The coronavirus continues to spread like wildfire, with almost a million people infected throughout the entire world. Gold and Bitcoin, however, are performing particularly well during the last two days.

Their steady performance also comes in times when Wall Street crashes, summarizing a terrible first quarter, and thousands of people are losing their jobs.

Gold, primarily regarded as a safe haven asset, holds relatively well in the current times of economic uncertainty. At least according to historic behavior during the most prominent financial collapses. And what about Bitcoin? There is a lot of going on discussions about whether BTC is a safe-haven asset, just like gold or not. Bitcoin now has its first major financial crisis.

27,000 Reportedly Lost Their Jobs In The US

As the coronavirus continues to spread, a lot of people are left without a job. This comes mainly because countless countries are instituting both mandatory and recommended lockdowns, sending entire industries in a troublesome situation.

According to a report by a private-sector payrolls processor ADP, 27,000 people lost their jobs in March alone. This, however, was better than most expectations as the consensus forecasts were calling for job losses of around 150,000.

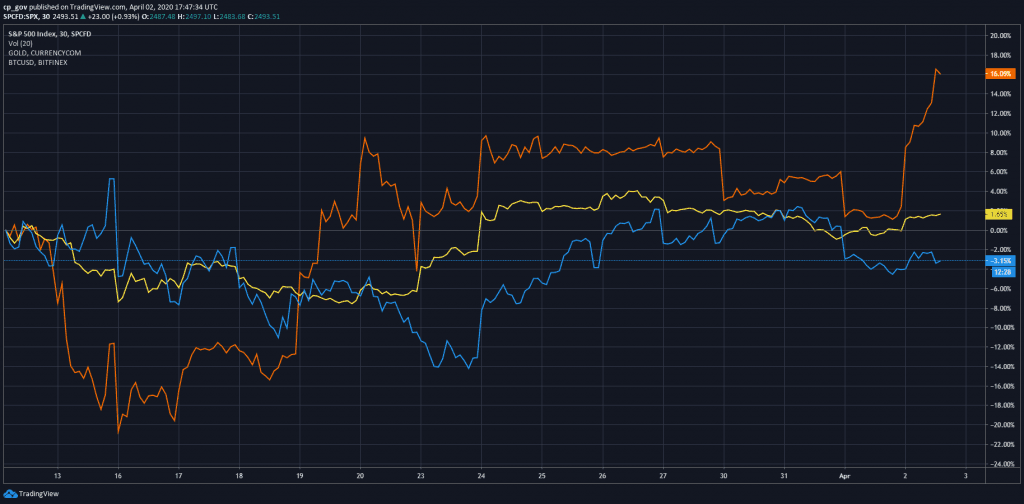

While Wall Street’s major indices saw 4-5% aggregated declines over the past two days, as of writing these lines, the price of gold surged by 2.5%, and Bitcoin price is even more impressive.

The price of gold has been holding up relatively stable lately and is fairly flat in the past few days as an ounce currently trades above $1,600.

As Cryptopotato reported, however, some models are putting the fair value of gold to about $8,900, which is more than five times higher.

Bitcoin Price Also On The Move

Gold is not the only asset that’s been holding up its value fairly well. Bitcoin has been performing rather nice over the past 24 hours as it managed to gain more than $900 and is currently trading above $7,000.

It’s worth noting that the cryptocurrency is up more than 14% on the day and is bringing the entire market with it. Bitcoin is now facing its highest price since the fatal crash that took place on March 12.

Cryptocurrency Market Overview. Source: Coin360.comAs seen on the above chart, altcoins are also popping up, with Ethereum, Bitcoin Cash, Litecoin, EOS, Binance Coin, and all the other majors bringing in nice double-digit increases. The entire market has increased by a total of $20 billion in the past day alone.

The post Uncorrelated Safe-Haven: Gold And Bitcoin Record 2-Day Price Surge Despite Plunging Markets appeared first on CryptoPotato.

The post appeared first on CryptoPotato