The DeFi space continues to surge in popularity as the total value locked in protocols quickly approaches $7 billion. One of the protocols leading this increase is Aave.

But it’s definitely not the only thing that’s capturing the market’s attention. Elsewhere, in the field of traditional finance, the price for Tesla stocks is up more than 360% since the beginning of the year.

With this, the CEO at Aave, Stani Kulechov, has made an interesting suggestion to the chief at Tesla, Elon Musk.

Tokenize Tesla Shares?

The CEO and Founder at Aave, which is currently the second-largest DeFi lending protocol with upwards of $1.25 billion locked in it, took it to Twitter to make an interesting suggestion to Elon Musk.

Kulechov said that he’d be “excited someday to tokenize Teslas.” Now, many would think that he’s referring to tokenized company stock, which isn’t something new or in any way revolutionary. In fact, tokenized securities were at the forefront of another shortlived hype cycle known as the Security Token Offering or STO.

Aave’s CEO, however, had another thing in mind.

“I would be excited someday to tokenize Teslas, allow people to use the cars as collateral in AaveAave to borrow USDC, and spend it for affordable Mars trips. This is called DeFi, and it’s coming to improve finance.” – He said.

Of course, it’s unlikely that he’s been entirely serious about it because there are plenty of technical impossibilities for this to work.

Yet, it remains rather exciting to contemplate how DeFi can be implemented in regular people’s lives and help them capitalize on existing assets.

Tesla’s Impressive 2020

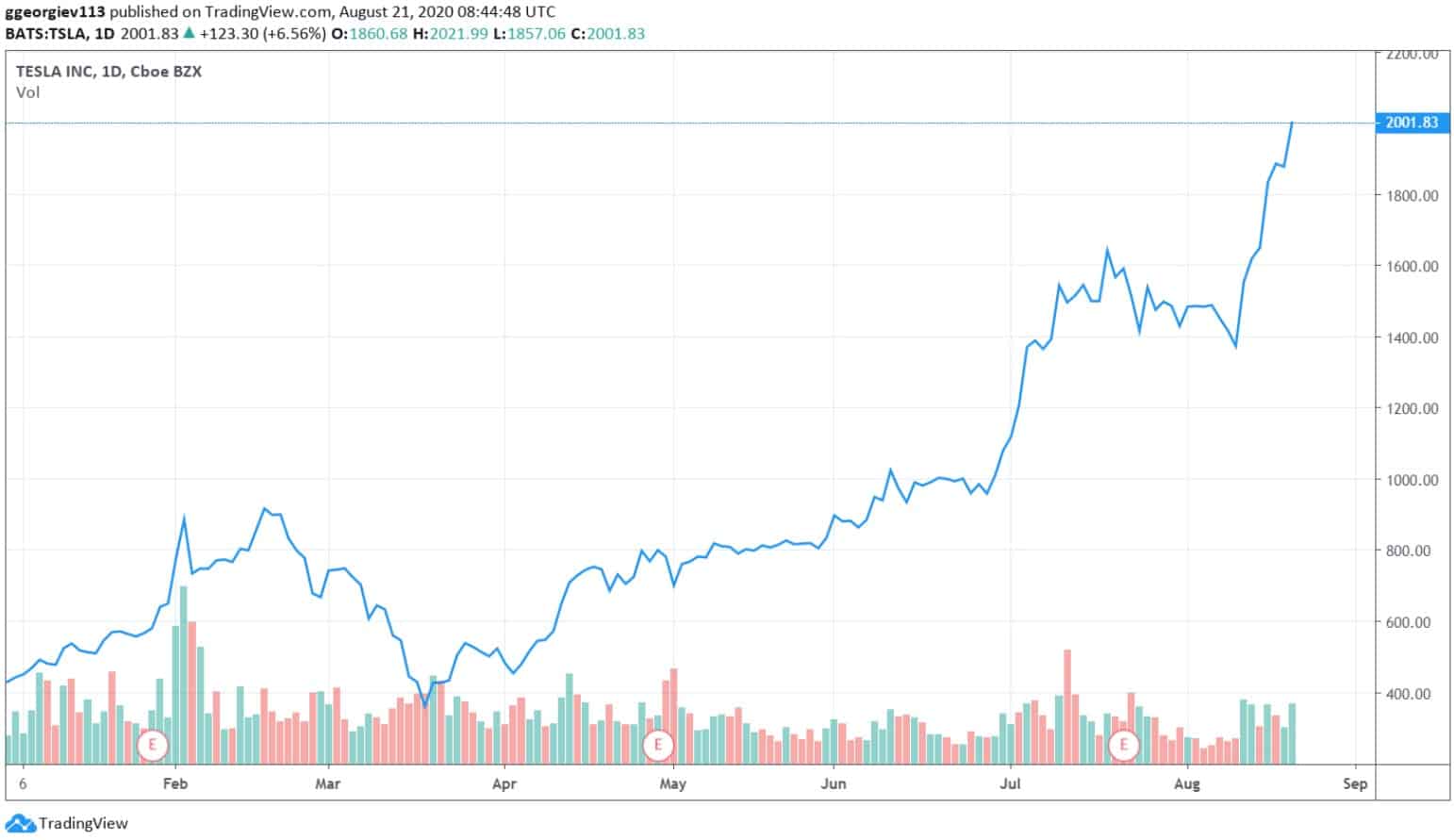

In yesterday’s trading session, Tesla (TSLA) stocks gained more than 6% and ended at $2,001.83, setting an intraday record of around $2,021.

On Wednesday, the stock slipped and put a halt to a five-session winning streak, charting 37% gains in that term.

The current run kicked off after the carmaker made it public that it will go through a 5-for-1 stock split last week.

This move aims at “making stock ownership more accessible to employees and investors.” Interestingly enough, there’s a discussion about a similar approach with one of the hottest DeFi coins right now.

As CryptoPotato reported yesterday, YFI’s community is considering a 10:1 split if the price for the asset remains higher than that for BTC for ten consecutive days.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato