On a day when the rest of the cryptocurrency market is trading in red, IOTA investors are bagging profits as the 18th largest coin recorded an incredible daily 10% increase in the last 24 hours, which completes almost 40% price gain in the past seven days.

And if you were wondering, IOTA had seen more than 100% increase since the new decade. At the time of writing, IOTA has slightly retracted and is trading at $0.338 with a market cap of approximately $941.5 million.

IOTA-USDT (Binance) 30-days overview, Source: TradingView

For one thing, fundamentals like positive news have a way of impacting the performance of a coin in the crypto industry, and that seems to be the case of IOTA. The recent surge in price could be tied to several positive recent IOTA news and developments, including Bittrex listing and the increased adoption rate from a surprising direction.

IOTA Chrysalis MainNet Upgrade

The project announced earlier today that they would be adding new features to the mainnet through a planned upgrade called Chrysalis. According to the official project blog, “the objective of the IOTA Foundation is to fully optimize the IOTA mainnet pre-Coordicide and offer an enterprise-ready solution to our ecosystem.”

Although a “chrysalis” is a quiescent insect pupa, especially of a butterfly or moth, in the IOTA, it is the mainnet’s intermediate stage before the completion of the coordicide, a function known as the death of the Coordinator. With the coordicide, IOTA will be able to function without a central coordinator. This chrysalis upgrade, on the other hand, will help to improve the usability of IOTA’s current mainnet before the coordicide becomes fully active.

IOTA For Automating Commercial Processes

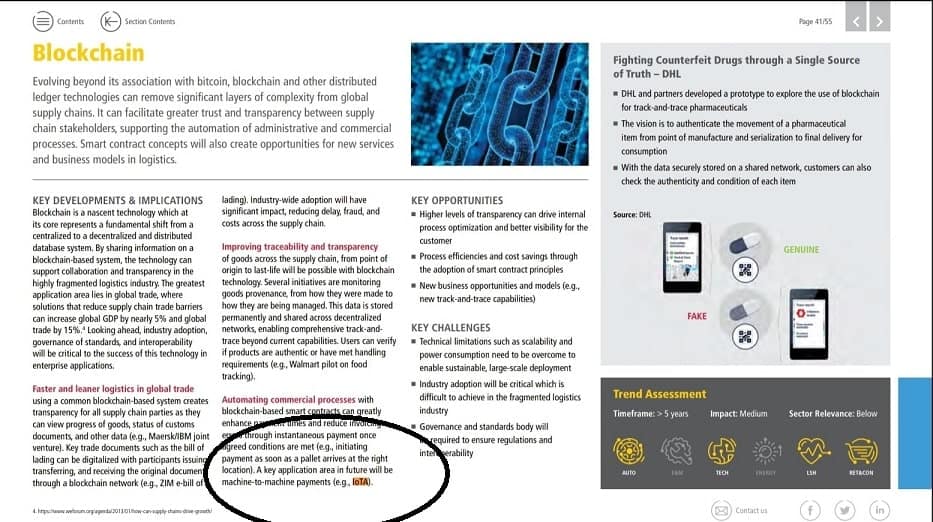

Talking about mass adoption, DHL, one of the world’s leading logistics companies, mentioned IOTA as a blockchain-based tool that will be valuable in the future for automating industrial processes in the supply chain.

“Automating commercial processes with blockchain-based smart contracts can greatly enhance payment times and reduce invoicing errors through instantaneous payment once agreed conditions are met (e.g., initiating payment as soon as a pallet arrives at the right location). A key application area in future will be machine-to-machine payments (e.g., IoTA),” according to DHL.

DHL on IOTA. Source: DHL Logistics

IOTA Listed on Bittrex Global

Perhaps, the announcement that Bittrex Global had initiated the listing the IOTA native token (MIOTA) for trading activities has a significant effect on the coin’s recent price jump. Bittrex is one of the reputable exchanges in the cryptocurrency industry, and adding support for IOTA is a significant milestone for the IOTA community.

Although, for the time being, Bittrex is only offering the BTC/IOTA trading pair, the listing shows the progress of the project and its token.

But Not Everything Is Blooming

Despite all the positive news, trouble seems to be brewing as the board members of the IOTA project are having a conflict of interest.

Sergey Invancheglo, one of IOTA’s co-founder, plans to take legal actions against David Sonstebo, who is another co-founder of the project and also the CEO, over a dispute involving 25,000,000 MIOTA (about $7.7 million) funds that seemingly related to JINN Labs.

I notify the #IOTA community that I no longer work with David Sønstebø and am contacting my lawyers to get my 25 Ti from him. He refuses to transfer the iotas to make me act for his own benefit and against mine.

— Come-from-Beyond (@c___f___b) February 2, 2020

JINN Labs is a computer hardware firm that was founded by both Invancheglo and Sønstebø in 2014, just a year before the IOTA project was initiated.

According to Invancheglo, who left the IOTA foundation almost a year ago, CEO Sonstebo has refused to transfer the funds to his wallet. Invancheglo further accused David of embezzlement, while requesting that the CEO should resign from his position.

The post appeared first on CryptoPotato