S&P 500 stock Estee Lauder is pricey, but there may be another way for investors to play retail and capitalize on strong consumers. | Source: Shutterstock

By CCN Markets: The S&P 500 is comprised of nearly a dozen sectors, all of which traded in the green today. Leading the charge is skincare stock Estee Lauder, which is a reflection of the strong consumer that continues to keep this economy afloat. The stock is currently hovering at a new 52-week high after Estee Lauder reported stronger-than-expected earnings and provided a sunny outlook for 2020. Estee Lauder has factored in the impact from the tariffs, so any surprise to the upside on that front could unlock further gains. The timing of the earnings was also good as investors were able to focus on fundamentals while bond yields finally rose today.

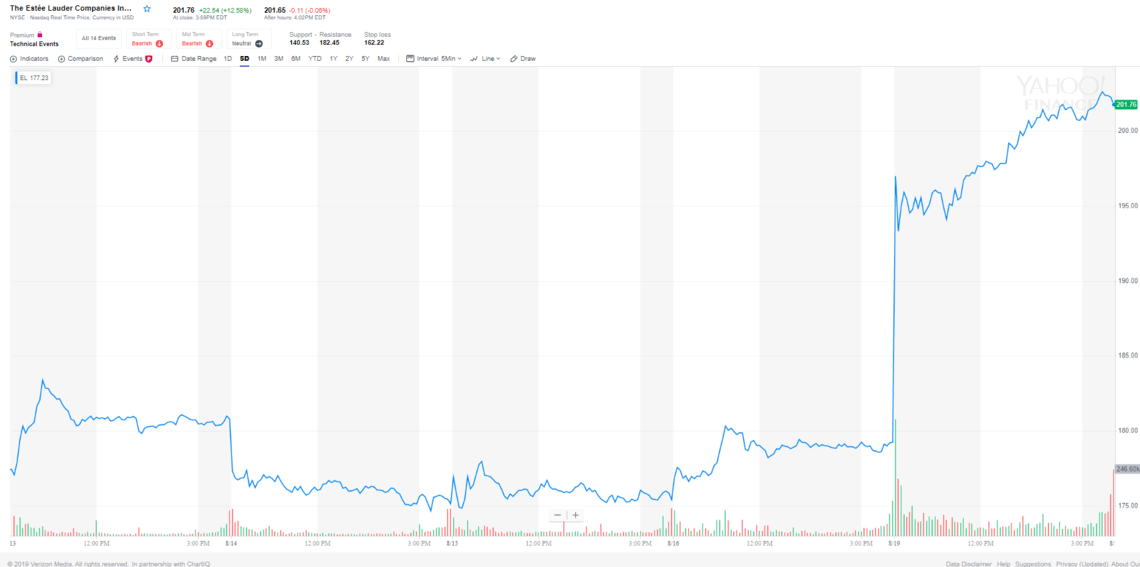

Estee Lauder’s stock was the No. 1 performer in the S&P 500 today. | Source: Yahoo Finance

S&P 500: Don’t Mess with the Bulls

The Dow Jones ended the day hovering above 26,000 to 26,136, about 800 points higher than last week’s bottom, while the S&P 500 ended 1 percent higher to 2,923. The Nasdaq was the best-performing index by increasing 1.5 percent. We won’t mention any names, but somebody sitting in Washington, D.C. is no doubt pleased with today’s performance.

When you mess with the bulls you get the horns

Old #stockmarket saying

— Deepak R Khemani (@DeepakRKhemani) August 19, 2019

Stock market bull and Fundstrat Co-Founder Thomas Lee is reminding investors to “buy the dip.”

Fyi. This tweet below adds to factors supporting a sustained rise in stocks…https://t.co/Ta3ViKk1Ik

— Thomas Lee (@fundstrat) August 19, 2019

Mighty Consumer the Rock Star in this Stock Market

Last week, we learned that July retail sales outpaced expectations by more than 2:1, with companies like Amazon and Best Buy having their best showing in months, MarketWatch reports. Americans are working in this low-unemployment economy, and that is fueling the optimism that is leading to higher spending. Imagine what the results would have looked like if the U.S./China trade war wasn’t raging because despite today’s gains the overhang of tariffs is still holding back the S&P 500.

Estee Lauder is a dividend-paying stock that has seen its value balloon by more than 50 percent year-to-date. The stock is pricey, which should give investors pause in case there is profit-taking ahead. But consumer stocks are all the rage.

Tomorrow Home Depot is reporting earnings, and the stock is trading higher in after-hours trading. Unlike Estee Lauder, HD is trading off its highs, so if the earnings aren’t a complete disaster, there could be upside and the valuation is more reasonable. So that may be a way to play retail.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY