[Featured Content]

Tidex is a cryptocurrency exchange founded back in 2017. The platform is known for its relatively lower trading fees and for its staking options which include Tether (USDT).

The interface is comprehensive and easy to use, while the overall platform is robust and well-built.

According to CoinMarketCap, it boasts an average trading volume upwards of $3.3 million, and about 55% of it is comprised of Bitcoin. While it may not be amongst the most widely used exchanges, Tidex does have a lot to offer, and its future appears bright.

Cryptocurrency Trading Made Cheap and Simple

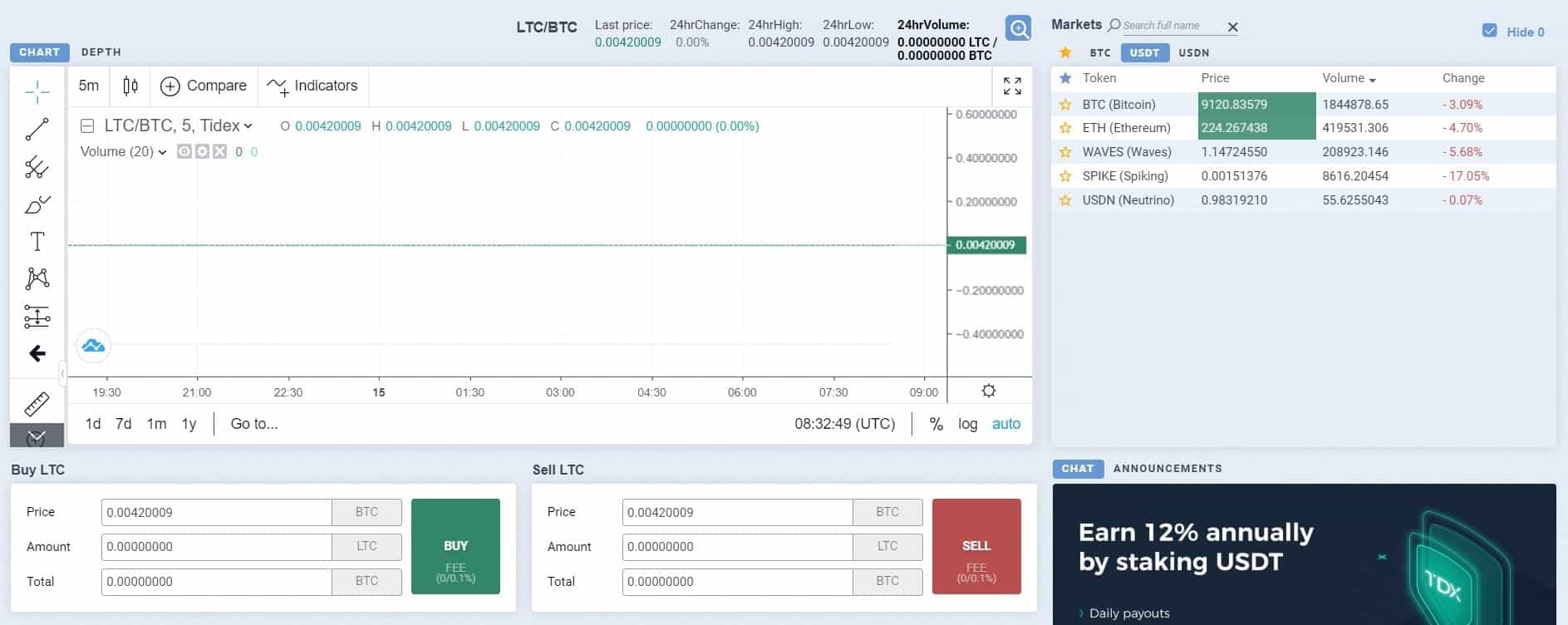

Tidex offers a very user-friendly and simplistic design when it comes to cryptocurrency trading. The platform is very intuitive and easy to use.

This is how the interface looks like. There’s a trading chart, pair selection, order placement, and chat announcements. Below are the order books where you can track the market’s depth.

Unfortunately, the selection of cryptocurrencies isn’t that substantial. At the time of this writing, you can only trade Bitcoin, Ethereum, Waves, Spike, and USDN against Tether. Against BTC, there are slightly more altcoins to consider.

However, what it lacks in variety, Tidex compensates with impressively low trading fees. Currently, market makers enjoy zero-fee trading until September. Market takers, on the other hand, pay only 0.1%

Cryptocurrency Staking

Like many other exchanges that have taken up on cryptocurrency staking, so is Tidex. Staking is the process of holding funds in a wallet to support the operations of its blockchain-based network. For doing so, users receive daily rewards.

At the time of this writing, Tidex supports both Waves and Tidex tokens for staking. An important thing to consider is that there are absolutely no fees for staking these altcoins.

Staking Waves requires a minimum amount of 100 WAVES to hold for at least one day. It brings an annualized return of 5% paid out daily.

Tidex token staking, on the other hand, requires 500 TDX held for at least a day and it also delivers a 5% annualized return paid out daily.

Interestingly enough, Tidex also allows users to stake Tether (USDT). The minimal holding period is 24 hours, and users are required to stake at least 100 USDT. The annual yield is substantially higher – it’s 12% and it’s paid out daily.

Bitcoin-Backed Loans

Another interesting thing that Tidex offers are crypto-collateralized loans. Users are able to borrow USDT using their Bitcoin as collateral.

The way it works is relatively simple. Users need to create a loan request and transfer the collateral assets to Tidex. After that, they will receive the loan, and as soon as it’s paid alongside the interest, the collateral will be returned to the borrower.

A Well-Rounded Exchange

At this point, it’s pretty clear that Tidex is a lot more than just a simple exchange. However, it’s also worth mentioning that it’s supposedly rather secure. Until the time of this writing, there’s no evidence suggesting that Tidex has been hacked, unlike a lot of other exchanges.

Moreover, the exchange offers comprehensive trading fees discounts of up to 90% for users who hold large amounts of TDX – the exchange’s native token.

In conclusion, the platform seems like a reliable one where you can trade a selected choice of cryptocurrencies against Bitcoin and Tether. You can also stake a few altcoins and USDT and receive up to 12% annualized return. And if that’s not enough, Tidex also offers BTC-backed crypto loans.

The post TIDEX: Low Fees and USDT Staking Trading Exchange appeared first on CryptoPotato.

The post appeared first on CryptoPotato