(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

The global elites have various policy tools to prop up the status quo, which inflict pain now or later. I take the cynical view that the only goal of elected and unelected bureaucrats is to remain in power. Therefore, the easy button is constantly pressed first. Hard choices and strong medicine are best left for the next administration.

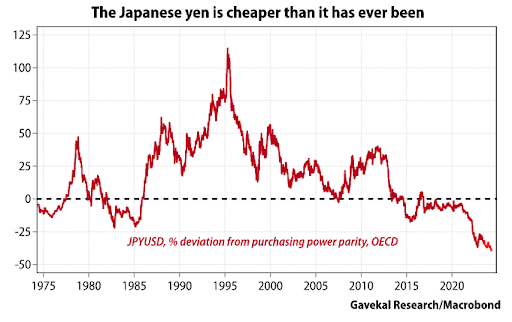

A series of extremely long essays will be needed to fully explain why the dollar-yen exchange rate is the most important global economic variable. This is my third attempt at describing the chain of events that led us to crypto Valhalla. Rather than offer a complete and comprehensive picture first, I shall do as they do. Give you readers the easy button. If the policymakers abstain from using this tool, then I know the longer, harder, more drawn-out course-correcting action will play out. At that point, I can offer you a fuller explanation of the sequence of monetary events and relevant historical perspectives.

The real “oh, they are real fucked” moment came as I read two recent Solid Ground newsletters written by Russell Napier about the lose-lose situation in which the monetary mandarins in charge of Japan and Pax Americana wallow. The most recent newsletter published on May 12th described the easy button that is available to the Bank of Japan (BOJ), Federal Reserve (Fed), and US Treasury.

Very simply, the Fed, acting on orders from the Treasury, can legally swap dollars for yen in unlimited amounts for as long as they wish with the BOJ. The BOJ and Japan’s Ministry of Finance (MOF) can use these dollars to manipulate the exchange rate by purchasing yen. By strengthening the yen in this manner, it avoids the following:

- The BOJ raises rates and, in the process, forces regulated pools of capital, such as banks, insurance companies, and pension funds, to buy Japanese Government Bonds (JGB) at high prices and low yields.

a. To buy these overpriced JGBs, these pools of capital would have to sell their US Treasury securities (UST) to raise dollars to buy yen and repatriate it. - The MOF sells USTs to raise dollars and buy yen.

If Japan Inc., the largest holder of USTs, does not become a forced seller, it helps the US Treasury continue to fund the free-spending federal government at negative real interest rates. Otherwise, the Treasury would have to initiate yield curve control (YCC). This is the ultimate destination, but it must be forestalled as long as possible because of the apparent inflationary and possibly hyperinflationary effects.

Seppuku

Who is the biggest holder of JGBs? The BOJ.

Who is in charge of Japan’s monetary policy? The BOJ.

What happens to a bond when interest rates rise? The price falls.

Who loses the most money if interest rates rise? The BOJ.

If the BOJ raises interest rates, it commits seppuku. Given its strong self-preservation instinct, the institution will not raise interest rates unless it has a solution for spreading the losses to financial players other than itself.

If the BOJ does not raise interest rates and the Fed does not cut interest rates, the dollar-yen interest rate differential persists. Because dollars yield more than the yen, investors will continue selling the yen.

To understand why a weakening yen is causing geopolitical and economic issues, let’s travel to China.

China Ain’t Happy

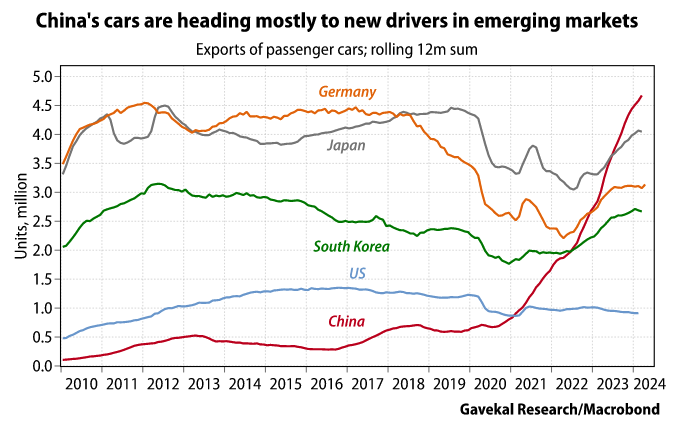

China and Japan are direct export competitors. Chinese goods are of equal quality to Japanese ones in many industries. Therefore, the only thing that matters is price. If the CNYJPY exchange rate rises (weaker JPY vs. stronger CNY), China’s export competitiveness is hurt.

Chinese President Xi Jinping no likey this CNYJPY chart.

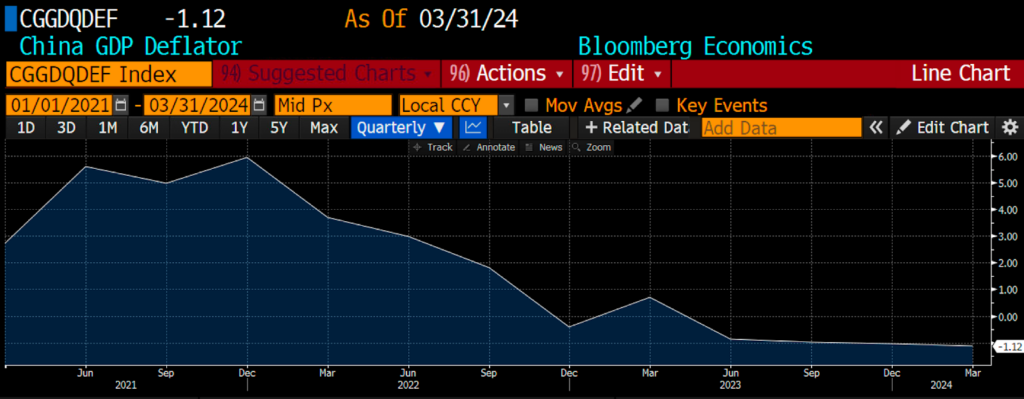

China pinned its hope of exiting deflation on manufacturing and exporting more goods.

Property = Bad

Manufacturing = Good

And that is where cheap bank credit shall flow.

As you can see, China and Japan are neck and neck in the emerging passenger auto export market. I use this as an example of global export competition. Given the volume of cars purchased each year, this is probably the most important export market. Also, the global south is young and growing; they will add more cars per capita over the coming years.

If the yen keeps weakening, China will respond by devaluing the yuan.

The People’s Bank of China (PBOC) basically pegged the yuan to the dollar with a slight strengthening bias since 1994. That is what this USDCNY chart shows. That is about to change.

China must devalue the yuan implicitly by creating more yuan credit onshore and explicitly via a higher USDCNY value so exports win on price vs. the Japanese. They must do this to fight a deflationary bust due to the bursting of the property bubble.

The GDP deflator converts nominal into real GDP. A negative number means prices are falling, which is not great for a debt-based economy. Because banks issue credit in return against asset collateral when asset prices fall, debt repayment is called into question, and its price falls as well. This is deadly, and it is why China and every other global economy require inflation to function.

Creating the required inflation is easy; just print more money. However, the Chinese monetary printing presses aren’t running hard enough. Credit, as always, is created by the commercial banking system.

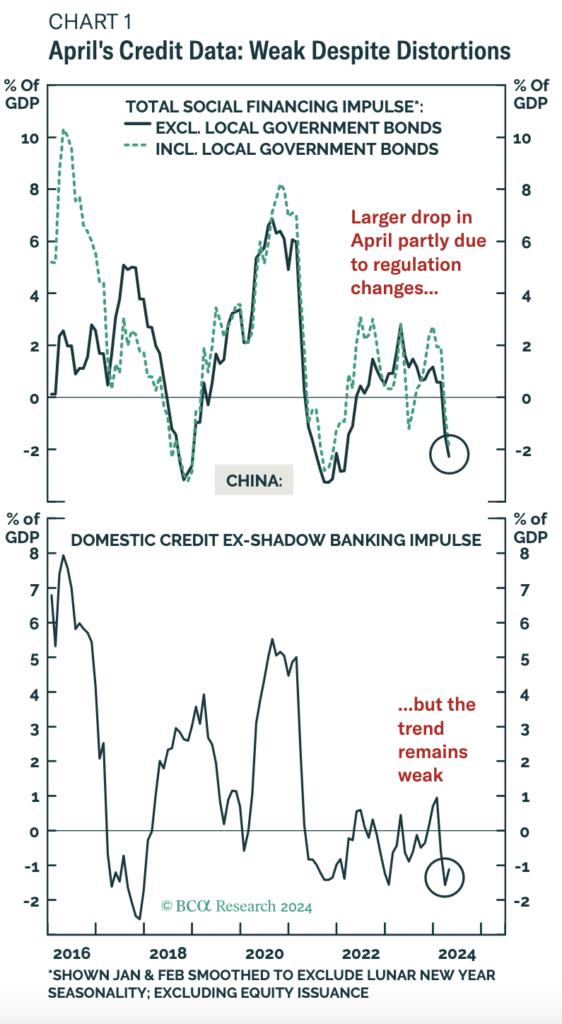

These BCA Research charts clearly show a negative credit impulse, which indicates there is not enough credit money creation.

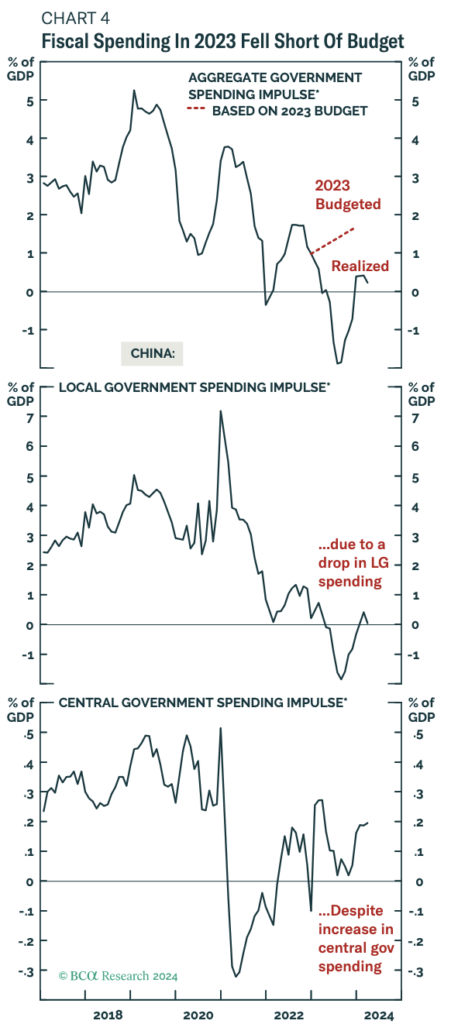

The local and central governments are also not spending enough to end deflation.

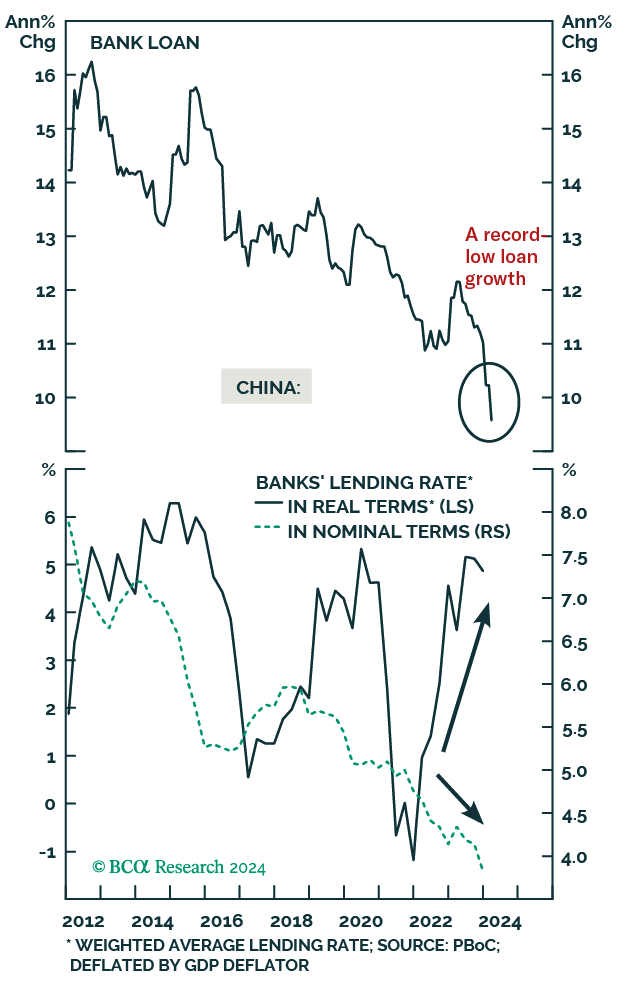

Real interest rates are positive. The growth in the quantity of money is falling, but its price is rising. Bad bad bad.

China must create more credit either via government spending or lending more to businesses. To date, China has refrained from launching bazooka stimulus programs as they did in 2009 and 2015. I believe that this is due to a well-founded fear that these domestic money creation policies will negatively affect the currency, which they, at least for now, wish to keep stable against the USD.

To create the above chart, I divided China’s M2 (yuan money supply) by the reported foreign exchange reserves. At its height in 2008, the yuan was 30% backed by foreign reserves, which mostly consist of USTs and other dollar assets. Currently, the yuan is only 8% backed by reserves, which is the lowest it’s been since data was published.

The money supply will grow even more if China ratchets up credit creation. That increases the stress on the dirty yuan-dollar peg. I believe that for domestic and foreign political reasons, China wishes to keep the dollar-yuan rate stable.

Domestically, China does not want to intensify capital flight by massively devaluing the CNY. Also, this increases import costs. China imports food and energy. When these costs go up too quickly, social disorder is not far behind. The lesson that any Marxist, especially a Chinese one, takes away from the history of revolutions is to never let the rate of food and energy inflation get out of control.

The key constituent China cares about is how Pax Americana reacts to a weakening CNY. I will get into this later, but a weak yuan makes Chinese-origin goods even cheaper. This decreases the incentives for Americans to reshore manufacturing capacity. Why would they build expensive factories and employ expensive skilled labour (if they can find it) when their final product is still not price-competitive with one of Chinese origin? Unless the US government hands out massive corporate welfare, American manufacturing firms will continue producing things abroad.

The Rust Belt No Likey

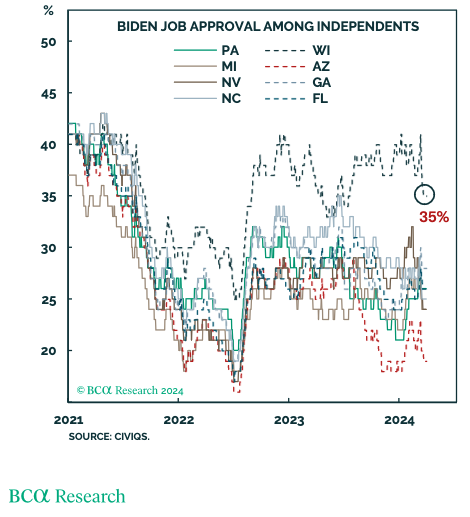

Slow Joe is getting crushed in states whose manufacturing base left for China over the past 30 years. If China devalues the yuan, jobs will continue to flee. If Biden doesn’t carry these states he loses the election. Trump’s 2016 victory came at the margin due to wins in Rust Belt states with anti-China rhetoric.

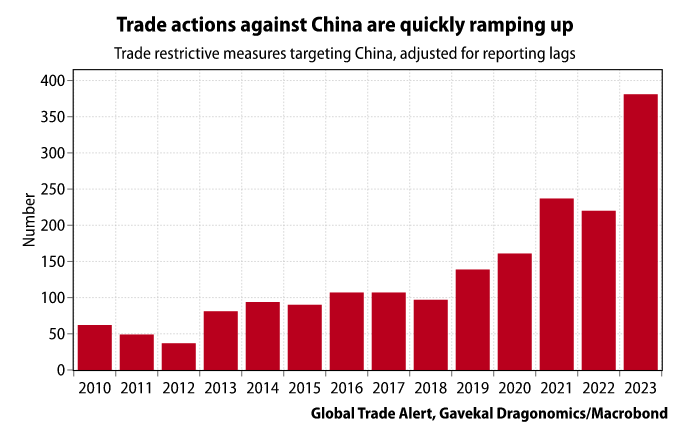

Some readers might argue that Biden’s handlers finally get the message; anti-China rhetoric and actions flow from the Biden administration more regularly. In fact, Biden just announced another raise in tariffs on various goods of Chinese origin, like electric vehicles.

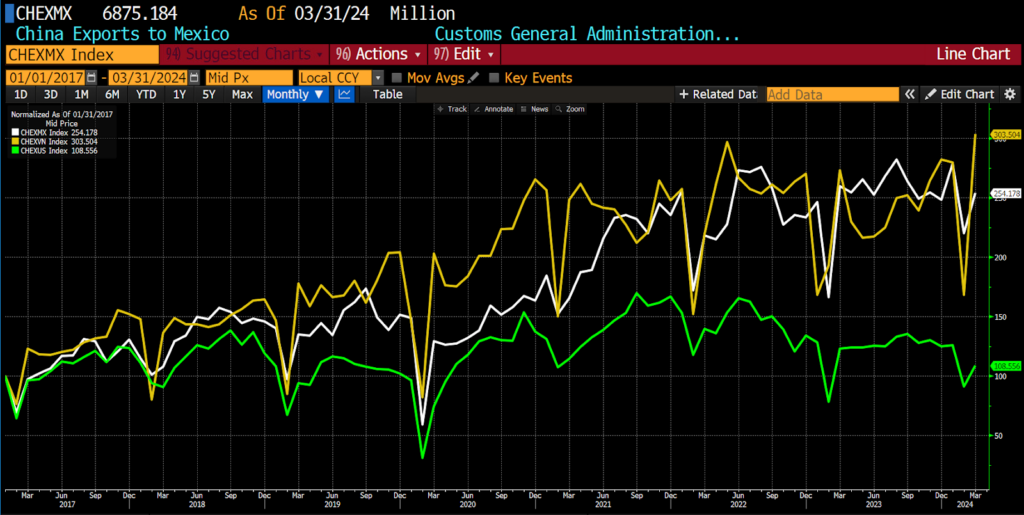

My counter is that Chinese goods don’t always ship directly from China. If the product is cheap enough, China will first export to a US-friendly country before it eventually makes its way to America. The goods are then counted as coming from another country, not China.

This is a chart of exports from China to Mexico (white), Vietnam (yellow), and the US (green). Trump’s reign began in 2017, which is the start date of this index at a 100 value. Trade between China and Mexico grew by 154%, between China and Vietnam by 203%, but rose only 8% with the US. Obviously, the value of trade with the US is dramatically higher than with Mexico and Vietnam, but it is clear that China is using these two countries as a waystation for goods to evade tariffs.

If the good is of high quality and low price, it will find its way into America. While politicians will make a big show about punitive tariffs to combat “dumping,” China can easily shift the destination of its exports around. Countries like Vietnam and Mexico would love to earn a small commission for allowing goods to pass through their borders into America.

Biden must win these battleground states to keep the Orange Man at bay. Biden cannot afford a yuan devaluation before the election. The Chinese will use this fear of electoral loss to their benefit.

The China Treat

If I were on the Chinese Communist Party’s standing committee that advises President Xi, this is what I would suggest.

China conveys the following threat to the Biden flunkies who visit Beijing. Over the past few quarters, Secretary of State Blinkin and Bad Gurl Yellen have made multiple trips to Beijing. I imagine the real meat of the conversation centred around China’s threat.

If the US does not get Japan to strengthen the yen, China will respond by devaluing the yuan vs. the dollar and exporting its deflation to the world. The deflation is exported via cheap goods produced in massive quantities.

China also pressures Yellen to enact a weak dollar policy by increasing the supply of dollars globally by whatever means necessary. This allows China to deploy bazooka stimulus again because, on a relative basis, the rate of yuan credit creation will match that of the dollar.

In return, China will keep the USDCNY rate stable. The yuan will not depreciate vs. the dollar. Maybe China even agrees to limit the amount of product it ships to America to help American firms reshore production.

If Yellen and Blinken baulked at that threat, I would follow up with the nuclear monetary option.

China is estimated to have stockpiled over 31,000 tonnes of gold. That is the sum of government and private citizens’ holdings. The Party technically owns everything in China, so I added government and private holdings together. That sum of gold is worth roughly $2.34 trillion at today’s prices. The yuan is implicitly 6% backed by gold. I divided China’s reported yuan money supply by the value of all gold held in China.

As I mentioned, China’s FX Reserves / M2 stands at 8%. The yuan is roughly equally backed by dollars and gold.

My threat would be to announce a yuan vs. gold dirty peg. Here is how China could get to that outcome:

- As quickly as possible, sell USTs for gold. At some point the US will probably freeze China’s assets or restrict the ability for China to sell all of its roughly $1 trillion worth of USTs. But I believe China would be able to sell a few hundred billion worth of USTs quickly at fire sale prices before the US politicians got their shit together.

- Instruct any SOE that holds US equities or USTs to sell as well and purchase gold.

- Declare that the yuan will now be pegged to gold at a level that implies a 20% to 30% devaluation from current levels. The price of gold in yuan terms will rise (XAUCNY goes up).

- The gold trades at a premium on the Shanghai Futures Exchange (SFE) vs. London Bullion Market Association (LBMA) fix. This causes traders to arbitrage the price by taking delivery of gold in London via long futures contracts and delivering it to Shanghai via short futures contracts. This draws gold from West to East.

- As the gold price rises globally, and physical gold warehoused at the LBMA member values declines, one or more major Western financial institutions goes bankrupt as they are caught short of physical gold. It has long been rumoured that Western financial institutions are naked short-selling gold in the paper derivatives markets. This would be GameStop on steroids, as it could bring down the entire Western financial system due to the insane amounts of leverage embedded within the system.

- The Fed is forced to print money to bail out the banking system, which increases the supply of dollars. This helps strengthen the yuan vs. the dollar.

After reading these hypothetical scenarios, readers might wonder why I believe the US is able to dictate Japan’s monetary policy. The key assumption is that by threatening the US, China can persuade the US to instruct Japan to strengthen the yen.

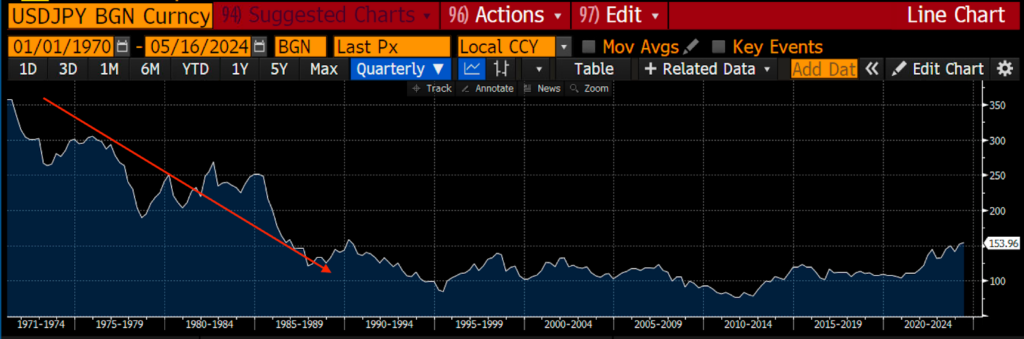

Japan routinely agreed to strengthen the yen during the 1970s and 1980s to reduce its export competitiveness against the US and Western Europe (basically Germany).

Above is the USDJPY chart. The USDJPY started the 1970’s at 350, imagine how cheap Japanese goods were to Americans in the grips of inflation at the time.

It is perfectly within Yellen’s power to politely suggest that Japan corporate strengthen the yen this time around to prevent retaliation from China.

If Japan plays ball, how will they do it? Let me illustrate why Japan cannot strengthen the yen by instructing the BOJ to raise rates and end its QE policies.

Japanese Bond Maths

I want to quickly explain why the BOJ would meltdown faster than Sam Bankman-Fried on a witness stand if they were to raise rates.

The BOJ owns over 50% of all outstanding JGBs. They essentially price-fix all bonds with a maturity of 10 years or less. They really care about the 10-year JGB rate, as that is a reference rate for many fixed-income products (corporate loans, mortgages, etc.). Let’s assume their entire portfolio consists of 10-year JGBs.

Currently, the on-the-run 10-year JGB #374 is worth 98.682 with a yield of 0.954%. Assume the BOJ raises its policy rate to such a degree that the yield matches the current UST 10-year yield of 4.48%. The JGB is now worth 70.951 or a decline of 28% (I’m using Bloomberg’s <YAS> bond pricing function). That is a mark-to-market loss of $1.05 trillion, assuming the BOJ owns 585.2 trillion yen worth of bonds and the USDJPY rate is 156.

Losing that amount of money is game over for the con job the BOJ runs on yen holders. The BOJ holds only $32.25 billion worth of equity capital. Not even crypto degens trade with as much leverage as the BOJ. Seeing these losses, what would you do if you held yen or yen-denominated assets? Dump or hedge them. In any event, the USDJPY would be north of 200 faster than Su Zhu and Kyle Davis can run from the BVI court-appointed liquidator.

If the BOJ really had to raise rates to narrow the dollar-yen interest rate differential, they would first force pools of domestic regulated capital (banks, insurance companies, and pension funds) to buy JGBs. To do this, these entities would sell their foreign dollar-denominated assets, mostly USTs, and US stonks, use those dollars to purchase yen, and then buy negatively real-yielding high-priced JGBs from the BOJ.

From an accounting standpoint, as long as these institutions are held to maturity, they will not have to mark-to-market their JGB portfolio and report huge losses. However, their clients, whose money they manage, would be financially repressed into bailing out the BOJ.

From Pax Americana’s perspective, this is a bad outcome because the Japanese private sector would sell trillions of dollars’ worth of USTs and US equities.

Whatever solution Yellen suggests to strengthen the yen, it cannot require the BOJ to raise rates.

The Easy Button

As described above, there is a way to weaken the dollar, allow the Chinese to reflate their economy, and strengthen the yen without necessitating any sales of USTs. I will discuss how an unlimited dollar-yen currency swap can square this circle.

To weaken the dollar, its supply must increase. Imagine the Japanese needed $1 trillion worth of firepower to strengthen the yen from 156 to 100 overnight. The Fed swaps $1 trillion for an equivalent amount of yen. The Fed prints dollars and the BOJ prints yen. It costs each central bank nothing to do so because they own their respective domestic currency printing presses.

Those dollars exit the BOJ’s balance sheet because the MOF must pay for yen in the open market. The Fed has no use for yen, so it stays on the Fed’s balance sheet. When a currency is created but stays on the central bank’s balance sheet, it has been sterilised. The Fed sterilises the yen, but the BOJ unleashes $1 trillion into the global money markets. Therefore, the dollar weakens against all other currencies as its supply has increased.

Because the dollar has weakened, China can create more onshore yuan credit to battle the pernicious effects of deflation. If China wants to keep the USDCNY rate unchanged at 7.22, it can create an additional 7.22 trillion yuan ($1 trillion * 7.22 USDCNY) of domestic credit.

The CNYJPY rate falls, which is weakening from the Chinese perspective or strengthening from the Japanese perspective. The global supply of CNY increased, while the amount of yen decreased due to Japan MOF purchasing yen with dollars. Now, the yen is fairly valued vs. the yuan on a purchasing power parity basis.

Any dollar-based asset rises in price. This is great for US stocks and, ultimately, the US government, as it levies capital gains taxes on the profits. This is great for Japan Inc. because they collectively own over three trillion dollars’ worth of dollar assets. Crypto booms, as there is more dollar and yuan liquidity floating in the system.

Japanese domestic inflation declines as imported energy costs fall because of a strong yen. However, exports will suffer due to the stronger currency.

Errbody gets something, some more than others, but this helps keep the global dollar system intact during the run-up to the US presidential election. No country has to make painful choices that negatively impact its domestic political standing.

To understand the risks to the US for engaging in such behaviour, first, I need to draw the equality between YCC and this dollar-yen swap boondoggle.

Same Same but Different

What is YCC?

It is when a central bank is willing to print infinite amounts of money to buy bonds to fix the price and yield at a politically expedient level. As a result of YCC, the supply of money increases, which causes the currency to weaken.

What is this dollar-yen swap arrangement?

The Fed is prepared to print infinite amounts of dollars so that the BOJ can forestall raising rates, resulting in UST sales.

Both of these policies are equivalent in the outcome; that is, UST yields are lower than they otherwise would be. Also, the dollar will weaken as supply pumps.

The swap line is better politically because it happens in the shadows. Most plebes and even patricians don’t understand how these instruments work or where they are hidden on the Fed’s balance sheet. It also doesn’t require consultation with the US Congress because the Fed was given these powers decades ago.

YCC is much more apparent and sure to arouse vocal concerns from engaged and enraged citizens.

The Risk

The risk is that the dollar weakens too much. Once the market equates a dollar-yen swap line with YCC, then the dollar kamikazes to the ocean floor. When the swaps are unwound, which will eventually happen, it will spell the end of the dollar reserve system.

Given that it would take many years for the market to force such an unwind, a politician concerned about garnering support today will support the enlargement of the dollar-yen swap lines.

Watch Out

How can you monitor whether I’m right or wrong?

Watch the USDJPY rate closer than Solana devs monitor uptime. Much closer, in fact …

The dollar-yen interest differential is not being addressed. Therefore, regardless of the intervention, the yen will continue weakening. After each intervention, pull up this webpage and monitor the dollar-yen swap line size. On Bloomberg, monitor FESLTOTL Index. If it starts to increase materially, and by that, I mean in the billions of dollars, then you know this is the path the elites have chosen.

At this point, add the size of the dollar swap lines to your handy dollar liquidity index. Sit back and watch crypto ratchet higher in fiat terms.

Wrong.com

I can be wrong in two ways.

The BOJ is changing its weak yen policy by raising rates substantially and indicating it will continue. By substantially, I mean 2% or more. A mere 0.25% rate hike won’t dent the 5.4% interest rate differential between the dollar and yen.

The yen continues to weaken, and the US and Japan do nothing about it. China retaliates by devaluing the yuan against the dollar or pegging it to gold.

If either of the above scenarios occurs, it will ultimately yield to YCC in the US in some form, but the path to YCC is complicated. I have a theory about the sequence of events that takes us from here to there, and I will publish a series of essays on the journey if necessary.

Timing is Everything

The market knows the yen is too weak. I believe the pace of yen depreciation will accelerate into the fall. This will put pressure on the US, Japan, and China to do something. The US election is a crucial motivating factor for the Biden administration to come up with some solution.

I think that a USDJPY surge towards 200 is enough to put on the Chemical Brothers and “Push the Button.”

This is the lite-version of why all crypto traders must constantly monitor USDJPY. I am confident the clown brigade in charge of Pax Americana will take the easy way out. It just makes political sense.

If my theory becomes reality, it is trivial for any institutional investor to buy one of the US-listed Bitcoin ETFs. Bitcoin is the best-performing asset in the face of global fiat debasement, and they know it. When something is done about the weak yen, I will mathematically guestimate how flows into the Bitcoin complex will ratchet the price to $1 million and possibly beyond. Stay imaginative, stay boolish, now is not the time to be a cuck.

Related

The post appeared first on Blog BitMex