- Tron dropped to 15th on the market cap spot but now showing strength with 5.68% gains

- The key breakout level for Tron lies at $0.022 resistance against the US Dollar

- TRX buyers show interest after remaining indecisive for about six days

Major Resistance Levels: $0.022, $0.030

Major Support Levels: $0.018, $0.016

General Sentiment

For the past few days, the entire crypto market saw a slight loss as a result of Bitcoin’s sideways movement. But now, most of the top altcoins are charging back with gains, including Tron that is now up by 7%.

Tron has dropped to 15th position in terms of market cap after being overtaken by Ethereum Classic (ETC) and most especially by Tezos (XTZ) over the past five days of trading. Nonetheless, the bulls are just regrouping back. Tron could reclaim its position if the demand continues to increase.

More so, we may need to see ETC and XTZ show a small sign of weakness. However, the next few days of actions would determine the line of action for the overall TRX trading

Tron Price Analysis

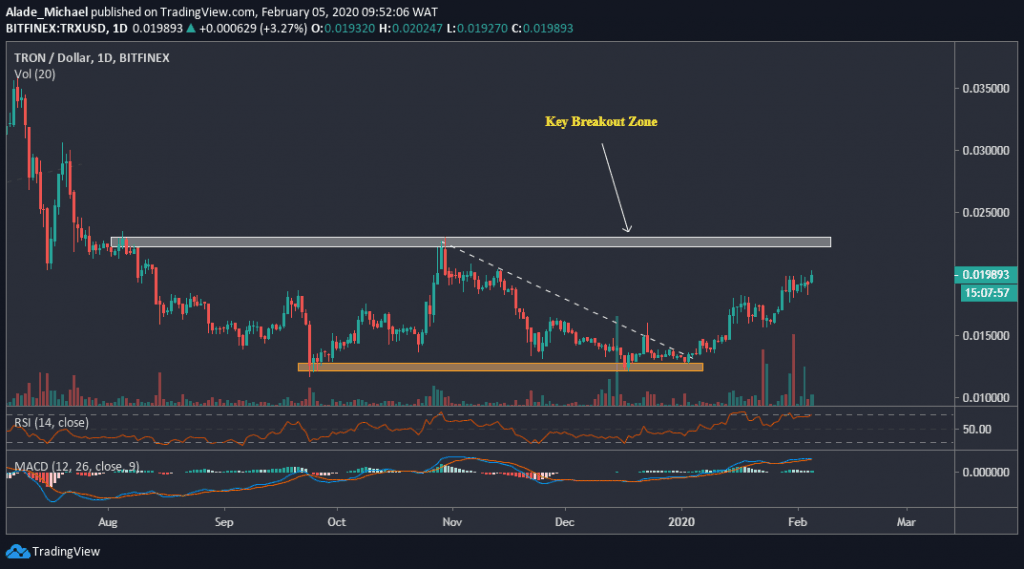

TRX/USD. Source: TradingView

Against US Dollar, Tron started the year on a bullish foot, gaining more than 60% over the past four weeks of trading. Following the last 24-hours, TRX is now trading around $0.020. Meanwhile, this growth was footed by a double-bottom formation that was created in late 2019, followed by the early January break above the white-dotted regression line.

Tron consolidated around $0.019 for six days, and now it appeared the bulls are beginning to show interest again. We can see that Tron is now targeting the grey resistance zone on the daily chart. Once this area is breached, we can expect more buying pressure in this market. And if the bullish actions fail, Tron may resume consolidation or even drop to the nearest support.

The important level to keep an eye on is the critical breakout zone at $0.022 resistance. Once Tron clears this zone, the next possible resistance is $0.030, followed by $0.035 and beyond. For support, Tron may retest the $0.018 if rejection occurs. A further drop could send TRX to $0.016.

On the technical indicators: Tron has slightly dropped after testing the overbought region. A further rise could produce more gains in the market. Conversely, Tron is looking bullish on the daily MACD. We could see more upward movement in the coming days.

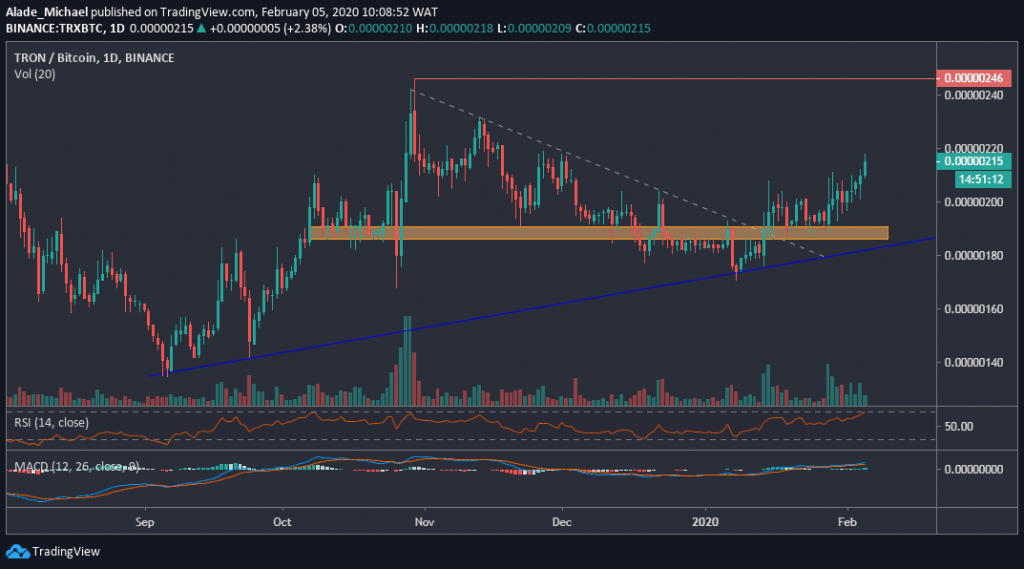

TRX/BTC. Source: TradingView

Against Bitcoin, Tron has recently resumed its upward movement after witnessing a two-month correction on the daily chart. Following this latest price increase, TRX now found vital support on the orange zone of 190SAT price levels. At the same time, the short-term rally is supported by the blue rising trend line, as seen on the price chart.

The break above the white-dotted regression line has produced the current trading price at around 215SAT level at the moment. The primary price target here is the late October 2019 resistance of 246SAT – the red horizontal line. A positive could produce more gains for Tron. However, TRX may correct down if the buyers fail to show commitment further.

Tron’s volume is just coming up at the moment. An increase can be expected as soon as the demand catches up. Looking at the technical indicators, TRX is almost overbought on the RSI, but there’s still room to accommodate more buying pressure. The MACD is currently positive, reflecting more price increase might come into play soon.

It’s essential to keep an eye on the 246 SAT resistance level, along with a bullish breakout. The current support for this market is the 190 SAT level. Support below this level lies at 170 SAT. A break below this support may lead the market to a serious bearish momentum.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato