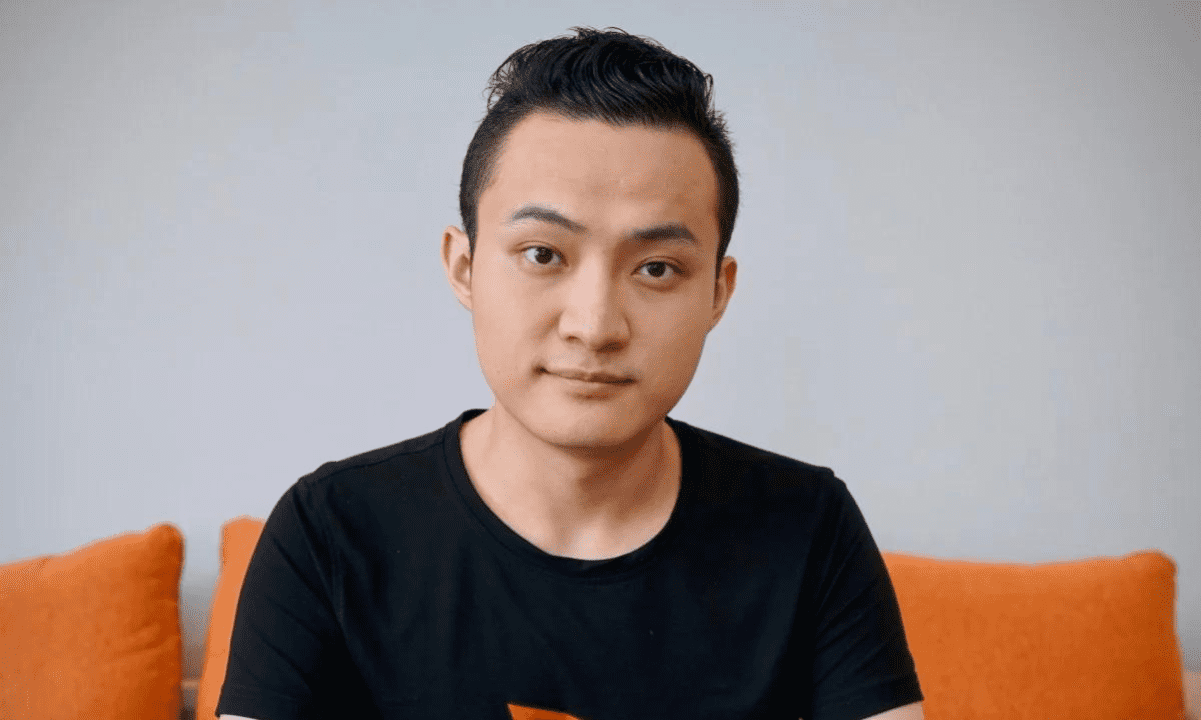

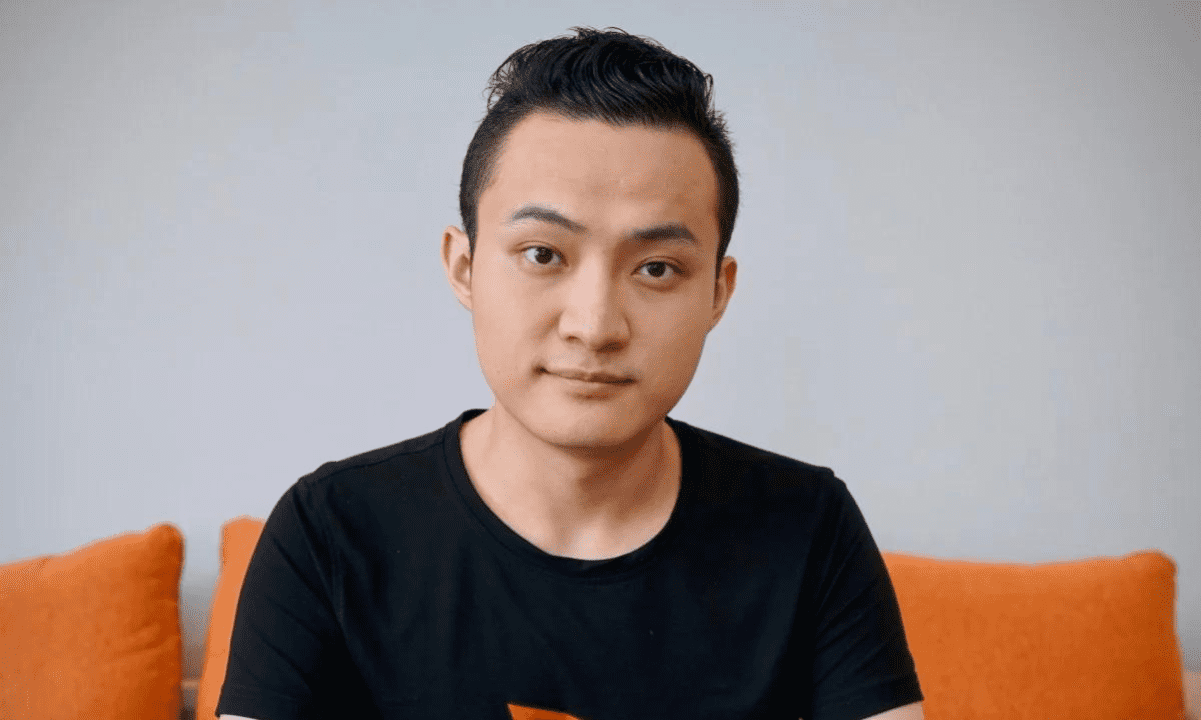

Justin Sun, the founder of the Tron blockchain, has purchased five million Curve tokens (CRV) from an address labeled “Curve.fi Founder” in an attempt to help with the decentralized exchange Curve Finance’s bad debt situation.

As disclosed by blockchain analytics platform Lookonchain, Sun bought the tokens at an average price of $0.4 via an over-the-counter transaction, amounting to $2 million, which he paid in Tether (USDT). The Tron founder acquired the assets below their current trading price of $0.59.

Sun Buys 5M CRV to Assist Curve Finance

Commenting on the transaction on Twitter, Sun said his joint efforts with Curve Finance founder Michael Egorov would introduce a stUSDT pool on the decentralized exchange to amplify user benefits and support the platform.

“Excited to assist Curve! As steadfast partners, we remain committed to providing support whenever needed. Our joint efforts will introduce the @stusdt pool on Curve, amplifying user benefits. Together, we aim to empower the community and forge a decentralized finance!” he said.

Sun’s CRV purchase comes amid worries that liquidating Egorov’s $100 million loans would trigger an implosion of the DeFi ecosystem. The concerns were heightened after Curve Finance suffered an exploit that led to the loss of more than $47 million.

Curve Founder’s $100M Loans at Liquidation Risk

As CryptoPotato reported, several Curve Finance pools using Vyper, a smart contract programming language for the Ethereum Virtual Machine, were compromised in a reentrancy attack on July 30. The hack drove CRV’s price down, threatening the liquidation of Egorov’s loans across various lending protocols.

ADVERTISEMENT

According to crypto research firm Delphi Digital, the loans are backed by 47% of all CRV in circulation, amounting to 427.5 million tokens. Egorov borrowed 63.2 million USDT on Aave and pledged $305 million worth of CRV as collateral. He supplied another 59 million CRV against 15.8 million FRAX debt on Frax Finance.

Egorov’s loan on Aave has a liquidation threshold of 55%, meaning his position can be liquidated if CRV falls to $0.37. Although his Frax debt is much less than the Aave position, Delphi Digital noted that the former is riskier because of its time-weighted variable interest rate.

Earlier today, Egorov deployed a new Curve pool for FraxLend’s CRV/FRAX market with 100,000 CRV rewards to decrease the risk of his debt spiraling out of control.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato