2019 has seen large-scale blockchain adoption. With China trying to beat the world to its central bank-backed digital currency, the United Arab Emirates [UAE] too, has begun drafting regulations. According to reports, UAE has been preparing for a rapid expansion in light of increasing demand for cryptocurrencies.

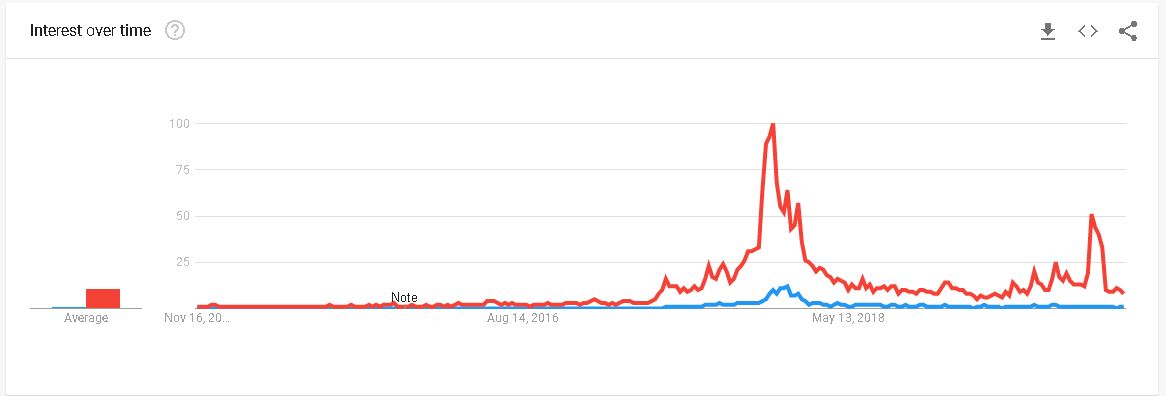

According to Google trends, the terms with an increased volume include, Bitcoin and cryptocurrency, along with other cryptos. However, apart from the search hike during the 2017-18 bull run, the trends for Bitcoin and cryptocurrency were at a rise in the UAE in 2019.

Source: Google Trends

The search volume for Bitcoin remained quite high in the sub-regions of Umm Al Quwain, Ajman, and Ras al Khaimah. While ‘cryptocurrency’ search trends were high in Dubai, Abu Dhabi, and Fujairah.

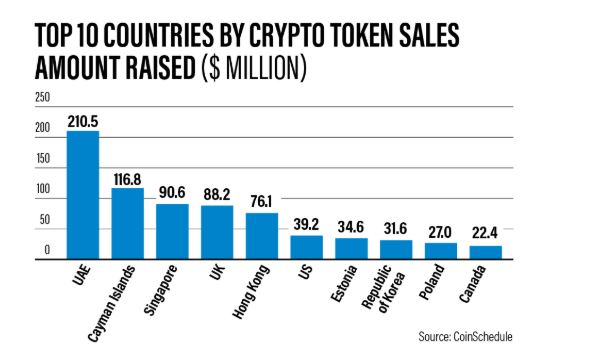

Apart from the rising trend, the country has seen crypto transactions worth over $210 million, making it one of the top countries reporting digital asset transactions. At Dubai’s International Financial Centre the country registered 100 fintech firms, a three-fold growth since 2018.

In early 2019, two UAE startups raised almost $210.5 million in token sales, accounting for almost a quarter of the total capital amassed globally according to CoinSchedule in April.

Source: The National

According to reports, the increased trading has lured many institutional investors and may expand in Dubai mainly due to extensive inflows of institutional investors.

UAE had previously announced its Securities and Commodities Authority [SCA] had sought the opinion of financial industry partners for finalizing the draft. For which it invited various investors, brokers, financial analysts, researchers, media and other interested parties to review the draft.

SCA had also announced to introduce Initial Coin Offering [ICO] by the end of the first quarter, while it was working on the ICO token trading platform.

The post appeared first on AMBCrypto