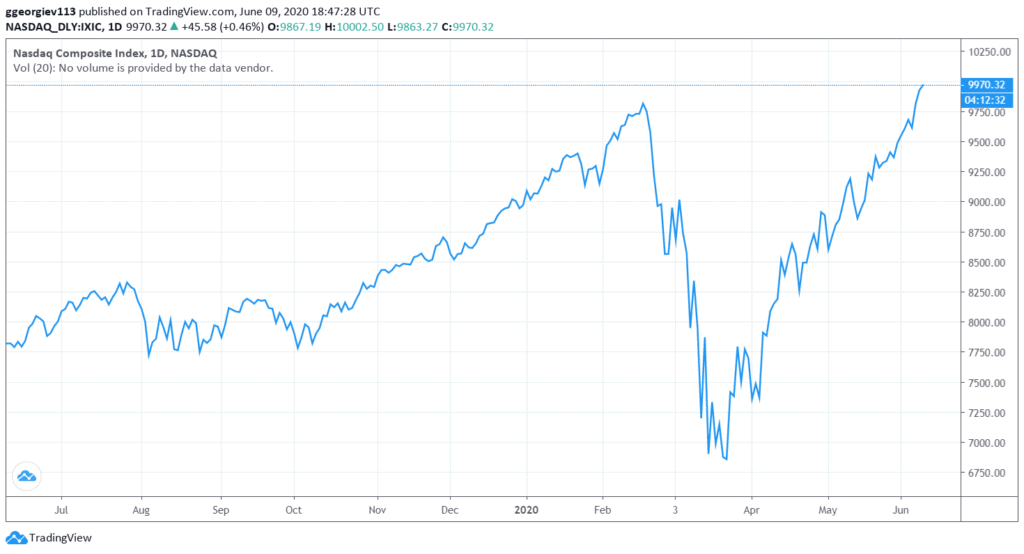

The Nasdaq Composite reached an ATH today, propelled mostly by large technology stocks, even while Bitcoin hovered below $10,000.

NASDAQ HITS ALL-TIME HIGH!

— Donald J. Trump (@realDonaldTrump) June 9, 2020

Nasdaq Erases Previous Losses

Today, the Nasdaq erased Coronavirus losses to seize a new record with the index led by the likes of Apple, Microsoft, Amazon, Alphabet, Netflix, and Facebook, which have driven a surge of 45% since last March. The Nasdaq Composite hit an all-time high today, breaching 10,000 for the first time. It has retraced a bit since then.

Firms like Hertz Global, a U.S.-based car rental company, also surged by almost 1000% in two weeks even after filing for bankruptcy as the S&P 500 is also recovering steadily.

Somewhat ironically, all of this happens as the environment in the US seems questionable at best. The words of prominent Bitcoin proponent Anthony Pompliano described it best.

It took a pandemic, an economic shock, and social unrest in all 50 states for the Nasdaq to finally break 10,000

— Pomp 🌪 (@APompliano) June 9, 2020

And yet, looking at a summarized heatmap showing the performance of the stock price of companies from the S&P 500 for the last week, it’s evident that legacy markets are having a significant run-up. At the same time, the NASDAQ Composite completed a textbook V recovery pattern.

Bitcoin Uncorrelated With Broader Stock Market

Bitcoin has failed to break $10k decisively even though it did surpass the $10k market price the first two days of June before retreating lower. Some reports showing mining-related data indicate that Bitcoin miners are in an accumulation phase.

However, data from Bloomberg, which formulated the DVAN Buy and Sell Pressure Indicator, showed that BTC fell below a critical trend line for the first time since last May, suggesting that the coin may be forming a new selling pattern. Bitcoin sees resistance at $10,000, and any drop will likely first test $9,500 according to the report.

For the most part, Bitcoin prices have not been able to successfully close above the $10,000 level despite the ATH of various stock market indices, signaling the decoupling of the two asset classes in terms of correlation.

The entire market is particularly indecisive over the past seven days as most of the cryptocurrencies are either charting insignificant gains or slight losses.

As it’s often the case, however, after prolonged periods of consolidation, the market usually takes a violent swing, and we might not be far from that moment.

The post The V Is Done: NASDAQ Surges To A New ATH As Bitcoin Struggles Below $10K appeared first on CryptoPotato.

The post appeared first on CryptoPotato