Bitcoin’s price will continue trading in a tight range between $6,000 and $10,000 until the rest of the year, believes popular BTC analyst Tone Vays. He also thinks that short-term breaches above $10k are insufficient since the asset heads back down almost immediately.

BTC Between $6k And 10K

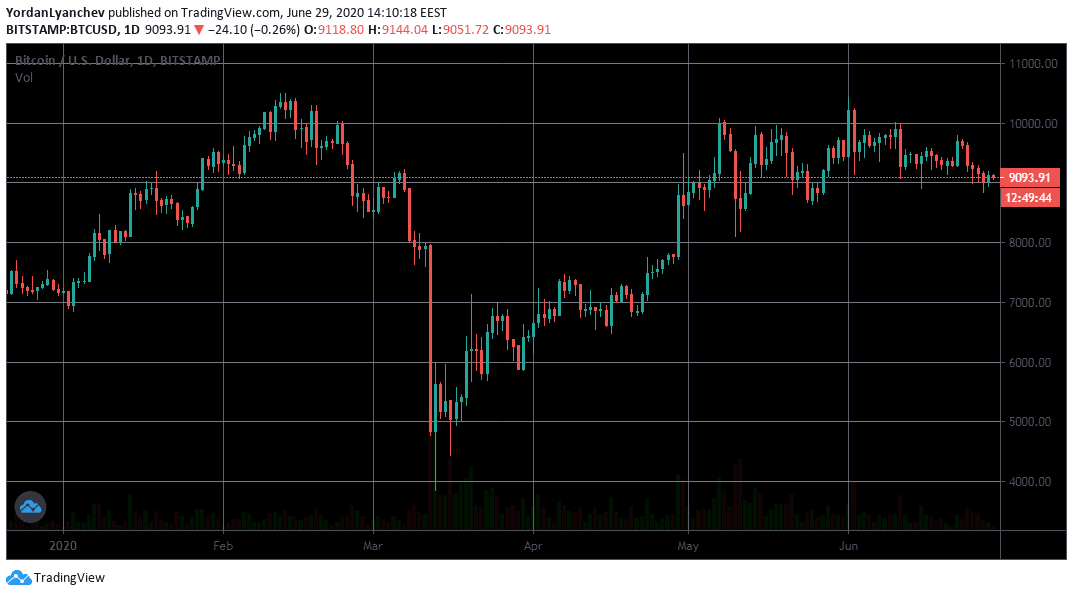

The price of the primary cryptocurrency has been on a roller-coaster since the start of the year. It entered the new century at about $7,200, but the bulls quickly took charge and spiked it to above $10,000 in February. The COVID-19 pandemic introduced itself to the Western world shortly after and inserted fear in the markets, which ultimately brought BTC below $4,000.

Bitcoin has recovered since then, and aside from a few unsuccessful attempts to conquer the coveted $10,000 mark, it has ranged between $8k and $10k for two months.

As such, the well-known commentator and analyst doubled-down on his prediction from earlier that the primary cryptocurrency will be contained in a slightly boarder range until the end of the year:

“Like I have been saying for months now, I have no reason to walk away from my prediction early in the year that Bitcoin is going to get stuck between $6,000 and $10,000 for the majority of this year.

We have spent lots of time above $9,000, but that doesn’t mean anything if we are going to pull back down towards $8,000 or $7,000.”

Gold To Go Up

Vays also joined the likes of Peter Schiff and Goldman Sachs as a believer that gold’s price will continue on its decisive run and will see new highs by the end of 2020.

“Gold should rally even if the S&P 500 starts to drop. While they both crashed in the onset of COVID-19 crash, now that investors have had time to think, I believe that they would be interested in a safe haven asset if the stock markets are going to be pulling back down once again. So I do think that gold has the potential to break the all-time high.”

He added that if the bullion indeed reaches a new price peak, it could surge “significantly beyond the $2,000 mark.” He based this quite optimistic prediction on the belief that once an asset breaks its previous ATH, especially after such an extended period, it tends to go even higher rapidly.

Additionally, if gold goes above $2,000, it will attract lots of media attention, which will lead to FOMO (fear of missing out) and people rushing in. Nevertheless, if the precious metal proceeds to $3,000, Vays claimed he will be “a huge seller of gold. I just don’t see it going much further.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato