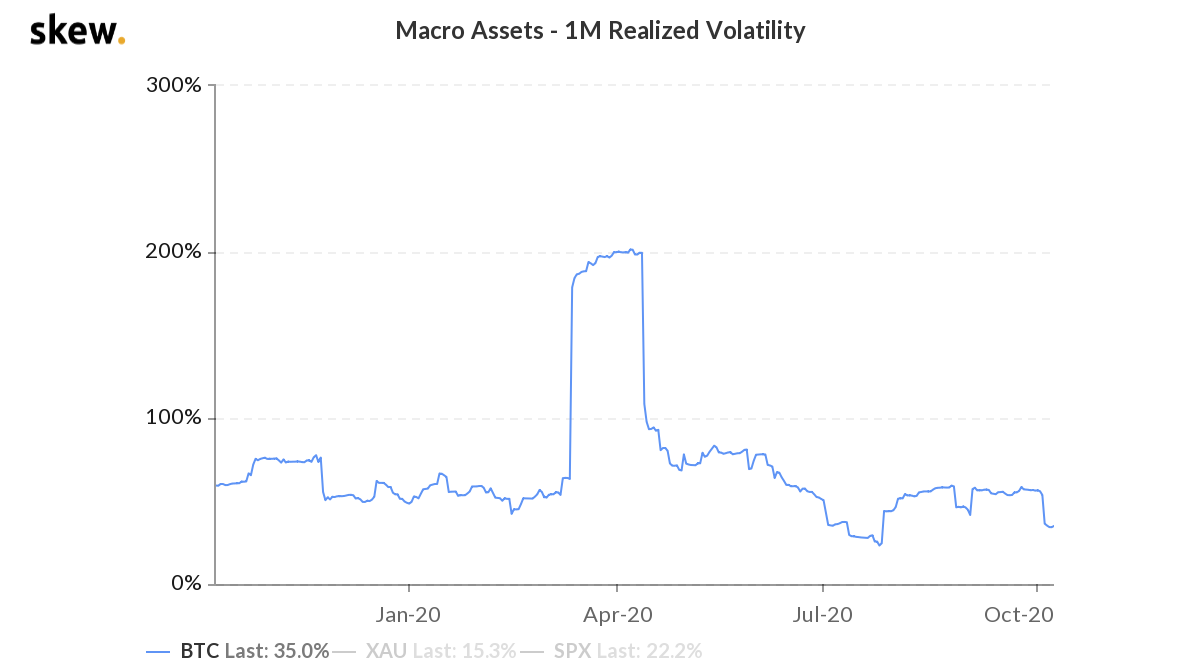

Bitcoin, the world’s largest cryptocurrency, seemed to be on a bullish trajectory yet again, at the time of writing. This, despite the fact that for long, BTC has been accused of being either too volatile or moving too sideways. While the analysis drawn out over the past few months has alternated between derivatives impact, on-chain metrics, and traditional stock correlations, the one thing that has remained common is the essence of unpredictability. Uncertainty, ergo, seems to be the only constant in the BTC market.

Binance’s September trading report recently noted that over the past few years, whenever Bitcoin has gone on a bull rally, there has been some sort of correlation with the traditional market. However, in 2020, the tables seemed to have turned a bit since Bitcoin mirrored Gold more than anything else.

Source: Trading View

The same can be observed by checking out the chart attached herein, with the same revealing that in 2020, Bitcoin relied on a healthy correlation with Gold, more than any other asset. In fact, every time Bitcoin has rallied higher in the past 9 months, the correlation with Gold has indirectly played a part, with both assets registering high levels of correlation. The importance of this fact is fairly high at the moment because Bitcoin and Gold have a negative correlation, according to recent data. At press time, it was continuing to dip, falling to -26.6%.

Now, with Bitcoin eyeing another breakout, the falling correlation with Gold suggests it needs to trigger its own rally.

So, is Bitcoin’s $11,000 crossing in trouble?

While trouble is a heavy word to throw around, temporary might fit the bill. However, it is temporary in the sense that Bitcoin might not have a strong base to consolidate on if it actually rallies over the next few days. It is possible that the recent bullish wave might have been kickstarted after Square bought $50 million into Bitcoin as a capital investment. That being said, MicroStrategy’s $500 million-splash hardly made a dent, so who really knows?

As mentioned above, Bitcoin’s price has a sound whiff of unpredictability at the moment, and one of the things that might activate BTC’s rally right now is a declining U.S dollar, with the fiat currency continuing to face huge selling pressure in the larger market.

While many speculators would pin it on high volatility for the imminent/expected rally, it may be too soon to confirm so. Hence, keeping all the factors in mind, eliminating Gold-BTC correlation, derivatives impact, and volatility, Bitcoin’s current rally is certainly on its path to another period of uncertainty.

The post appeared first on AMBCrypto