The crypto-verse has born the thwarts of the turbulence over the past 24-hours. Wherefore, at press time, the market capitalization of the business has dropped close to 7% around the clock. That now has left the numbers hovering around $1.76 Trillion. The consequences of the torments have been evident with the market leader Bitcoin. Which has shed ~8% in gains, and is presently trading at $36,438.70.

On the other hand, Ethereum is currently changing hands at $2,745.78, with losses accounting for 7%. The catalysts behind the plummet are adjudged to be options expiry, manipulation of price, long liquidations and stock market correlation. Successively, the fear and greed index has needled down to extreme fear, at a score of “22”.

Where Are The Funds Flowing?

According to Glass Node Alerts, BTC’s number of exchange withdrawals (7D MA) has hit its 1-month high of 1,944.214. Conversely, BTC’s realized cap has also reached a month low. Meanwhile, the transaction volumes (7 D MA) hit a 7-month high. And the number of addresses received from exchanges (7 D MA) has reached a 1-month high of 1,889.792.

Over the past 24-hours exchanges saw total liquidations worth $428.88 M. Out of which $368.38 M were longs and $60.5 M were shorts. Coming to Bitcoin, the previous day accounted for $16.01 M worth of longs on Binance. $20.46 M worth of longs on FTX, and $83.36 M worth of longs on OKEx.

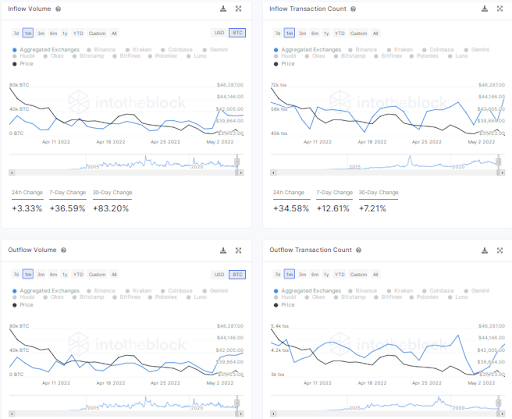

Learning from the analytics platform, Into the Block. The inflow volume of BTC on aggregated exchanges has been on a slide, since the start of the month. At present, the numbers stand at 33.89k BTC. The count of inflow transactions on aggregated exchanges has shot up to 66.6k Txs over the past 2-days. Whilst Binance recorded 33.35k Txs, Coinbase scripted 21.24k Txs.

The outflow volumes have also spiked up, since the start of the month. The count on aggregated exchanges now hovers around 39.7k BTC. The trajectory is similar in the case of outflow transaction count. The numbers on aggregated exchanges now stand at 4.64k Txs, of which Binance holds the lion’s share at 3.02k Txs.

Where Could BTC’s Price Head Next?

Just the previous day, Bitcoin had broken out from its descending wedge pattern, with assistance from a spike in volumes. The peak turned out to be a fake-out, as the BTC price. Fell for a downswing to levels around$36,000.

If the star crypto manages to construct its momentum towards $37,500, a run towards $40,302 could get validated. Conversely, if it fails to establish an uptrend, then the support at $34,091.99 could be on the cards.

Summing up, this weekend remains crucial for Bitcoin as well as for the broader industry. As it would be detrimental to the price projections of the assets. That said, we can expect the business to be volatile for the short term before the bulls embark on their shopping frenzy.

The post appeared first on Coinpedia