One of the most significant cryptocurrency fraudulent projects from the past few years recently tried to launder another 13,000 bitcoins. To do so, the perpetrators used numerous mixing services. Shortly after, the price of Bitcoin plunged by $500 in a matter of hours, and the question remains if this is the reason behind the drop.

PlusToken Laundered 13,000 BTC

According to the crypto Analyst ErgoBTC, PlusToken deposited approximately 13,000 bitcoins directly to mixing services in the past 24 hours.

Bitcoin mixing refers to services that allow users to mix their coins with other coins, so then it enhances privacy and eliminates the option to trace them using block explorers’ transparency.

The mixers are exchanges with no KYC. Once the users send Bitcoins or other cryptocurrencies to the mixer, they will get other coins in return, incoming to different wallet addresses. Mixers can mix Bitcoin for Bitcoin, and also Bitcoin in exchange for other cryptocurrencies, i.e., sending Bitcoin for Ethereum. Due to the above reason, mixers are considered illegal activities and often related to the Darknet.

~13k in new PlusToken mixer deposits in last 24 hrs.

Almost all previous mixer deposit change has entered mixing, confirming my theory.

Distributions still on/off. Much slower than September and November.

New report and full sit rep imminent. pic.twitter.com/vwrBuVk272

— Ergo ∴TxIDs Or It Didn’t Happen∴ (@ErgoBTC) March 6, 2020

Bitcoin was trading at about $9,100 at the time of the mysterious transaction. Consequently, the 13K BTC had an estimated value of over $118 million.

The analyst added that the team behind the fraudulent PlusToken have been selling on and off their digital assets since August 2019, in batches. Yet, they have slowed down recently.

The alleged perpetrators appear to be splitting the most substantial quantities into smaller portions so they could more easily dispose of their digital assets.

Not long ago, in December 2019, there was another transaction from the PlusToken to an unknown wallet, which could easily be a mixing service destination. The transaction was worth $105 million at that time, and unlike the current incident, Ethereum tokens total of 790K ETHs were involved.

The December Ethereum sale hurt the cryptocurrency market. In the following hours, the total market capitalization plunged with over $12 billion.

Bitcoin Price Plunges

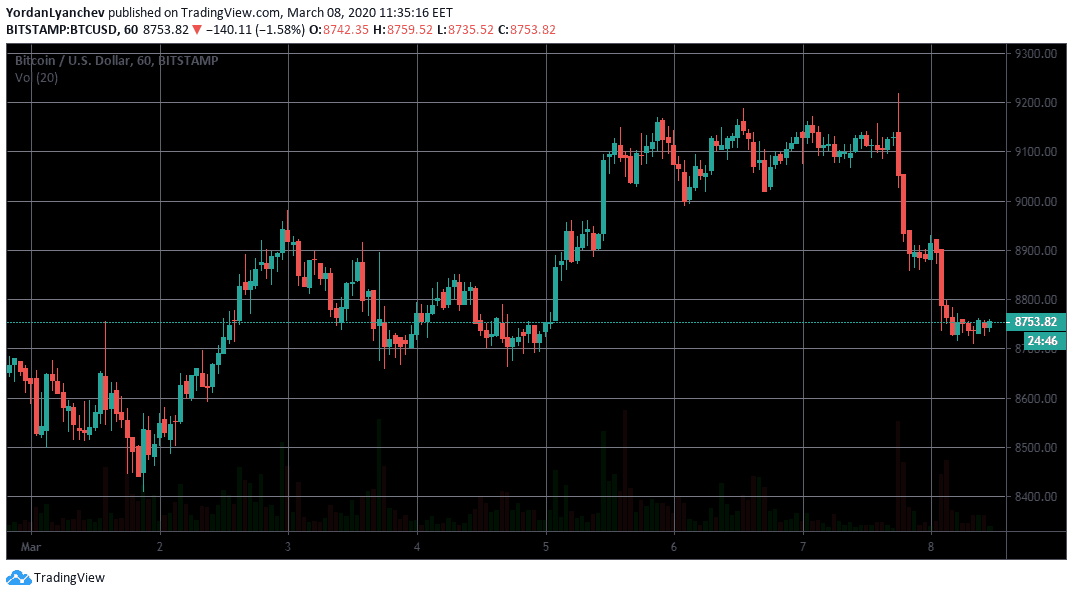

Similarly, the effect after yesterday’s supposed Bitcoin disposal is identical. In a matter of hours, the total market cap dropped by over 5%, causing the Bitcoin price to loose over $500 of its value intraday, ranging from a daily high of $9,200 to below $8,700 (as of now).

Most altcoins, or alternative coins, followed the same footsteps. Ethereum and Litecoin are down at around 6% to $230 and $59, respectively. Tezos and Binance coin record the most significant declines among the top 10 currencies. XTZ plummeted with 9% and currently trades at $2.92, while BNB is down with $8% to below $20.

Nevertheless, it’s not confirmed if yesterday’s negative price actions are strictly related to the PlusToken alleged money-laundering. With that being said, though, some members of the community strongly believe it’s true, as it’s not an isolated occurrence.

The post The Reason Why Bitcoin Price Crashed $500? PlusToken Scam Moved Another 13,000 Bitcoins Worth $118 Million appeared first on CryptoPotato.

The post appeared first on CryptoPotato