As 2024 comes to a close, excitement in the crypto market is reaching a fever pitch. Investors are honing in on five altcoins with the potential for huge profits. Ready to discover which digital assets could turn investors into millionaires? Let’s take a closer look.

Toncoin (TON): The Rising Star

Toncoin (TON) is making waves for more reasons than we can write. Currently priced at $6.64, TON has given its early investors a massive 1500% return. What is driving this momentum? Toncoin’s total value locked (TVL) has skyrocketed by 5,625.76% since the start of Jan 2024 till its peak at July end. This shows the growing confidence of the crypto community in the TON ecosystem.

The play-to-earn game Notcoin within the TON ecosystem has also helped in boosting its demand. The Open Network team is funding and incentivizing dApp developers, fostering market engagement and adoption. Toncoin’s transfer volume ranges between $5 billion and $10 billion, achieving about 10% of Bitcoin’s capacity. The number of Toncoin holders surged to 32 million. A recent all time high price, driven by capital inflow from Bitcoin and Ethereum, along with a large whale purchase, has boosted user acquisition.

Avalanche (AVAX): Scaling New Heights

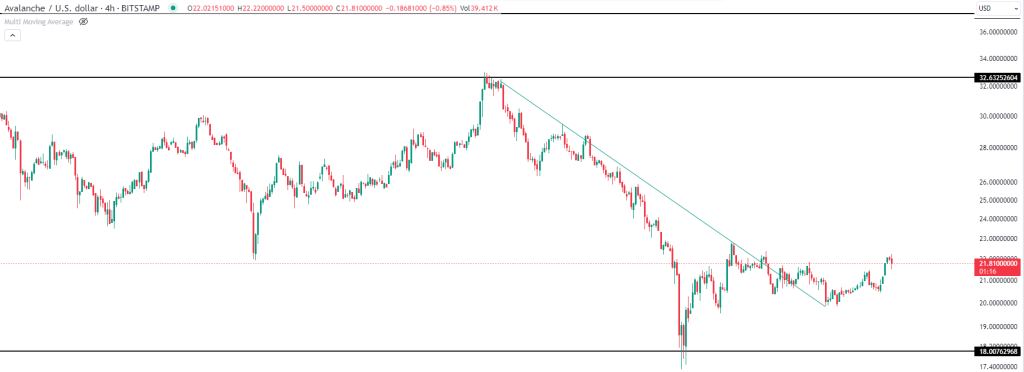

Avalanche (AVAX) is another altcoin getting attention due to its high utility. Currently trading around $21.90, AVAX’s price surge is due to institutional interest and on chain activity. Avalanche has partnerships with JP Morgan and Citi for real world asset tokenization.

The launch of Firewood, a blockchain database system, addresses scaling issues and makes the network more efficient. With great trading volume on its decentralized exchanges, Ava Defi ecosystem is growing rapidly. All because of unique tokenomics, including dynamic fees and a token burn mechanism, increase the value of AVAX, making it attractive for long-term growth.

Solana (SOL): The Speed Demon

Solana (SOL), trading around $143.04, is gaining traction. The rise in on-chain activities have renewed investors’ interest causing the recent price surge. Solana has partnerships with Visa for stablecoin settlements on its blockchain.

The introduction of FireDancer, a next-gen validator client, aims to improve Solana’s performance. Solana’s DeFi and NFT ecosystems are growing rapidly. Solana’s decentralized exchange volumes and NFT sales have surpassed Ethereum’s, attracting more users and liquidity. The rise of native meme coins like Dogwifhat (WIF) and Bonk (BONK) has boosted user activity on the Solana network.

Binance Coin (BNB): The Powerhouse

Binance coin has always been the center of attention for most traders. Global crypto enthusiasts have huge faith in Binance, hence huge love for its token. As of now BNB token is trading around $563.

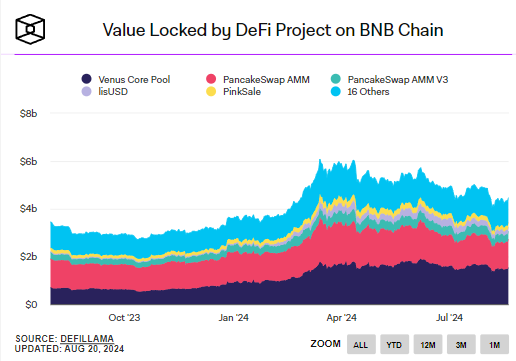

The rise in on-chain activity and increase in the total value locked on BNB Chain by 54% reaching $4.48 billion shows growing user base and engagement. The introduction of advanced Miner Extractable Value (MEV) solutions on the BNB Chain has optimized transaction efficiency and reduced costs. The BNB Chain DeFi ecosystem is growing by attracting more users and liquidity.

Aave (AAVE): The DeFi Leader

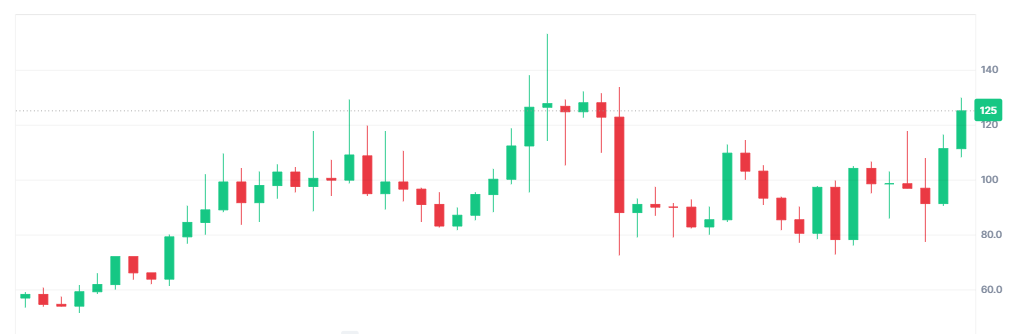

Aave is currently trading around $126.66. The introduction of improvements in Aave V3, like enhanced cross chain functionality, optimized gas fees, and increased security measures brings investors’ confidence. The total value locked in Aave has surged to $11.679 billion.

The native stablecoin of Aave, GHO is providing a decentralized and stable medium of exchange within the ecosystem. This has boosted user activity and interest in the platform.

Looking Ahead

Once Bitcoin breaks the bonds of resistance, altcoins will follow. The five alts we discussed have a very strong fundamental which makes them the best investment for great returns. Stay curious, dive into the details and you might just find your next big investment opportunity. Always keep in mind that this is not financial advice. The details provided are for educational purposes and you should always do your own research. Altcoins are more volatile that Bitcoin.

The post appeared first on Coinpedia