Therefore, even though the EU currently has a current account surplus, that surplus will dissipate quickly if Russia’s energy is cancelled.

Back to the Doom Loop

If surplus countries, most of which are outside the core Western axis, decide they would rather save in gold, hard commodities, and/or Bitcoin, then they will not purchase Western debt assets (e.g., US Treasuries or Euro member country bonds). Without foreign demand, a combination of options 1 and 2 must be employed to finance the national deficit.

For the US, this will lead to uncomfortably high inflation; for the EU, it will destroy this unnatural monetary (but not fiscal) union. In both cases, the central banks will resort to Yield Curve Control (YCC) to cap yields so that the government can pay its bills in nominal fiat terms. I will repeat– no government EVER voluntarily goes bankrupt. The prescription is always money printing and inflation.

The US

As a landmass, North America is very blessed. America can feed itself and provide for all its energy needs internally– meaning it can afford to cancel Russian energy. Subsequent prices for food and fuel might be higher, but America’s political fabric will survive because people will be able to continue eating and heating their homes.

America, however, promised its largest population cohort– the Baby Boomers– generous medical and retirement benefits. It also assumed the mantle of the policeman of the world, which necessitated a high and constantly rising defence budget. Taken together, these third rails of federal spending all but assure persistent annual deficits given the current levels of tax receipts. These deficits were previously financed by foreigners recycling USD savings into Treasury bonds. That allowed the Fed to print money to fight the deflationary aspects of technology and poor demographics, without much inflationary pass through into the real goods economy.

The US 10-year treasury yield is in yellow, and the size of the Fed’s balance sheet is in white from 2008 to 2022. The green trend channel shows that yields broadly fell as the Fed’s balance sheet ballooned in size. That is due to the helping hand of surplus countries “saving” by purchasing US Treasuries.

Now if we believe that cancelling Russia spurs capital account surplus countries to stop saving via purchases of Treasuries, who will finance the deficit?

Also, the Fed communicated that it will begin shrinking its balance sheet as of May 2022. Best case scenario: the Fed just allows its maturing bonds to run off. Worst case scenario: the Fed allows its maturing bonds to run off AND outright sells bonds. Who will buy the trillions worth of USD Treasury bonds the Federal government issues at negative real rates?

Foreigners – Nope

The Fed – Nope

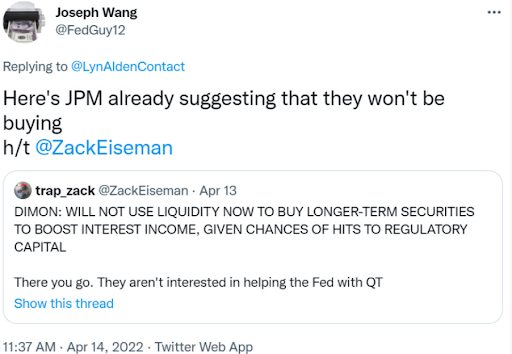

Domestic Entities – Maybe … commercial banks are the most likely home for these bonds. But, his royal highness Jamie Dimon proclaimed that JPM won’t be purchasing treasuries with its excess cash, lest they violate certain regulatory banking ratios. Therefore, some aspects of bank soundness would have to be relaxed in order for US commercial banks to step up their purchases of treasuries.

The Federal government will soon pay more in interest on its debt than it receives in tax receipts if it’s forced to pay an interest rate that is much higher than today’s. That is the start of an insolvency doom loop. The obvious solution is to redirect the Fed off of its inflation-fighting path towards one of accommodation once more. Accommodation will come in the form of explicit price fixing of the Treasury curve, which is euphemistically called Yield Curve Control (YCC).

Remember that the Fed has an institutional reference point for implementing YCC. All it takes is dusting off the covers of the post-WWII history books on how the Fed and Treasury colluded to fix the 10-year treasury yield and cap retail bank deposit rates so that real rates were extremely negative. These negative real rates allowed the USG to inflate away the debt incurred to win the war. If you want to learn more about this and how it spurred the creation of the Eurodollar market, read up on Regulation Q. Not sure what economic “ism” you would file this policy option under– but it might be the one that starts with an “S,” and not a “C”.

YCC is the end game. When it is finally implicitly or explicitly declared, it’s game over for the value of the USD vs. gold and more importantly Bitcoin. YCC is how we get to $1 million Bitcoin and $10,000 to $20,000 gold. There is no other politically palatable option, and the actions against Russia all but assure that YCC is coming sooner than you think. That is why the speed with which capital account surplus countries stop saving in USD denominated assets will dictate when we see the onset of YCC. Even if surplus countries save in gold and eschew Bitcoin completely (which will mean my sermon sucks), that in and of itself will precipitate the start of YCC. Again, YCC = $1 million Bitcoin.

The EU

Europe cannot feed itself nor provide for all its fuel needs internally, so it cannot afford to cancel Russian energy. However, Europe is a client state of the US, and Brussels is dutifully toeing the line for now.

EU countries share a secular Judeo-Christian culture, but that’s about all they have in common. Most of Southern Europe would be considered developing countries if it weren’t for the financial assistance of their German, French, and Scandinavian brethren.

The EU as a thing almost collapsed in 2011, but Super Mario Draghi proclaimed that the unelected (and therefore unaccountable) ECB would do “whatever it takes” to ensure the Euro project survives. That meant printing money and purchasing the bonds of the weakest EU members so their financing costs stayed affordable. That is perfectly fine when food and fuel costs stay constant, because Russia / Ukraine is providing cheap fuel and food at the margin. But now, there are real costs of rampant ECB money printing.

Take a look at this beauty of a chart. I know – my skillz are mad good. The white line represents the difference between the Greece 5-year Sovereign Bond Credit Default Swap (CDS) and the German 5-year Sovereign Bond CDS. The gold line is the ECB’s balance sheet. As you can see in 2011 – at the height of the crisis – the market believed Greece was extremely risky vs. Germany. As the ECB declared it would buy bonds from weak members, the market perceived that the risk of Greece vs. Germany declined by 99%! That’s what we call effective monetary policy. Riddle me this, what would happen if the ECB stopped buying bonds?

The EU member states also have a supreme desire to follow the energy policy recommendations of a Scandinavian high school student, and as a result, rely even more heavily on cheap Russian natural gas to achieve their green economy utopia. Currently, the EU has not stopped buying Russian energy, but they are seriously considering following America’s lead and reducing their Russian energy imports even further. The only way domestic governments will be able to placate hungry and cold citizens is printing money to pay for energy subsidies to keep the consumer price of food and energy at reasonable levels.

Now the doom loop begins. Inflation prior to the Russian conflict was already running at 40-year highs across the EU member states. The ECB would love to raise rates and combat this inflation, but it is in a serious bind. If it raises rates and stops purchasing weak member state bonds, then Southern Europe will quickly go bankrupt. The PIGS’ (Portugal Italy Greece Spain) only option at that point would be to go off the Euro so that they can redenominate Euro debt into local currency debt, giving them financial flexibility. That would be the end of the Euro, and would cause massive banking issues for Northern European banks who lent to Southern European companies. The banks’ debt assets would get paid back in local currency, but they would then owe Euros to investors … bye bye, thanks for playing.

If the ECB continues to print money so that the EU survives, then citizens of Northern European countries, angered by rampant inflation, will elect populist demagogues who will blame their economic woes on the profligacy of their Southern neighbours, and will run on a EU-exit platform. It’s the foreigner’s fault! (Hmmm… sounds like a familiar play I read in 1939).

The ECB is trapped, the EU is finished, and within the decade we will be trading Lira, Drachmas, and Deutschmarks once more. As the union disintegrates, money shall be printed in glorious quantities in a pantheon of different local currencies. Hyperinflation is not off the table. And again, as European savers smell what the rock is cookin’, they will flee into hard assets like gold and Bitcoin. The breakup of the EU = $1 million Bitcoin.

The EU doom loop is a certainty at this point. The degree to which Russian energy flow is curtailed determines the speed of collapse. If surplus countries decide that holding Euro debt assets is not safe, the pace of disintegration quickens even further.

Now we know why the saving preferences of surplus countries are important, but not what currency the majority of global bilateral trade is priced in. Let’s now delve into the f(x): considerations of a large and small surplus country.

China Imagination

I believe that China has an issue, but does China believe the same? Check this article from Nikkei Asia, entitled “China scrambles for cover from West’s financial weapons”.

The Western-led freeze on half of Russia’s gold and foreign exchange reserves after its invasion of Ukraine came as a shock to Moscow — and an unwelcome surprise to Beijing. The move underscored a brutal truth for China, the world’s largest holder of foreign reserves: One day, its international assets could be a tempting target, too.

Despite previous U.S. sanctions on dozens of Chinese corporations including Huawei and ZTE, Chinese policy advisers never believed Washington would go so far as to weaponize the entire world’s financial system.

However, that thinking has changed. In the space of a month the United States went from seizing $7 billion from the Taliban regime in Afghanistan central bank reserves to sanctioning Russia and freezing — according to the country’s Finance Ministry — around $300 billion of its $640 billion in gold and forex reserves.

As of January, China was holding just over $1 trillion of its roughly $3 trillion worth of foreign reserves in U.S. Treasurys, according to the U.S. Department of the Treasury. More than half of China’s reserves are denominated in dollars, according to the latest data published by the State Administration of Foreign Exchange (SAFE), which put the figure at 59% as of 2016. The wisdom of this arrangement is now the subject of much internal debate in China, and efforts to sanction-proof its financial system could have far-reaching effects on the global economy.

“We are shocked,” Yu Yongding, a prominent economist and former adviser to the People’s Bank of China, told Nikkei Asia, referring to the freezing of Russia’s reserves. “We never expected that the U.S. would freeze a country’s foreign currency reserves one day. And this action has fundamentally undermined national credibility in the international monetary system.

“Now the question is, if the U.S. stops playing by rules, what can China do to guarantee the safety of its foreign assets? We do not have an answer yet, but we have to think very hard.”

The first thing to remember is that China will continue trading with the world in USD and EUR terms. The issue is what to do with the existing stock of USD and EUR denominated assets– as well as the savings that will be generated internationally going forward.

It is impossible for China to sell trillions of USD and EUR worth of assets without destroying the global financial system. That hurts both the West and China equally and bigly. Therefore, the path of least destruction for those assets is to cease reinvesting maturing bonds back into the Western financial system. To the extent that China or its proxy State-Owned Banks can lighten up on Western equities and real estate without impacting the market, they will do so.

As I see it, there are three things China can purchase with their international fiat savings: storable commodities, gold, and Bitcoin.

Just so that you appreciate the magnitude of China’s foreign currency savings problem, please consume this snippet from a recent Michael Pettis newsletter where he discusses China’s Q1 GDP statistics.

Historic trade data

Source: Ministry of Commerce

Just as importantly, March’s imports actually contracted by 0.1 percent year on year to USD 228.7 billion, well below expectations that they would increase by roughly 8 percent. For the quarter, total imports were USD 657.5 billion, or just over 13 percent of the period’s GDP.

The result was a monthly trade surplus in March of USD 47.3 billion, which was substantially more than twice the trade surplus expected by the market. The surplus for the first quarter was $163.3 billion, equal to roughly 3.5% of GDP and the biggest first-quarter surplus China has ever recorded by a long shot, as Table 2 shows. It suggests that China is on track to run an even bigger annual trade surplus than last year’s record.

China’s multi-trillion dollar problem gets worse and worse, quarter after quarter.

Storable Commodities

This subset of stuff includes industrial metals like iron ore, nickel, lithium, etc.; storable hydrocarbons such as thermal coal and oil; and foodstuffs such as wheat, corn, rice, and soybeans. To the extent that China can pre-purchase certain commodities for the internal needs of their comrades, it makes sense to do so. The one issue with many commodities, especially foodstuffs, is that they cannot be stored indefinitely without spoilage. Also, China may lack sufficient storage facilities to house hundreds of billions of dollars’ worth of stuff onshore.

The supply chain is also an issue. Moving that amount of stuff from place to place is becoming increasingly difficult. Even if you can pay, there are just not enough ships to reroute commodities from producer to consumer given the changing patterns of global consumption. Imagine if a significant amount of Russian goods must now be re-routed by rail or ship from originally European destinations to China.

Another major issue is that producing countries may severely curtail or cancel exports of essential commodities completely. Everyone is now at the mercy of inflation– it is a daft policy to export to the world when you have dire needs at home. So, even if China is willing to buy more, there might not be willing sellers in the amounts required.

The logistical, storage, and supply / demand challenges render saving a significant portion of net international earnings in industrial commodities is likely not possible for China.

Gold

Gold is the most pristine, socially acceptable collateral when viewed over humanity’s 10,000 years of civilisation. As such, during times of distrust between flags, gold emerges as a neutral asset with which to settle trade and store surpluses. It is for that reason that this inert shiny rock is held on almost every sovereign’s balance sheet.

The world is certainly experiencing a rise of distrust between flags, and the exact structure of the next global monetary system(s) is uncertain. In light of that uncertainty, the default answer for countries with the largest “savings” problems should be to convert all net international earnings immediately into gold.

Should the gold need to be liquidated to pay for imports, countries can easily do so because every counterpart nation accepts the value of gold vs. real goods. As simple as this looks on the surface, is saving large amounts of gold feasible for China?

The first place to source gold is internally. China could consume all internal production and completely crowd out the private sector. The below table illustrates the degree to which internal production of gold can satisfy China’s current yearly account surplus.

|

China Gold 2021 Gold Production (mt – metric tonnes) |

370 |

|

Source |

|

|

Troy oz per mt |

32,150.70 |

|

Troy oz |

11,895,759 |

|

China 2021 Current Account Surplus |

$274,000,000,000 |

|

Gold / USD Exchange Rate |

$2,000 |

|

Current Account Surplus (gold mt) |

4,261.18 |

|

% China’s Surplus it Can Source Internally |

8.68% |

8.68% is a long way from 100%. Even your TikTok-corrupted brain can appreciate that ain’t going to work. And there is another larger structural problem with purchasing gold from Chinese miners. The goal of this exercise is to sell USD and EUR and receive a hard asset or commodity. Chinese miners must be paid in CNY, not USD or EUR. Therefore, from a sovereign perspective, China accomplishes nothing by exchanging USD or EUR for CNY, pushing the CNY exchange rate higher, and denting its relative pricing attractiveness of its exports vs. other countries.

The Shanghai Gold Exchange has one of the most actively traded gold futures contracts globally. However, this contract is priced in CNY, not USD. Because of that, and similar to purchasing internally mined gold, China cannot dispose of its non-CNY fiat currency in exchange for precious metal.

So, we can ignore purchasing internally mined gold and taking delivery of Shanghai Futures Exchange gold contracts as a solution to China’s savings problem.

China needs to find a willing buyer of USD or EUR fiat in exchange for gold. There are various gold contracts that trade on Western exchanges, but the COMEX contract (GCA Cmdty on Bloomie) is far and away the most actively traded. This contract is denominated in USD, which is exactly what China must convert into gold. China could purchase contracts with USD, take delivery, and then ship the gold back to China.

Let’s take this thought experiment to the extreme. Assume that China is on the other side of every short position on the GCM2 (June 2022 contract). The chart below illustrates how much gold China could hope to acquire at expiry.

|

COMEX Gold Contract GCM2 |

|

|

Troy oz per Contract |

100 |

|

Open Interest (19 April 2022) |

479,100 |

|

Open Interest (gold mt) |

1,490.17 |

|

% of China’s Current Account Surplus |

34.97% |

There are serious problems with this thought experiment. The first big issue is that the price of gold would rip higher as China tried to effectively corner the market. The next issue, which all of you gold bugs will appreciate, is whether there is enough actual unallocated gold ready to satisfy delivery. Take a look at this table, which estimates the available gold for delivery vs. the entirety of the GCM2 open interest.

|

Gold in COMEX Warehouse Troy Oz |

35,949,194.19 |

|

In mt |

1,118.15 |

|

% of Open Interest |

75.03% |

If China is 100% of the open interest, it would cause the contract to fail, as there is not enough gold in the warehouse to satisfy delivery. The exchange would declare some sort of force majeure in an attempt to wiggle out of its responsibilities – and China would not get the gold it desires.

And even if the warehoused gold equaled the open interest, unless there is magically another one thousand metric tonnes just waiting to be deposited at COMEX, there will be no ability to trade physically settled gold futures again– because there will be no gold to deliver!

If the derivatives markets cannot handle China’s flows, then China must resort to the spot market. The best course of action would be to purchase gold from large exporters. The below table lists the top 10 gold-producing nations for 2021 in metric tonnes.

|

Top 10 Gold Producing Countries (mt) |

|

|

China |

370 |

|

Australia |

330 |

|

Russia |

300 |

|

United States |

180 |

|

Canada |

170 |

|

Ghana |

130 |

|

Mexico |

100 |

|

South Africa |

100 |

|

Uzbekistan |

100 |

|

Peru |

90 |

|

Total ex China |

1500 |

|

% of China’s Surplus |

35.20% |

Suspend your disbelief and assume that all these countries would gladly take depreciating USD fiat currency that can be confiscated at will, and in return are willing to hand over all their annual production of precious gold to China. As you can likely tell by my tone, I don’t believe this would ever happen. But even if it did, it only covers an additional 35% of China’s yearly needs.

The below table is self-explanatory (source Statista):

|

If China … (% of current account surplus) |

|

|

Destroys COMEX by aking delivery |

34.97% |

|

Is allowed to buy all other large country’s gold annual production |

35.20% |

|

Total |

70.17% |

The only way China can save in gold terms is if the price of gold phase-shifts much higher, or it purchases way less gold than 100% of its annual current account surplus. How much gold China could reasonably decide to buy is a mystery, but I have shown that taken to its logical f(x): maxima, saving in gold terms does not fully solve the problem.

China used to house the majority of the Bitcoin network’s hashrate. Then, Beijing decided to ban mining, and all the miners packed up and left for other more hospitable locations.

Maybe China should revisit whether mining Bitcoin onshore is such a bad thing.

Bitcoin mining converts raw energy into a socially acceptable, digital, censorship-resistant permissionless currency. This is exactly the sort of asset China needs to acquire in exchange for the vast amount of digital, permissioned, censored fiat currencies it currency holds.

Walk with me baby …

- China has the ability to purchase hydrocarbons in the global market for USD in the billions of dollars.

- However, China does not need an infinite amount of fossil fuels to meet its economic needs, nor can China store a sufficiently large amount of these commodities.

- China could build new power plants and run existing ones harder to generate more electricity than its economy needs by a wide margin with additional hydrocarbons it purchases with USD or EUR.

- Then, China could allow the Bitcoin miners to return onshore and mine Bitcoin with the cheapest cost of electricity globally due to the vast amounts of surplus energy available.

- In return for cheap electricity and legally enforceable and protected property rights, China could then demand a hefty tax on all Bitcoin block rewards and transaction fees earned by local miners.

- In this way, China sells USD and EUR for hydrocarbons, burns hydrocarbons to generate electricity, and then stores the excess electricity in the form of Bitcoin earned from mining.

“But, but, but– centralisation!” my fellow Satoshi disciples cry. It’s a valid concern

– if executed in a vacuum, this national policy would lead to a hyper centralisation of hashrate inside of China. However, other current account surplus flags have a similar (but smaller issue) of needing a place to dump their Western fiat. If this thought experiment is sound and the idea goes viral, many flags will attempt to do the same thing at the same time. Competition will occur at the sovereign level and it will be unlikely that any one flag will centralise a vast majority of Bitcoin network hashrate within its imaginary squiggly line borders.

The other factor likely to prevent the centralisation of the hashrate in China is whether those flags that export energy wouldn’t just do this themselves. Why not restrict the export of hydrocarbons, produce more electricity locally, and mine Bitcoin instead of receiving depreciating, confiscatable Western fiat in exchange for pure precious energy? The only issue is that there are only so many semiconductor-powered ASIC mining rigs. Most rigs are produced and assembled by Chinese firms inside of China. Therefore, China currently has a natural advantage over other flags when it comes to procurement of essential hardware.

They who sell fiat first, sell fiat best. It’s now a race for the exit amongst self-interested flags.

Combo

There is no one “magic bullet” solution for the magnitude of China’s savings problem – unless, of course, China wishes to abandon its mercantilist growth model. China should likely employ a blend of all three strategies I laid out above. But don’t get confused about the “what” of China’s policy response– just have confidence that there will be a response. And in responding to its savings problem, China will accelerate the Western Doom Loop I previously described.

Remember

The Doom Loop = $1 million Bitcoin = $10,000 – $20,000 Gold

Hola Como Estas El Salvador

According to the World Bank, El Salvador ran a $121 million current account surplus in 2020. It has one of the smallest current account surpluses. At this minimum end of the f(x): what makes sense for El Salvador with respect to its savings policy?

The president of El Salvador is acutely aware that the current global monetary system is not geared towards supporting his country. One only has to look at the IMF and World Bank’s responses to its policy of accepting Bitcoin as legal tender to see the reaction of the West to a Global Southern country enacting monetary policy that differs from “best practices”.

“[The IMF Executive Board] stressed that there are large risks associated with the use of Bitcoin on financial stability, financial integrity, and consumer protection, as well as the associated fiscal contingent liabilities. They urged the authorities to narrow the scope of the Bitcoin law by removing Bitcoin’s legal tender status.”

“We are committed to helping El Salvador in numerous ways including for currency transparency and regulatory processes,” said a World Bank spokesperson via email.

“While the government did approach us for assistance on bitcoin, this is not something the World Bank can support given the environmental and transparency shortcomings.”

Similar to China, let’s walk through the same three current account savings policy options.

Storable Commodities

Given the small size of the surplus, the commodities market is perfectly large enough to absorb 100% of El Salvador’s savings. The issue then becomes figuring out where to put the stuff. The question is whether El Salvador, a very poor country, has the idle infrastructure necessary to properly store its most needed commodities.

If the country has suitable storage facilities, it is prudent to buy as much of the most-imported commodities as possible at today’s prices in anticipation of future commodity price inflation. If the country does not have suitable storage facilities, then it needs to find another asset or currency to purchase with its savings.

Gold

Buying $121 million worth of gold per year is quite easy and will not impact the global spot or derivatives markets at all. Storing that quantity – or multiples of it –onshore in physical form is easy as well. The real issue here is using that gold to make payments.

When trust in the Western bloc was high, many countries stored their gold at the major money centres of New York and London. Because most sovereigns stored their gold in the same warehouses, debiting and crediting different flags was as easy as changing a database entry. However, no flag can have conviction any longer that “their” gold will be immediately repatriated to them from the West when asked.

If you don’t hold it, you don’t own it.

To mitigate these real risks, all flags must self-custody their gold. That makes physical trading of the metal expensive and time consuming. For a large country like China, which likely deals in hundreds of billions of dollars’ worth of gold, the extra hassle is miniscule compared to the size of flag-to-flag trade. For a small country like El Salvador, though, these costs could become substantial.

Shipping or flying a few million dollars’ worth of gold around the world to pay for particular imports is expensive and takes time. In a world devoid of trust, the counterparty receiving gold in exchange for real goods will most likely want to see the gold unloaded at their port or airport before they satisfy their end of the bargain. This constraint might be relaxed if you are dealing with a large economy like China, but for the small flags it’s pay first, receive later.

Therefore, for El Salvador and small surplus countries like it, gold is easy to buy and store, but difficult and possibly expensive to use as a payment mechanism.

Purchasing extra hydrocarbons in order to store generated electricity by mining Bitcoin is definitely feasible for El Salvador. But given that El Salvador should not have too much difficulty buying and storing more hydrocarbons than it requires right now, it is dubious whether Bitcoin mining makes economic sense for El Salvador.

Bitcoin’s weightlessness is the most pertinent facet of its value proposition. El Salvador can store $121 million or $121 billion for the same cost. Payment using Bitcoin settles in 10 minutes and transaction costs are a fraction of sailing or flying from point to point.

The main issue is whether trading partners will accept Bitcoin. But even if they don’t, Bitcoin can quickly be converted into just about any fiat currency required. Bitcoin offers 24/7, censorship–resistant, affordable payment rails for small flags like El Salvador. The flags of the Global South pre-Bitcoin had no other choice but to lop percentage points off of their annual GDP in order to transact in small sizes across the parasitic Western TradFi financial system.

El Salvador and many of its low income peers send their productive youth out to the ageing West, which needs cheap manual labour. They receive income in Western fiat, and pay egregious sums to remit it back to their home countries for use by their families. Every country should study the progress El Salvador is making to offer an alternative crypto payment system.

While this is a theoretical essay on policy options at the f(x): maxima and minima, El Salvador’s sovereign balance sheet already holds Bitcoin. Not only have they made Bitcoin legal tender and integrated small-value Lightning payments throughout their economy, but their central bank is actively purchasing Bitcoin. As of January 2022, El Salvador held 1,801 BTC (Source Bloomberg).

Last I checked, El Salvador is still a functioning state that can afford to trade internationally, even though a small percentage of their foreign currency reserves are held in Bitcoin. El Salvador is the first real test case of a flag that finally started to think in its best interest and eschew the outdated and unhelpful economic policies promoted by the IMF and World Bank. I am eager to see if other small flags emulate this behaviour.

A virus spreads slowly, then exponentially. Don’t be disheartened if the pace of idea propagation appears slow at the outset. The righteous shall prevail eventually. El Salvador is the first small, but extremely important step towards denting the hold orthodox economic thinking has on global monetary policy makers.

Loopty Loop

The shock of cancelling the world’s largest energy producer from the dominant Western financial system cannot be undone. No policy maker globally can ignore the precarious nature of any funds held in Western fiat currencies and their respective assets. Therefore, the Doom Loop’s occurrence is assured. Even if the sanctions were removed today and Russia had free use of its funds once more, the mere fact that such sanctions could (and did) happen serves as a warning to never allow oneself to be put in such a situation again.

At the f(x): maxima and minima, flags will pursue a savings policy mix that includes storing commodities and purchasing gold / Bitcoin. The fact that USD and EUR assets are not part of this mix, combined with entrenched real goods / energy inflation puts the Doom Loop into motion.

The Doom Loop will usher in $1 million Bitcoin and $10,000 – $20,000 gold by the end of the decade. We must agitate for self-interested flags to save part of their current account surplus in Bitcoin so that Bitcoin farm-to-table economies sprout around the globe. Again, unlike gold, Bitcoin must move – otherwise the network will collapse.

Bear no malice towards those recalcitrant flags that refuse to learn even after hearing the good word.

As Lord Satoshi said, “Forgive them, for they do not know what they do.”

Related

The post appeared first on Blog BitMex