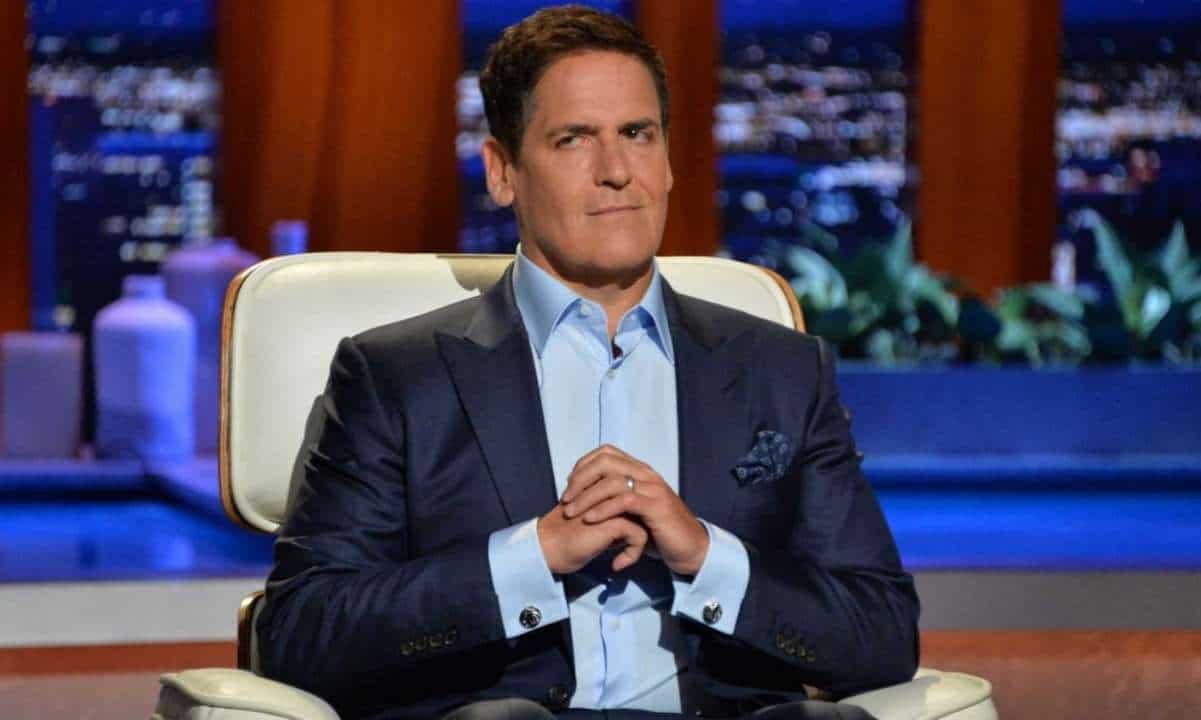

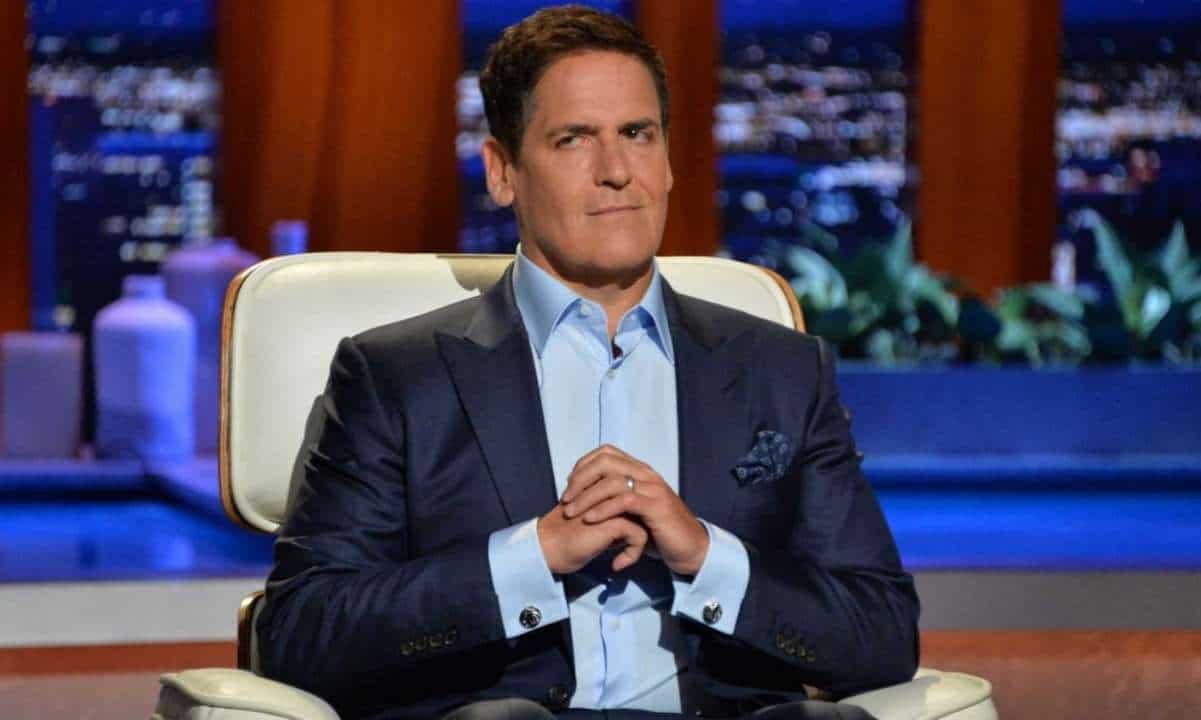

Billionaire tech investor Mark Cuban fought a lengthy Twitter debate with former Securities and Exchange Commission (SEC) official John Reed Stark – a crypto skeptic who believes the promise of blockchain has “long since faded.”

While Cuban objected to his core arguments about the potential of the industry and the SEC’s role in it, he conceded that the vast majority of crypto tokens and blockchain companies will die.

Is Regulation Clear Or Not?

The debate began on Wednesday with Stark’s interpretation of recent comments from Judge Amy Berman Jackson, who is overseeing the SEC’s lawsuit against Binance.

During a hearing, the judge expressed skepticism of the SEC’s approach to resolving crypto-industry-related issues through “test case litigation” rather than through new rule-making. While an oft-cited criticism of the agency by the crypto industry, Stark determined that matters of “regulatory clarity” were “irrelevant” to Binance’s specific case.

In response, Cuban told Stark that he was “misreading” the impact of the judge’s comments. Lack of clarity in crypto does not primarily affect large enterprises but “the vast majority of crypto applications” that are small startups.

Wrong my friend, respectfully:https://t.co/HWREUPIfi0

— John Reed Stark (@JohnReedStark) June 14, 2023

ADVERTISEMENT

“So when the judge says it’s hard for her to fully understand or grasp the rules, she reflects what all small start-up entrepreneurs feel when they want to follow the rules but don’t have a clear path there,” wrote Cuban.

Crypto industry leaders, including Coinbase, have argued for years that the SEC does not provide clear guidance on which crypto products constitute securities offerings nor how to register certain products. SEC commissioner Hester Peirce agrees with this assessment, as do crypto-supportive congressmen, including Tom Emmer and Warren Davidson.

Stark, however, disagreed about a “lack of clarity” in crypto, asserting that it already has “extraordinary regulatory transparency and lucidity.” Moreover, he claimed outright that crypto tokens lack utility beyond speculation, having failed as a store of value, investment, currency, or “revolutionary equalizer for the “unbanked.”

“Blockchain faces extraordinary obstacles to evolving into the magical financial and societal panacea that its promoters have been promising for over 15 years,” wrote Stark.

Most Firms Will Die, But Crypto Will Thrive

Cuban defended crypto for the concrete benefits it could provide and for its right to develop into a more mature technology that leaves a positive impact on the economy.

“90 percent of blockchain companies will go broke,” he said. “99 percent of tokens will go broke. Just like 99 percent of early internet companies did… But the winners will be game changers. That’s the way tech works.”

Cuban added that the SEC is not meant to decide whether or not a technology is “valid.”

After suing Coinbase and Binance last week, SEC Chair Gary Gensler aired his own skepticism of crypto’s purported use cases, claiming that the world doesn’t need more “digital currency.”

“We already have digital currency. It’s called the U.S. dollar. It’s called the euro or it’s called the yen, they’re all digital right now. We already have digital investments, he said.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato