2020 is the year of DeFi. The total market value, user volume, and lock-up funds of DeFi have skyrocketed, driving the rapid rise of decentralized lending, derivatives, decentralized stablecoins, DAOs, DEXs, oracles, etc. Hundreds of projects have emerged in the market, wishing to become part of the trend. With the rapid development of DeFi and related markets, market sentiment was quickly ignited, and a large number of decentralized exchanges (DEX) are competing for the market share, which in return further push forward the development of DeFi.

What’s the current status of DEX?

The population of DeFi directly led to a sharp increase in the popularity of DEX. Since June of this year, Compound, a lending agreement in the DeFi field, has launched yield farming and its governance tokens have soared from around $18.5 to $377, an increase of more than 20 times; in July, the transaction volume of decentralized exchanges was more than 4 billion U.S. dollars, which marks the highest monthly trading volume in DEX history. Recently, UniSwap set off an upsurge of liquidity mining and liquidity pools, instantly igniting the entire currency circle. Under this environment, all new and old blockchain projects wish to connect with DEX: old projects that have been listed on CEX wanted to build an additional liquid pool in DEX; while new projects hope to debut on DEX.

Source: Hao Yang

DEX has become one of the most eye-catching areas in DeFi

Unfortunately, good times did not last long. In August, various scandals occurred one after another in the DeFi market, and liquid mining ended up in big trouble, arousing public attention and discussion. Due to the lack of censor in some exchanges, and the listed projects is a mixed bag, some DeFi token value vanished in the air, and some of the investors ended up with tears. In particular, the JustSwap incident has just become a joke in the circle a week ago, triggering great public doubt of security in the DEX market.

In addition to the long-standing problem of security, DEX also faces many other problems.

1. In terms of user experience, DEX is very different from CEX and users cannot obtain the historical price of the trading pair through the interface, so they lack a clear understanding of the current buying price in the recent price range, so they cannot perform transaction execution flexibly.

2. Due to the congestion of transactions on the DEX chain, users often have to wait for several minutes to know the final status of the transaction, ending up paying a high price (GAS).

3. In terms of risk control, most of the current DeFi applications are completed based on Ethereum contracts, resulting in congestion of the Ethereum network and the lack of mature cross-chain support for DeFi, which is not conducive to the further development of DeFi.

At this critical moment, many DEX projects are hoping to solve the problems of DEX and waiting for the opportunity to surpass the old DEXs. Among them, the most outstanding one is TitanSwap.

TitanSwap aims to become the King of Swap?

Source: Titan

TitanSwap recently released a white paper, proposing a decentralized financial center that provides the best liquidity solutions based on different “asset types”, emphasizes user-friendliness, and works as an aggregate liquidity reserve pool that supports multi-chain intelligent routing.

According to the official introduction of TitanSwap, TitanSwap aims to offer new millennials and Generation Z complete control of their financial products without any centralized custody. TITAN offers a solution for using a small number of digital assets, without the need to understand complex on-chain transactions or to have advanced financial knowledge.

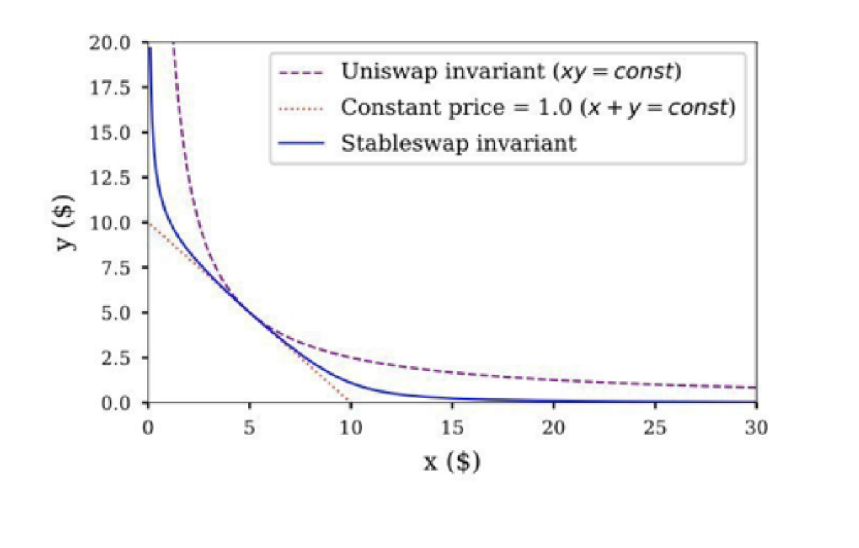

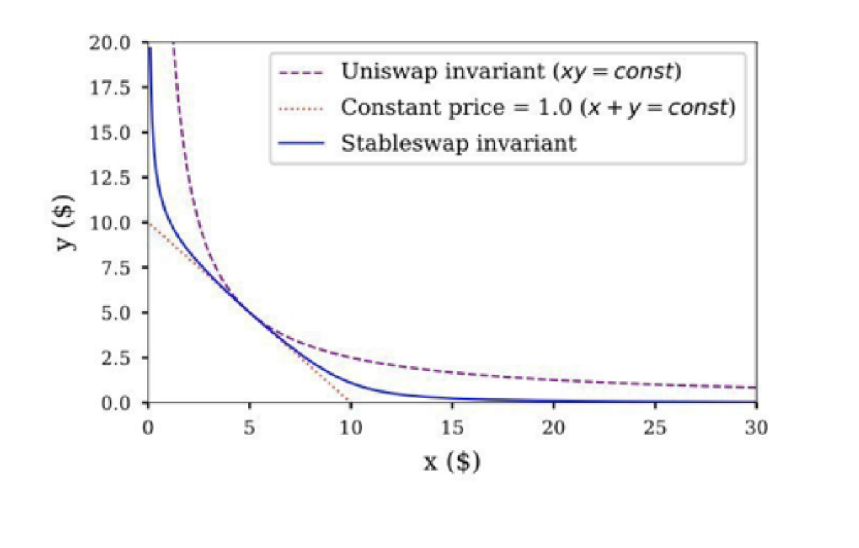

Most of the DEXs adopt the AMM mechanism, under which, the discovery of prices and the risk of liquidity providers are largely determined by the Bonding Curve. Unlike other DEXs, TitanSwap uses an Adaptive Bonding Curve to achieve a perfect combination of greater liquidity and better price discovery mechanisms for different asset types. The Adaptive Bonding Curve automatically adapts to different joint curves for different asset types, so as to provide users with the best exchange path: allowing liquidity providers to achieve minimal impermanent loss while traders can trade with smaller slippage.

Source: Hao Yang

In addition, TitanSwap will establish a liquidity pool, Titan Pool, on the Ethereum network. It is worth mentioning that the TITAN Pool will not be the only choice for TitanSwap. TitanSwap will pick the best liquidity pool according to the trading pairs and the size of the order, ensuring that exchanges can be changed under Smart Route calculation and the chosen paths which include TITAN Pool, Uniswap Pool, Balancer Pool, and Curve Pool.

Subsequently, in the second phase, Titan Smart Route will realize the orders via cross-chain smart routing with the automatic selection of multiple mainnet liquidity pools. For example, the exchange of TRC-20 to ERC20 can complete the real non-custodial cross-main chain asset exchange through multiple main chains, multiple liquidity pools, and multiple exchange steps. This will support more trading pairs and facilitate a one-stop decentralized center for financial services.

Moreover, TitanSwap adopts TITAN Layer2 Support as an optional solution, using Layer2 protocol before ETH2.0 to increase the efficiency of on-chain clearing and settlement and effectively reduce GAS consumption. At the same time, TitanSwap will support the TITAN Automated Order. TITAN Automated Order enriches the order types under the existing AMM mechanism and aggregates them through TITAN Automated Order to further improve the user experience under the non-custodial decentralized model.

Source: Hao Yang

When JustSwap is under criticism, and UniSwap is finding itself hard to solve its problem, TitanSwap is making its efforts to integrate different swaps into one. Focusing on better user experience and providing cross-chain support for DEX, TitanSwap provides creative solutions for DEX and DeFi.

Source: Hao Yang

According to TitanSwap’s Twitter account, the first version of TitanSwap will be officially launched on September 7.

Standing on the shoulders of DeFi predecessors, TitanSwap is worth looking forward to.

Disclaimer: This is a paid post and should not be considered as news/advice.

The post appeared first on AMBCrypto